It’s not easy holding on to a stock that pulls back after a great run. The natural instinct is to quickly take profits before they vanish completely. This is especially true for stocks in a TFSA account — where your gains are basically tax-free.

But here’s the thing: if the company you own hasn’t done anything specific to warrant the sell-off, it’s often better to sit on your hands.

Stocks go down all the time. As long as your company’s financials continue to improve, the chances of a rebound are always good.

That’s exactly what we saw with Canfor Corporation (TSX:CFP) yesterday.

What happened?

Shares of the lumber company gained a solid 4.5% on Thursday (and it’s up another 1% this morning). It’s a much-needed bounce after falling about 15% in recent weeks.

What had investors breathing a sigh of relief?

Simple: the company posted very strong Q2 results. Adjusted operating income soared to a record $334 million on sales of $1.46 billion (also a record for the company). Moreover, Canfor ended the quarter with a solid $174 million in net cash on its balance sheet.

It was a solid quarter all the way around.

So what?

But what makes these numbers so significant? Well, remember: up until mid-July, Canfor shares had been an awesome tear. As my fellow Fool Victoria Hetherington points out, strong lumber prices — driven by a combo of NAFTA news and environmental legislation changes — have really been a boon to the company.

But as I mentioned, fears have crept in. Lumber prices have dipped. U.S. housing starts dropped to a nine-month low. General volatility has picked up.

So, Canfor’s Q2 results serve as a reminder that things are still pretty good in the lumber business.

Despite recent turbulence, North American lumber demand stayed strong all across the company’s segments. On average, U.S. housing starts came in at 1.26 million units on a seasonally adjusted basis. That’s down 4% from last quarter, but up 8% from Q2 2017. Canadian housing construction remained solid. Globally, demand from China, Japan, and other regions was stable.

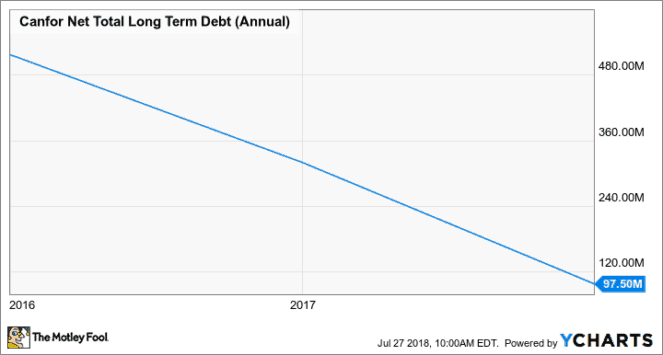

But here’s the part I love most: the company’s net cash position continues to increase. As of June 30, it represents about 8% of its total capitalization.

That’s in line with the bullish trend we’ve been seeing in Canfor’s net debt.

Demand goes up and down. Right now, lumber demand is strong. But it’s reassuring to know that Canfor’s balance sheet can hold up if (and when) it weakens.

Now what?

For now, I share in Canfor’s optimism.

“Looking ahead, the U.S. housing market is forecast to continue its ongoing gradual recovery through the balance of 2018,” said president and CEO Don Kayne. “North American lumber prices are projected to remain solid, and high by historical standards, in the third quarter of 2018 reflecting solid seasonal demand.”

With the stock still off about 13% from its 52-week highs and trading at a single-digit P/E, betting on that projection seems reasonable.