The recent market sell-off has provided a number of very interesting buying opportunities for astute investors to take advantage of. While I believe that much of the recent sell-off can be attributed to sky-high valuations coming down and some institutional money being taken off the table, it is true that today’s economic environment is very much conducive to capital appreciation in equity markets — interest rates remain near historical lows, U.S. tax cuts are expected to continue to stimulate the economy in the near to medium term, and growth remains slow and steady, providing an environment in which stocks can only be expected to continue to rise in the very near term.

That being said, companies like Sierra Wireless, Inc. (TSX:SW)(NYSE:SWIR) have experienced sharp declines exacerbated by lower-than-expected forward guidance and an overall market sell-off, which has sent Sierra’s share price into a tailspin in recent weeks. Sierra currently trades at a discount to its 52-week high of nearly 50%, meaning a return to its previous high would entail a double-up for investors should the company be able to right its ship and continue along its growth trajectory in the second half of 2018.

Earlier this month, the company announced forward guidance which was lower than expected and warned investors and analysts that some one-time items will be upcoming due primarily to a network upgrade and tight component supply, which is likely to eat into profitability via increasing costs and potentially reducing revenues.

The concerning part about this announcement is a suggestion that these unusual items may occur in the future, given the company’s statement that these were “mainly non-recurring items.” The extent to which future cash flows may be impacted by issues with components or ongoing concerns with production remain to be seen; however, the recent sell-off certainly makes sense in light of this new information.

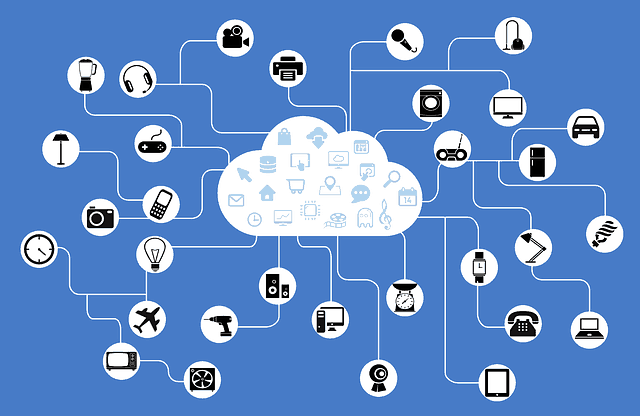

That being said, Sierra is an interesting company operating in the growing Internet of Things (IoT) space, providing investors with a huge opportunity to take advantage of a movement which is likely to transform the way we use everyday devices and how these devices are connected to the Internet and each other. The IoT trend is one investors should not ignore and, whether through Sierra or another company, they should look to gain exposure for the long term.

It appears that Sierra may experience some bumps in the road moving forward; however, on the whole, this company remains one of the premier plays in this space.

Stay Foolish, my friends.