TFI International Inc. (TSX:TFII) is arguably one of the best overlooked and underrated stocks trading on the TSX. The transportation and logistics company keeps on trucking, which has caused shares to skyrocket 134% since the beginning of February 2016.

The transport and logistics company formerly known as Transforce has obliterated the markets of late and looks to be going parabolic. Although the recent bout of outperformance may imply overvaluation, that simply isn’t the case, as the stock trades at a very modest 14.5 times forward earnings, which is substantially lower than the company’s five-year historical average P/E of 27.9.

While some investors have profited from the wonderful business, I believe the company’s mere $3.88 billion market cap is keeping TFI International stock off the radar of the average retail investor. This leads me to believe that the stock is a dividend growth gem that’s hiding in plain sight.

Although TFI had issues with its dividend payout during the Great Recession, the company has been able to reward investors with low double-digit dividend gr0wth numbers on a somewhat consistent basis over the last few years. As the Canadian and U.S. economies heat up over the next few years, TFI has the capacity to fuel even more double-digit dividend hikes to go with market-beating capital gains.

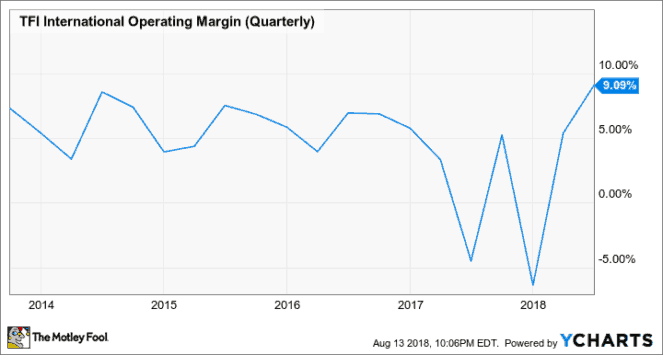

Moreover, TFI is experiencing remarkable operational improvements that were most evident in the company’s latest quarterly results.

For Q2 2018, TFI beat the street on both the top and bottom line. Revenue for the quarter was up 4.3% year-over-year to $1.32 billion, and adjusted EBITDA was up a whopping 28.1% year-over-year to $186.7 million, thereby surpassing expectations of the consensus by nearly 20%.

The major reason for the bottom line beat was attributable to margin improvements across the board. Management’s prior efforts are paying dividends (literally) and the once operationally inefficient company is now back on the right track and is much better-positioned to capitalize on the opportunity at hand as the U.S. economy continues to flex its muscles.

Foolish takeaway

Back in May, I urged TFSA investors to watch the company for any signs of operational improvement. The last quarter, I believe, is a grand slam and shows more than enough evidence that operations have returned to running at full speed. I think the Q2 2018 rally was warranted and could propel the stock to even higher levels from here.

The valuation also remains modest in spite of the return to operational efficiency, so TFI is stock you’re going to want to own at these levels.

If the rails are the backbone of the economy, truckers like TFI are the ribs or limbs. If you’re looking for a way to profit from a strong economy, look no further than TFI.

Stay hungry. Stay Foolish.