I used to worry a lot when it came to investing. Any time some crisis — or threat of a crisis — hit the newsfeeds, I always had severe anxiety about how much money I stood to lose.

But these days, I’m more practical. The question I always ask about a seemingly worrisome story is, “How can I profit from it?”

Well, investors got another tariff-related news item earlier this week. And with this headline, Bay Street wasted no time in trying to take advantage.

Is there still room for us Fools? Let’s take a closer look.

Uranium investigation

This is the news I’m talking about: U.S. president Trump plans to open a probe into whether uranium imports threaten to impair national security. So, what’s the big deal?

It’s a move that could lead to tariffs on shipments of the metal.

Now, the investigation itself has already added to trade tensions. That’s for sure. And uranium is used primarily to fuel nuclear power plants. So, a tariff on the metal would be another hit on power plants already hurting from weak demand.

But here’s why uranium miners Energy Fuels Inc. (TSX:EFR)(NYSE:UUUU) and Ur-Energy Inc. (TSX:URE)(NYSE:URG) petitioned the U.S. government to help: U.S. uranium miners provide less than 5% of domestic consumption for the metal. They also argue that it’s an uphill battle competing with government-subsidized miners in Russia, Kazakhstan, and Uzbekistan.

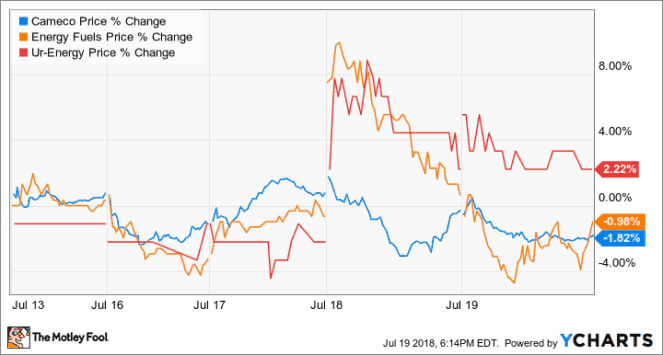

It’s no surprise that the shares of both Energy Fuels and Ur-Energy — along with uranium king Cameco Corp. (TSX:CCO)(NYSE:CCJ) — quickly climbed on the investigation.

But here’s the good news for contrarians: the excitement has already passed. After a speedy correction, all three stocks have largely given up their mid-week gains.

Check it out:

Cameco even released a statement saying that it sees “no immediate effect” from the uranium probe. Cameco is a tricky one, because it’s based in Canada but also has U.S. mines.

The potential impact isn’t clear — positive or negative.

That said, Cameco offered its two cents. “If the issue in question is the overreliance of the United States on uranium supplied by state-controlled enterprises from countries not aligned with American policy interests,” president and CEO Tim Gitzel said, “this clearly does not apply to Canada or Cameco.”

So, where do investors go from here? Well, if you have a high risk tolerance (and long time horizon), these “U-stocks” might make some sense.

As my fellow Fool Andrew Walker touched on, the long-term outlook for uranium is generally positive. The upside is already there. Now, when you add the catalyst of a potential tariff on foreign shipments, stocks like Energy Fuels, Ur-Energy, and even Cameco look that much juicier.

You don’t even have to “pay up” for that potential catalyst after the recent reversal.

The Foolish bottom line

There you have it: three U-stocks that could fly if Trump ultimately imposes a tariff on foreign uranium shipments.

But remember, Fools: only aggressive investors should even think about jumping in. Conservative investors need not apply.