One REIT offers some of the biggest distribution yields on the TSX today, while another is executing a new strategy and buying back a significant portion of outstanding units at a 7% premium. Making an income-oriented investment decision about Dream Industrial Real Estate Invest Trst (TSX:DIR.UN) and Dream Office Real Estate Investment Trst (TSX:D.UN) is not an easy choice right now.

Let’s look at which of the Dream-managed REITs is a better income play today.

Dream Industrial REIT

Dream Industrial owns 218 industrial income-producing properties with 19 million square feet of gross leasable area. Its property portfolio is well diversified geographically, with 26% located in western Canada, 25% in Ontario, 20% in Quebec, 14% in eastern Canada, and 15% in the United States.

The REIT’s rich monthly payout yields 7.11% on a forward-looking basis and looks very sustainable, with an adjusted-funds-from-operations payout rate of 86.1%, far below the 90% target for most REITs in North America.

Dream Industrial has recorded some of the highest occupancy rates in the industry, with average in-place and committed occupancy at 96.6% by the end of last year. Its debt ratio, at 49.5%, has improved significantly from 54% over the past three years, and this is a favourable achievement in a rising interest rate environment.

The REIT’s portfolio competitiveness is likely to improve going forward as it aggressively expands in the U.S., where current portfolio occupancy is a staggering 100%. The availability of new competing supply of industrial space is currently low, yet there is an exponentially growing demand for new leasable space, which is forecast to outpace supply by 2020, thanks to the strong growth in e-commerce retail sales, which require three times more processing and storage space than traditional retail outfits.

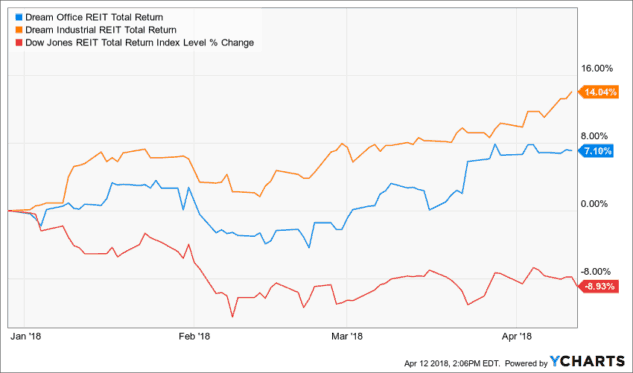

Income investors in this expanding REIT are likely to enjoy growing distributions and capital appreciation, as Dream Industrial executes its growth strategy. In fact, investors have enjoyed some of these benefits this year.

Dream Office REIT

Dream Office held 42 properties by end of 2017, totaling 8.2 million square feet of gross leasable area. Though somewhat diversified, 60% of the remaining portfolio is in downtown Toronto, one of North America’s fastest-growing cities, and the REIT’s ongoing strategic refocus targets hold 20 properties generating 70% net operating income from the Greater Toronto Area by year-end 2018.

The REIT’s current monthly payout yields 4.26% on a forward basis, but its sustainability is not yet so clear, as it’s been executing its turnaround strategy since 2016.

Most noteworthy, Dream Office announced a substantial unit-buyback program last month in which it intends to purchase about 14% of its outstanding equity units at a 7% premium to their closing market price on March 22, thereby lifting the current market price significantly.

However, there is the danger that the market price may fall back to prior trading levels once the buyback exercise is completed, but the valuation may continue increasing in the long term, as the REIT is focused on higher-quality appreciating assets in premier locations.

Massive distribution cuts since 2016, after management announced a new restructuring strategy that would see the REIT dispose of more than $3 billion worth of investment properties in a short period, shook investor confidence in the REIT, but the 34% reduction in outstanding units boosted the trading price by nearly 40% to date.

Occupancy levels, at 90.4% (including commitments), weren’t that impressive and continued to decline last year, but the REIT enjoys one of the lowest debt ratios in the industry, with a debt-to-assets ratio of 39.6%, showing a lower interest risk exposure profile.

Interestingly, the REIT increased its investment in superior-performing Dream Industrial to 25.6% in 2017, presenting its unitholders with some good economic hedge should current strategic refocusing efforts fail to deliver desired results.

Investor takeaway

While Dream Industrial is a great income play today, Dream Office is a speculative buy, as its payout stability is yet to be proven and asset sales still continue, but the units could significantly outperform if current strategic re-focusing efforts yield the desired results. I would go with growing, higher-yielding, and more stable Dream Industrial with significant upside potential for now, but total returns have been the same since June 2016.