Warren Buffett’s approach to investing has minted him billions of dollars over the years. To know how much, consider that Berkshire Hathaway Inc.’s (NYSE:BRK.A)(NYSE:BRK.B) book value per share — the key metric Buffett uses to gauge performance — grew at a compounded average rate of 19.1% between 1965 and 2017 versus the S&P 500’s 9.9% returns. Berkshire beat the S&P 500 in 40 out of those +50 years.

It can’t get any better when it comes to making money from stocks. This means, if you want to beat the market and get rich, it pays to follow Warren Buffett.

Here are three top Buffett investing principles you must know.

Invest in a moat

“Economic moat” is one of the most popular terms coined by Buffett, and rightly so. A moat is a competitive advantage that a company has over rivals, one which allows it to grow profits year after year for decades. It could be a leadership position, cost advantages, high switching costs, or brand power.

That also means you should understand a business well to be able to identify if it enjoys a moat. That, again, is one of Buffett’s top secrets to success: to invest only in what you understand.

Think Canadian National Railway (TSX:CNR)(NYSE:CNI). Railroads are a lifeline to an economy, as they facilitate trade and commerce by transporting goods, so it isn’t a business that’ll go out of favour.

That aside, Canadian National is the largest railroad in Canada, the only transcontinental railroad in North America, and also the most cost-efficient railroad. Not surprisingly, these competitive advantages have sent Canadian National shares soaring over the years, making investors rich.

Stay invested

Buffett can be credited for popularizing the buy-and-hold concept. In fact, one of Buffett’s best quotes of all times was when he said, “Our favourite holding period is forever.”

Of course, that doesn’t mean you should never sell a stock, but selling too early is, perhaps one of the biggest mistakes investors make.

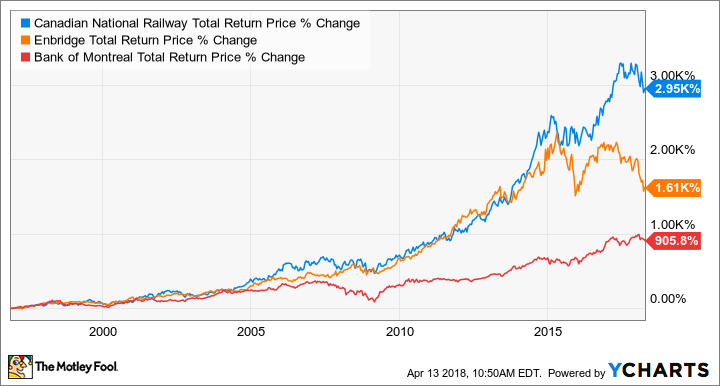

If not held for the long term, Canadian National stock’s total return (price appreciation plus reinvested dividends) chart wouldn’t look as good. The same goes for Bank of Montreal (TSX:BMO)(NYSE:BMO) and Enbridge Inc. (TSX:ENB)(NYSE:ENB), two other stocks I’ve highlighted below just to show you how even stocks in volatile sectors like banking and energy can mint money if held for long periods.

CNR Total Return Price data by YCharts

Reinvest your profits

You might consider “power of compounding” as more investing jargon, but trust me, it works like magic when you want to make money.

You can make compounding work for you two ways: by staying invested — in which case, you’re indirectly reinvesting all the nominal gains you’ve made so far back into the stock, thereby multiplying your gains.

The second way is to buy dividend stocks and reinvest those dividends back into the stock. Guess what? All three stocks highlighted in the above chart, Canadian National, Bank of Montreal, and Enbridge, have one common link — each is a top-class dividend payer. If not for their stable and steadily rising dividends, their returns would’ve been much smaller.

I have given more examples of how compounding has made some multi-millionaire stocks here, and I strongly urge you to read it. Because once you do, you’ll be even more convinced that you too can beat the market, like Warren Buffett.