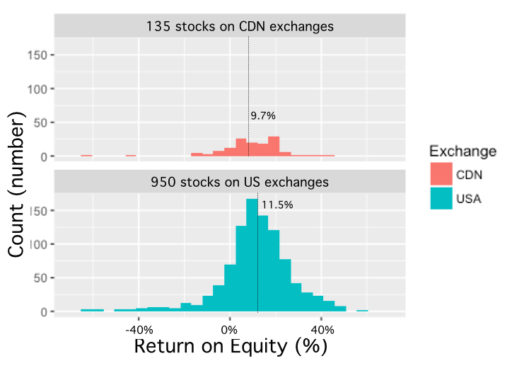

U.S. markets have delivered handsomely in recent years. Backing up the hype, the median return on equity (ROE) from 950 U.S. stocks I surveyed was 11.5% over the trailing 12 months (average ROE was 10.5%). The median ROE for 135 companies trading on Canadian markets was 9.7% (average ROE was also 9.7%).

The two charts show ROE for all the companies surveyed. There are fewer Canadian stocks to consider. What else stands out? Simply put, U.S. stocks generated more income per equity (and that may or may not translate to earnings for 2018). This simple comparison explains, to some extent, why investors have turned to U.S. markets (I’ll continue to delve into this comparison).

Overall, 2017 was a sub-par year for the TSX as a whole. Investors might be feeling it. The exchange lagged behind many of the other major indexes. I am certain, however, that past performance is not an indication of future rewards. Furthermore, it is not hard to find Canadian equities worthy of core holding status, and other growth stocks gems. Read on!

Examples of TSX wheat from the chaff

Canadian Pacific Railway (TSX:CP)(NYSE:CP) is one of the largest rail companies in North America with a market cap of $33 billion. The ROE is 43%, which is four times the average among many TSX stocks. Canadian Pacific’s debt load is not excessive. Its 2018 earnings are estimated to drop about 10%, however — down $2 from $16.44 earnings per share (EPS).

Mutual funds have a major stake in Canadian Pacific. In fact, it is currently one of the most-owned stocks among the big-shop institutions. The share price has traded in a range for the past three months. If you believe the TSX will outperform in 2018, then Canadian Pacific would be a sensible pick.

Constellation Software Inc. (TSX:CSU) is another well-liked, well-run Canadian company. I wrote favourably about Constellation in November, and nothing has happened to change my opinion. I’m even more bullish. This $18-billion-market-cap software-as-a-service company has a 42% ROE and posts solid profit margins. The EPS forecast is noteworthy because earnings are expected to triple from 2017. Looking at Constellation’s chart should tell you something very telling: it hardly pulled back in the share price, while many big names were dropping 10% or more during the volatile February frenzy.

Spin Master Corp. (TSX:TOY) is the third company on this list of achievers. This $6 billion toy company had a humble beginning over 20 years ago, born in Canada; it now distributes globally. Sales have increased at an impressive clip, roughly 25% per year (or more) since 2012. The ROE is currently 40%. The stock rarely drops in price; instead it tends to “gap up,” meaning that share prices move up sharply. The higher price multiple is consistent with share price for growth stocks. Foolish investors are following this stock, and mutual funds hold a large stack in Spin Master.

Stock Up Sale

Stock Up Sale