“Be fearful when others are greedy. Be greedy when others are fearful.” —Warren Buffett

I think you’ll agree that no truer words on investing have been spoken.

Most people intuitively know that in order to have success in the market, you need to zig when others zag. But like most things, it’s easier said than done.

It isn’t easy buying a plunging stock surrounded by bad news. And it isn’t easy selling a soaring stock that everyone says will be the next Amazon. But with enough practice and experience, you’ll steadily become a more confident contrarian.

To help give you a boost, here are three beaten-down stocks that have several reasons to bounce back over time. Of course, given their inexpensive nature (with lots of upside), the perfect place for them is likely in your TFSA account.

After all, tax-free profits are the best profits.

Advantage Oil & Gas

Advantage Oil & Gas Ltd. (TSX:AAV)(NYSE:AAV) is down 54% over the past year. Nasty. So, it’s definitely not for the faint of heart.

Company-specific production issues and an increased debt load have put heavy pressure on the stock. Meanwhile, sector-related political clouds and soft commodity prices have only exacerbated the sell-off.

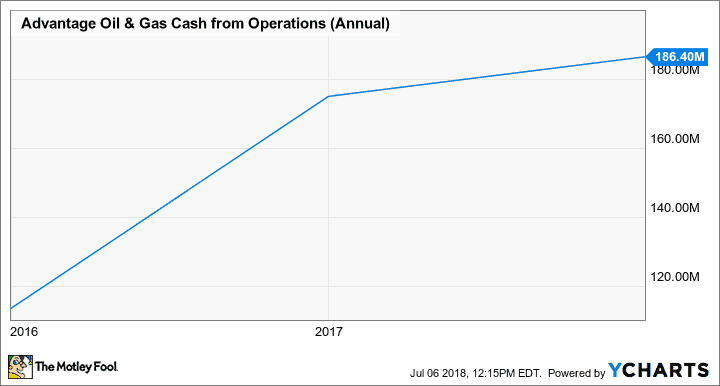

But here’s the good news: Advantage remains one of the lowest-cost small-cap energy producers in the country. Furthermore, operating cash flow continues to improve.

If commodity prices keep firming up, Advantage’s paltry price-to-cash flow ratio of four might end up proving to be a steal.

WestJet

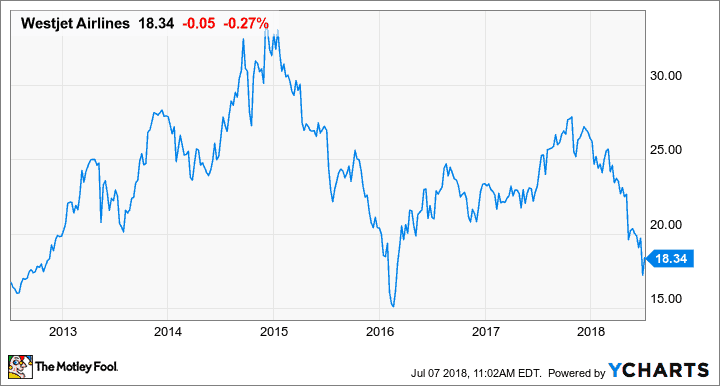

The first half of 2018 has been pretty turbulent for WestJet Airlines Ltd. (TSX:WJA). Earnings have been dampened by labour unrest and higher fuel costs, and it’s all been reflected in the stock price.

Year to date, WestJet shares have declined about 30%.

That said, WestJet’s long track record of generating profits is quite rare in the cutthroat airline industry. And buying the stock on big dips has always tended to work out well in the past.

Given the company’s continued push into international markets and attractive yield of 2.4%, the current dip likely isn’t an exception.

Cineplex

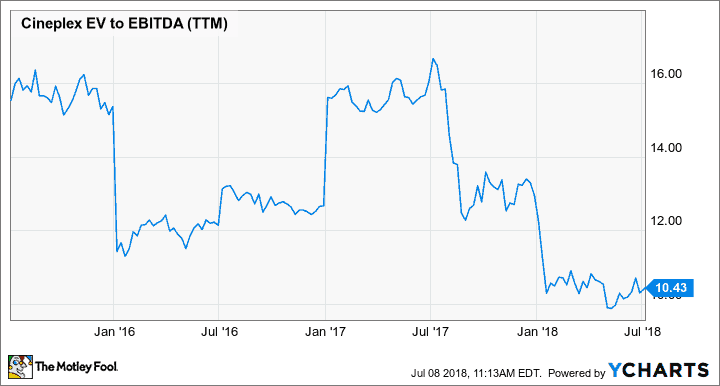

Our last turnaround stock is Cineplex Inc. (TSX:CGX), which has seen its shares fall a whopping 40% over the past year.

That ugly performance shouldn’t be a huge surprise. Streaming services like Netflix and CraveTV continue to eat into Cineplex’s theatre business. In fact, box office attendance has been in decline for two straight years.

But here’s one reason to remain optimistic: an attractive valuation. Thanks to the severe price decline, Cineplex stock trades at an EV/EBITDA of just 10.4 — pretty cheap relative to recent years.

If management’s turnaround initiatives take hold — more diversified entertainment complexes — the stock could skyrocket from here.

The Foolish bottom line

There you have it: three potentially attractive turnaround stocks for your TFSA account. But, as always, don’t forget to do your due diligence.