Finding new dividend stocks in the Canadian stock market can be tricky, particularly if you want to find companies that are involved with emerging technologies. Aside from some larger companies, such as BlackBerry Ltd. (TSX:BB)(NYSE:BB), finding tech companies to invest in can be fairly rare, extremely small, or do not pay a dividend.

Neo Performance Materials Inc. (TSX:NEO) is a newly listed company on the TSX, and it may just be the type of company you want to add to your dividend portfolio. It pays a small dividend of approximately 2% at current prices and is involved in producing rare earth materials for many new and emerging technological areas.

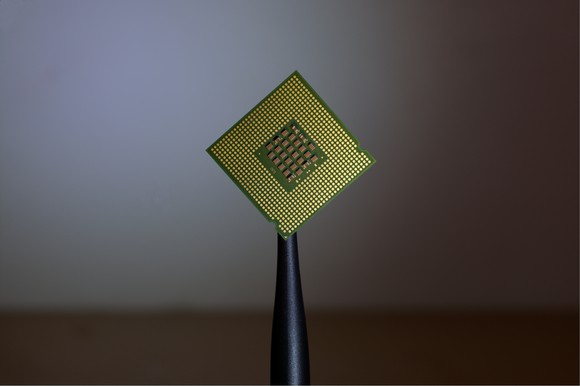

Neo is a supplier of advanced rare earth materials. It operates in three business segments: Neo Chemicals and Oxides, Neo Magnequench, and Neo Rare Metals. These materials are used to make items more efficient, light-weight, and strong. Neo’s materials are used in many sectors, such as the wastewater treatment, automotive, lighting, and display markets.

The company is a global leader in rare earth material production, being the number one market leader for several of its business segments. The company is heavily involved in many high-growth trends, such as electric automobiles, smart devices, and super alloys. The company supplies these materials to many well-known businesses, such as Panasonic, Philips, and Samsung.

Besides being involved in high-growth business trends, the company also has a solid balance sheet and a decent dividend. Neo does not have a long history as a public company, but the current state of its balance sheet inspires confidence.

Neo has $94 million in net cash on the balance sheet and almost no debt. Furthermore, the company has positive earnings and decent free cash flow. However, since the company has just been publicly listed, investors should pay close attention to determine if there will be revenue, earnings, and free cash flow growth in the coming years.

Total revenues increased 12% year over year and have been growing in each of the three segments. Magnequench’s revenues alone were up 17% over the previous year due to the need for electric motors in new vehicles. Chemicals and Oxides’s revenue increased 55%, and the rare metals segment’s revenues were 24% higher.

Another beneficial aspect of the company is that it is not a commodity producer. Rather, the company purchases the raw materials. The company is dedicated to growing its business through strategic acquisitions.

Neo Performance Materials would make an interesting addition to a dividend portfolio. It provides some diversification into technology, which can be difficult to find in Canada. It is involved in many high-growth areas, such as electric vehicles and connected homes. And it also pays a small dividend, which is extremely difficult to find with many technology stocks.

Be aware, though, that this is a newly listed company. Remember to keep track of earnings and cash flow and continue to monitor the progress of this interesting Canadian company.