Here at The Fool, we always preach patience. It’s easy to become frustrated with a stock that steadily drifts down. Heck, it’s even frustrating to own a stock that goes sideways for a long period of time.

But the fact of the matter is this: the majority of a stock’s returns usually come on a few “big” weeks of the year. Also, it’s almost impossible to tell exactly when these winning days will come. If you bail too quickly, you could miss them.

Case in point: Toromont Industries Ltd. (TSX:TIH). The stock has traded in an extremely tight range for all of 2018 — essentially returning nothing.

And then, bam! Wednesday happened. Let’s take a closer look, shall we?

What happened?

Shares of Toromont — which distributes Caterpillar equipment — shot up a whopping 14.7% yesterday. Thanks to the surge, the stock now trades at an all-time high.

What has Bay Street so pumped? The company posted market-thumping Q2 results. Earnings spiked 67% to $27.1 million, as revenue flew 82% to $961.3 million. For context, analysts expected revenue of only $886 million. Talk about a blowout.

So what?

Why are these results especially significant?

Well, judging from the stock’s performance in 2018, it’s obvious that investors had their doubts. After all, Toromont is an industrial company. And the worries over trade tensions have weighed most heavily on industrial stocks. Toromont’s strong Q2 sends a clear message that recent tariffs haven’t had a negative impact on business — not yet, anyway.

The solid results also reinforce management’s direction.

Last year, Toromont purchased Quebec-based Hewitt Group for $1.0 billion. This greatly expanded the company’s size and geographic reach. Big deals like that don’t always work out. But Q2 serves as an early indicator that solid progress is, indeed, being made.

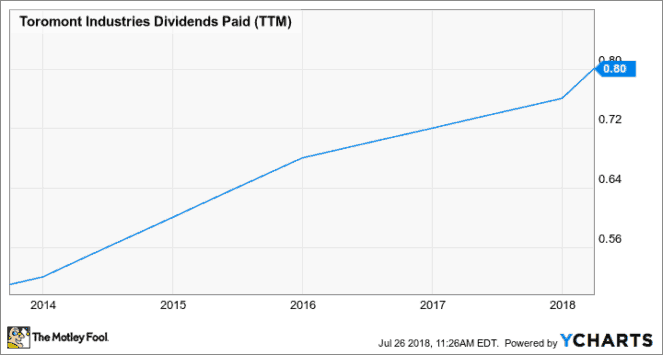

Dividend investors should also be pleased. Along with the results, management announced a quarterly dividend of $0.23 per share. It was recently increased 21% in the April payout.

Given Toromont’s operating momentum, the dividend should easily stay on its solid growth trajectory.

Now what?

I wouldn’t be so quick to take profits off the table. Toromont’s recent expansion is only starting to bear fruit. If you’re a shareholder, it would be a shame not to reap the long-term benefits — all for a quick 15% pop.

“We are still in the early days of realizing the growth opportunities presented by the substantially expanded business and while much work remains, we are pleased with the progress achieved so far,” said president and CEO Scott Medhurst. “Focus remains on integration and sharing best practices across the broader organization to better serve our customers and business partners.”

You’re not a shareholder? The stock’s PEG ratio of one and dividend yield of 1.6% — both pretty reasonable — make it at least worth considering.