Let’s not get ahead of ourselves — robots are not yet here to take all of our jobs away. Those that rely on jobs that will be impacted by recent minimum wage hikes in Ontario need not fear the humanoid robot that’s able to do all the repetitive tasks of a human, at least for quite some time to come.

That being said, a recent article by fellow Fool contributor Joey Frenette, highlighting the importance of technology in industries, such as fast food, which have traditionally relied on manual labour and remain relatively low tech, described the transformational nature of this sector overall. A tech race of sorts appears to be underway by Restaurant Brands International Inc. (TSX:QSR)(NYSE:QSR) and its competitors in creating a fast-food environment that is much faster at delivering your burger or coffee than what many experience during peak times at your local Burger King or Tim Hortons.

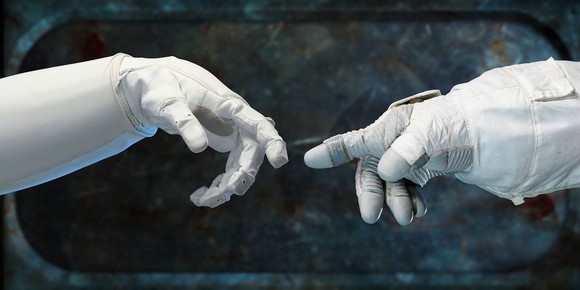

The recent re-organization at Restaurant Brands in the company’s C-Suite, with former CFO Josh Kobza moving to a new role as chief technology and development officer, says a lot about the ways in which traditional low-tech industries such as fast food are adapting to the changing needs of consumers. Integrating technology with a human resource talent pool will most certainly cut jobs from the equation, and in areas with rising minimum wages, such as Ontario, these moves are likely to be sped up even more, furthering a technological revolution in sectors that have long been considered lesser candidates for high-tech solutions.

As we have seen in a number of retail environments, the technology of self-checkouts and other minimum-wage-job-destroying machines has gotten much better in recent years. The cashiers and those who have been replaced by order-taking technologies implemented at world-class quick-service restaurants have been, at least theoretically, re-purposed in an economy which should be able to utilize their labour in a more efficient manner.

While fellow Fool contributor Will Ashworth has suggested investors buy Starbucks Corporation (NASDAQ:SBUX) instead of Restaurant Brands (I actually tend to agree with him on a fundamental valuation perspective on this trade), Starbucks has a long way to go in improving its technological prowess in an industry which appears to be transforming rather quickly. The improvements being made at Restaurant Brands should be identified by investors as a meaningful way of using capital to replace labour, an age-old method of value creation which has served our economy well for centuries.

Stay Foolish, my friends.