So, there’s a tech boom coming? Once every couple of years we hear the same thing. Looking at the current model of economic growth, it does seem to be the case that tech is indeed a growth area, but for some reason it never seems to reach the Canadian markets. Overstated prospects for actual tech stocks shouldn’t put you off investing in tech, though; the trick is to do it indirectly.

Invest in tech without investing in tech

It sounds like an oxymoron, but it isn’t. While other stock markets have super-powered tech sectors, the TSX really does not. But what the TSX does have is a very strong mining section. So, here’s how you get invited to the international tech boom party: you invest in the materials that big tech companies rely on, rather than invest in actual tech companies on the TSX.

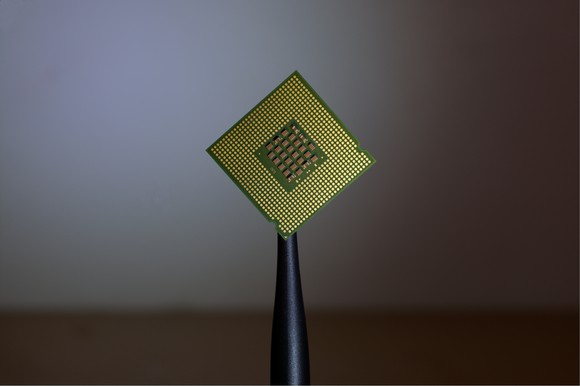

What kinds of materials are we talking about here? Predominantly, you want to look for minerals and precious elements that are used in the production of electronics and machine parts. In order of prospective gains, these currently include silver, lithium, gold, and cobalt, depending on which specific stocks you go for, but you could add others to your proxy tech stock basket if you dig around.

The element of supplies

Every industrial sector has its own supply chain, and there are usually opportunities to invest at key stages along each of them. The tech supply chain starts with components, most notably precious elements. The sturdiest way to invest in tech, therefore, might be to look at some of the following commodities.

Cobalt is a key component of the alloys used for jet and gas engines, so it’s worth considering for indirect tech investment. However, it is also used in the production of some steels, so do a bit of homework ahead of potential U.S. steel tariffs before you gobble up stock in the blue stuff. Cobalt may also start to be replaced by iron soon in some battery production processes, so again, do your homework before you buy.

Gold, however, is a particularly strong play if you want to invest indirectly in tech but also want a really solid defensive commodity in your portfolio. Go for one of the more stable companies with good growth prospects, such as McEwen Mining Inc. (TSX:MUX)(NYSE:MUX), which holds assets in Canada, Mexico, Argentina, and the U.S., and has a canny management style.

Lithium Americas Corp. (TSX:LAC)(NYSE:LAC) is putting its money on two pretty vast mining projects: one in Nevada, and one in Argentina. This two-column approach may not seem super diversified, but the sites in question are impressive, and you should look into Lithium Americas if lithium is your thing. You may have missed the boat on its discounted shares, but it’s a stock worth holding on to if you can get your hands on it.

Silver is going to be a big deal later in the year and through 2019 at the very least. If you want to invest in the grey stuff ahead of a silver bull, go for Pan American Silver Corp. (TSX:PAAS)(NASDAQ:PAAS) and/or Silvercorp Metals Inc. (TSX:SVM)(NYSE:SVM), both of which are stable and geographically diversified.

The bottom line

Far from being dead money, silver stocks are set to have their day in the sun, so it makes sense to chuck a few in your shopping cart. At the very least, they’ll just stay dull and you can sell them in a few years. The flip-side is that a silver bull might start to shake its horns, and that’s precisely what some analysts are calling for.

Gold stocks, too, should be on your list of defensive commodities right now. Throw in a few other mining stocks, especially lithium, and you have a pretty smart way to invest in a tech boom without exposing yourself to actual tech stocks.