In today’s low-rate world, good income is tough to come by. With savings accounts, GICs, and even bond funds paying next to nothing, investors are being forced into “less safe” areas for a crack at a decent return.

But as regular readers know, high yields don’t always have to mean extreme risk. As long you’re diligent, it’s certainly possible to find dividend stocks with an attractive risk/income trade-off.

Well, oil and gas producer Vermilion Energy (TSX:VET)(NYSE:VET) might be one of those opportunities — particularly for investors looking for TFSA income. The company announced a cash dividend last week, which is currently yielding a juicy 6.9%.

Let’s dig in, shall we?

Monthly maven

Here are the details of the dividend announcement: Vermilion will pay a cash dividend of $0.23 per share on September 17. But it will only pay it to shareholders of record on August 31.

So, is the stock worth scooping up by the end of next week? I believe so, and here’s why.

First, Vermilion’s operations are humming right along. In Q2, production increased 15% year over year to 80,625 boe/d. Moreover, strengthening oil prices and the U.S. dollar are serving as a solid tailwind for the company’s cash flow. During the quarter, Vermilion’s fund flows from operations (FFO) — a key metric in the energy space — clocked in at a whopping $193 million.

“Oil prices strengthened by over 10% in Canadian dollar terms during the second quarter of 2018, contributing to a 23% increase in FFO relative to the prior quarter,” said Vermilion in its press release.

“The combination of higher oil prices and a weaker Canadian dollar provides significant leverage to our FFO and free cash flow as the majority of our costs, capital investments and dividends are paid in Canadian dollars.”

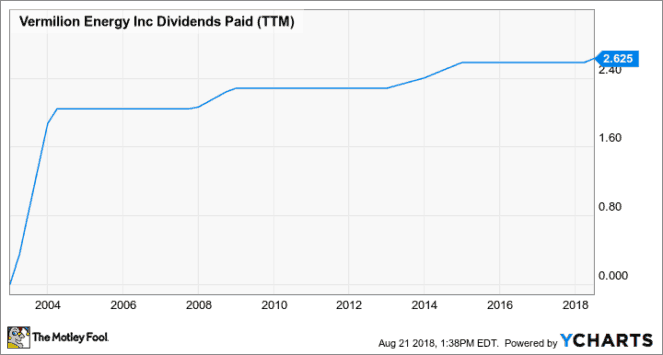

On top of that current operating strength, dividend investors can take quite a bit of comfort in Vermilion’s payout track record. Specifically, the company has paid a monthly dividend to shareholders since 2003. And over that time, it has increased four times with zero reductions.

Check it out:

It’s clear that delivering a consistent dividend is a top priority for management. Vermilion even states this explicitly, describing its business model as one that “emphasizes organic production growth augmented with value-adding acquisitions, along with providing reliable and increasing dividends to investors.”

Given all that the company does to reduce risk — hedging, commodity diversification, relatively low leverage — it’s tough to disagree with that description. Companies love to talk about how committed they are to shareholders, but Vermilion is one of the rare ones that take measures to ensure it.

The Foolish bottom line

There you have it, Fools: Vermilion represents a particularly attractive income opportunity. The company’s solid production, strong cash flows, and commitment to a stable dividend make its 6.9% yield too tempting to ignore.

While Vermilion might not be the most enticing play for growth-oriented investors, conservative Fools hungry for monthly TFSA income should definitely take a look.