Stock picking can be simple if you want it to be. After all, investing is basically the act of laying out cash to get more of it back. Thus, it makes total sense to zero in on companies that actually give it back!

Whether it’s in the form of hefty buybacks or fat dividend cheques, shareholder payments should be the top priority of conservative investors. We get into loads of trouble when we bet too heavily on cash-burning businesses that promise tremendous riches “down the road.”

As the old saying goes, “a dividend in hand is worth triple-digit revenue growth in the bush.” Okay, I might have paraphrased a bit, but you get my point.

To give you a dividend jumpstart, I’ve highlighted three companies that boast hefty yields of at least 6%. Moreover, they all have market caps above $5 billion, which helps us screen out more speculative high-yield plays.

Take a look:

| Company | Market Cap | Dividend Yield |

| H&R REIT (TSX:HR.UN) | $5.9 billion | 6.7% |

| Inter Pipeline (TSX:IPL) | $9.5 billion | 6.8% |

| Vermilion Energy (TSX:VET)(NYSE:VET) | $6.1 billion | 6.3% |

Now, don’t hurry off and buy these stocks for your TFSA just yet. As always, you need to do your diligence — particularly in the high-yield space. Stocks with high yields often have lower growth rates and/or increased risks, so just make sure you know what you’re getting into.

With that said, H&R REIT looks especially interesting to me.

Diversified dividends

If you’re unfamiliar with H&R, it’s a diversified REIT with total assets of about $12 billion. The company owns high-quality office, retail, industrial, and residential properties spread over 38 million square feet.

Late last year, H&R management made a commitment to trim the slow growth “fat” from its portfolio and focus only on high-growth assets. But unfortunately, the shares have underperformed ever since.

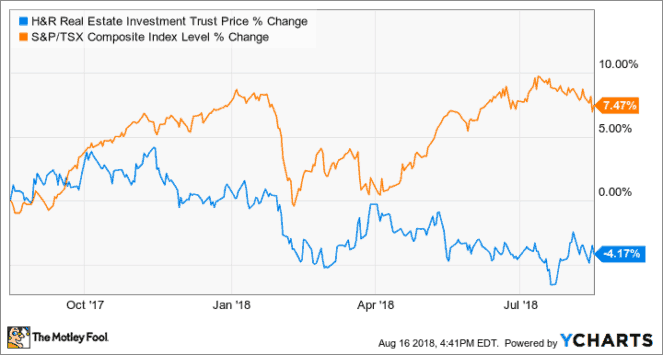

Over the past year, H&R is down 4% vs. a gain of 7.5% for the TSX:

But H&R might be turning the corner.

In its Q2 results released just last week, H&R managed to produce positive growth in both property operating income and same-asset property income (cash basis). Meanwhile, management continued to streamline the portfolio, selling 63 lower growth U.S. assets for US$633 million.

“From a strategic perspective, Q2 2018 was quite productive, with significant asset sales completed in accordance with our goal of streamlining our portfolio and enhancing our growth profile,” said president and CEO Thomas Hofstedter. “We also expect to collapse our stapled unit structure in the next month, simplifying our capital structure and further enhancing H&R’s profile.”

Given the company’s operating trajectory, it’s tough to bet against that bullishness.

The bottom line

H&R seems to be headed in the right direction. So, a bit of patience might be all that’s needed. In the meantime, investors can collect a very satisfying 6.7% yield while they wait (and tax-free if it’s in a TFSA).

The company’s credit metrics remain strong, suggesting that Mr. Market might be overestimating the risks a bit.

Fool on.