I’m a bottom-up investor. That means I use company fundamentals — financials, competitive advantage, management, valuation — as the driving force behind my decisions. In contrast, top-down investors tend to focus first on economic and industry forecasts — then try to select companies that will benefit.

But as I get older, I appreciate the top-down approach more and more. In fact, my biggest investment mistakes have come from not paying close enough attention to broader variables.

With that in mind, here’s an easy way to play the thriving economy: restaurant stocks. Or, as I like to call them, “eat-out” plays.

Let me explain.

Tasty from the top down

The logic is simple: when the economy is hot, people tend to eat out more. And that’s exactly what we’re seeing in the U.S. right now.

According to data from restaurant researcher TDn2K, same-store restaurant sales increased 1.1% in June. That doesn’t sound impressive. But it represents the fourth straight month of positive or flat comparable sales, pointing to a steady trend of improvement.

“With more people working and wages rising a little faster, consumers are spending again,” said TDn2K economist Joel Naroff.

Here’s another bit of good news for the sector: households don’t seem to be overextending themselves like they have in the past. While they’re spending a bit more, they’re also saving a bit more. This suggests that the solid restaurant demand we’re seeing is sustainable — as opposed to a temporary uptick.

To be sure, that data looks primarily at the U.S. But the same case can be made here in Canada — where the economy is also running hot.

Makin’ bacon

The Bank of Canada raised rates last week to 1.5%. According to Governor Stephen Poloz, the economy is “operating at capacity with inflation already a target.” Analysts even expect Poloz to raise rates again this year and then three times in 2019.

So, what restaurant stocks, specifically, would I use to capitalize on this economic strength?

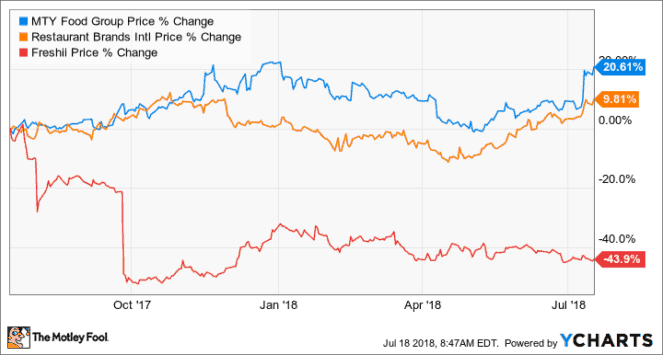

Well, I think a small basket of Restaurant Brands International Inc. (TSX:QSR)(NYSE:QSR), MTY Food Group Inc. (TSX:MTY), and Freshii Inc. (TSX:FRII) makes a tonne of sense.

I’d also buy them in equal amounts. In this way, you can play the strong economy without being overly exposed to any one specific company. Between the three stocks, you have a nice mix of aggressive growth (Freshii), mid-cap balance (MTY), and large-cap stability (Restaurant Brands).

In terms of performance, they also provide a decent blend of momentum and contrarian plays.

Remember: the main goal of top-down investing isn’t to pick the outperformers of a sector. The main objective is to ensure sound exposure to a favourable area of the market based on the “big picture.”

The Foolish bottom line

There you have it, Fools: my small basket of three “eat-out” stocks to take advantage of the solid Canadian economy.

Of course, even with top-down investing, due diligence is key.