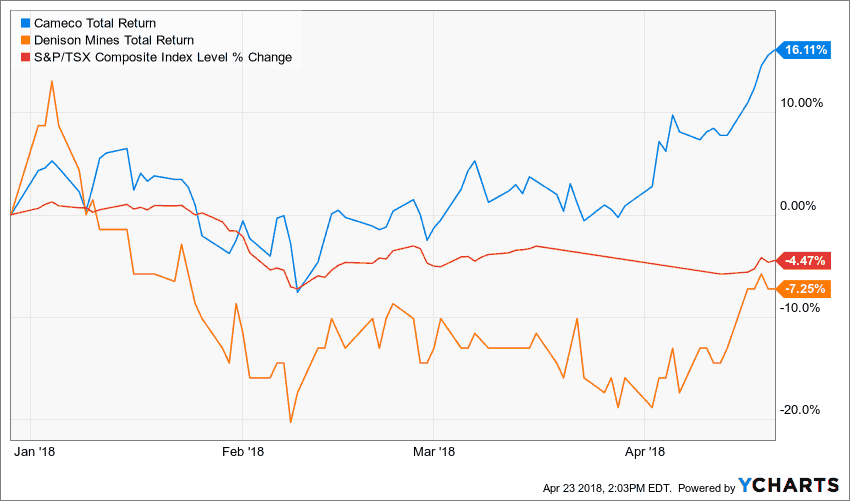

Cameco Corp. (TSX:CCO)(NYSE:CCJ) stock is on a sustained rally this April and has significantly outperformed a weaker S&P/TSX Composite Index during the period. The low-cost leading uranium player has found new glory. Should investors expect continued market-beating returns on the stock going forward?

Cameco is engaged in the exploration, development, mining, refining, conversion, fabrication and trading of uranium, a clean energy fuel for generating electricity in nuclear reactors in an industry that has been under severe strain after the Japan Fukushima nuclear disaster of 2011.

While the stock has been recently volatile, as investor sentiment alternated between hope and despair, the latest news from Russia has presented uranium investors with some new hope towards a revival of the nuclear fuel market.

The recent big news

In its economic sanctions brawl with the United States, Russia is considering banning uranium exports to the U.S., the biggest uranium consumer and importer in the world, and that’s a significant move.

The United States, which consumed 18.16 thousand metric tonnes of uranium in 2016, imports about 89% of its uranium requirements. Russia, one of the biggest producers of uranium in the world, directly accounts for 14% of U.S. uranium requirements, but Russians reportedly control a further 28% of U.S. uranium supplies from Kazakhstan and Uzbekistan, according to Katusa Research and as reported by Financial Mail.

Thus, Russia’s export ban, if effected, would affect 42% of U.S. annual uranium needs, leaving a big supply gap for other uranium producers to fill. That’s a significant gap that Canada, which supplies 25% of U.S. uranium needs, is not expected to cover single-handed.

Cameco and rising miner Denison Mines Corp. (TSX:DML), are expected to significantly gain new business south of the boarder, hence the positive sentiment on the respective stocks after the Russia news.

Problems with the thesis

The United States utilities are said to be buying most of their uranium requirements on the spot market. Uranium spot prices have been subdued for a long while, and there have been several false recoveries over the years, as the market remains oversupplied from both new production and secondary material supplies.

Russian uranium may have no immediate alternative takers at the moment, yet it will still continue flooding the spot market and keep both contract and spot prices down. While Cameco may enjoy more business from the United States, deal prices may not improve.

Most noteworthy, Cameco recently shut down one of the biggest high-grade and low-cost uranium mines, the McArthur River mine and associated Key Lake milling plant, not because of low business volumes, but because of an unsustainably low uranium pricing environment. The company has decided to liquidate inventories instead and to buy more material from the spot market to feed into its long-term contract supplies.

Therefore, higher business volumes with no contract pricing improvements may not be what Cameco is looking for at the moment.

Should you buy now?

There were several, short-lived bullish runs in uranium spot prices in 2017, but the momentum was not sustained, as demand remains too low in an oversupplied market. While there is still hope for a uranium market recovery in the long term, as new reactor builds in Asia and restarts in japan are expected to eventually sustain higher demand and price resurgence.

The Russian uranium-export ban, which is set to be tabled next month, may shake the market a bit, but it may not lead to improved uranium spot and contract prices if Russia redirects the supplies into the flooded spot market.

Cameco stock, therefore, remains a speculative play today. The recovery timeline remains blurry, and recent production cuts from Cameco and KazAtomProm are yet to show any significant erosion of market supply surplus.

Worse still, we are talking about a currently volatile political scenario. It is still possible that Russia, which profits more from enriched uranium sales to the U.S. than from mining production spot supply deals, may hesitate in implementing a move that removes profitable deals from its order books.

The sanctions may not be passed, and Cameco, which faces some significant near-term risks, may find its shares trading lower again.