Never judge a company’s quarterly report by Mr. Market’s reaction to it.

While it’s natural to do this, Bay Street often bases its judgement on the “headline numbers” of a report. But in order to be successful as an investor, you need to dig much deeper than that. Then (and only then) can you figure out the real story.

Take Molson Coors Canada (TSX:TPX.B)(NYSE:TAP) for instance. Investors haven’t taken kindly to the stock ever since its reported Q2 earnings last Wednesday. But upon further inspection, there’s good reason to be bullish.

Let’s dive in.

Disappointing … on the surface

First, the headline numbers: Molson posted Q2 earnings per share of $1.88, nicely topping expectations by $0.05. But unfortunately, revenue came in flat at $3.09 billion — missing the consensus by $10 million.

That top-line figure was driven by slumping brand volume, which fell 2.4% year over year to 25.7 million hectoliters.

So, one thing’s clear: industry demand — particularly in North America — continues to be weak. This is what Bay Street was concerned about most, and nothing in Molson’s report eased those worries.

But why am I bit more optimistic? Because Molson’s financials continue to firm up.

Even though demand remained soft, Molson generated whopping free cash flow of $659.8 million in Q2 — up $73.1 million from the prior year. Moreover, management expects strong free cash flow for the remainder of the year.

“Our full-year underlying cost savings and free cash flow guidance has not changed, despite ongoing industry demand challenges in the U.S. and Canada and inflationary pressures,” said CEO Mark Hunter. “While we are aggressively addressing our volume performance in North America, performance in our Europe and International businesses was strong in the quarter.”

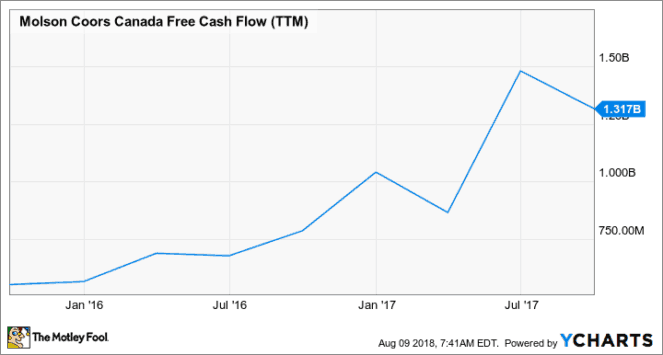

Specifically, the company sees full-year free cash flow of $1.5 billion plus or minus 10%. That’s right in line with the upward trend we’ve been seeing in Molson’s free cash flow recently.

Check it out:

Headwinds remain, but management is doing a great job to cut costs and invest in the right places. There are hundreds of businesses out there facing larger industry softness, but very few can keep their cash flow climbing in the midst of it!

Molson’s massive scale, geographic reach, and dozens of leading brands give management the opportunity to pull lots of different strings — and they’re clearly pulling the right ones.

The Foolish bottom line

Molson’s strong free cash flow generation is being overshadowed by industry softness. Mr. Market is clearly more focused on near-term demand than the company’s long-term financial strength. But that should be just fine with us Fools.

Because with the stock now down 16% over the past year and trading at a single-digit price-to-free cash flow ratio, it’s giving us the chance to gulp down Molson on the cheap.

Fool on.