Buying low is crucial to winning investing. But it’s tough. Jumping into something that others are racing to get rid of can be a lonely and scary thing, so very few investors actually do it on a consistent basis. There’s great comfort in the crowd.

Of course, if it were that easy, everyone would be making contrarian riches. The truth is that great TFSA fortunes are built by buying solid companies:

- While they’re being completely overlooked by Bay Street;

- When Mr. Market is frustrated with their operating performance; or

- During times of overall market panic.

Unless you’re willing to zig while others zag (at least most of the time), your chances of outsized wealth decrease significantly.

Now, I can’t pick your beaten-down stocks for you. But here are five possible “buy low” ideas that you might want to consider. These are all companies that boast healthy returns on equity (ROE) above 20%, yet whose shares are down double-digits over the past month.

Check it out:

| Company | Trailing 12-month ROE | 1-Month % Change |

| CI Financial (TSX:CIX) | 33% | -10% |

| Constellation Software (TSX:CSU) | 44% | -15% |

| Magna International (TSX:MG)(NYSE:MGA) | 21% | -11% |

Just a word of caution, Fools: these stocks have been sold off for very specific reasons, so don’t rush out and buy them blindly. They’re not formal investment recommendations, but rather suggestions for further research.

That said, Constellation Software looks like an especially interesting turnaround opportunity.

Dimming Constellation?

For those unfamiliar with Constellation, it’s a tech stock that’s been an absolute Bay Street darling over the past decade. I’ve always wanted to get my hands on it, but the valuation has always kept this stubborn value investor away.

Well, after the recent pullback, I might finally be getting my chance.

So what’s all the worry surrounding Constellation right now? It all started back in July when the company’s Q2 earnings increased just 2% to $52 million. That’s a pretty decent profit for most companies. But for a high-flyer that typically sports a P/E in the high 60s, 2% earnings growth just isn’t going to cut it.

High-growth, high-multiple companies get crushed that much harder when they disappoint Bay Street. Why? Because there’s already so much optimism baked into the price. Right now, investors are recalibrating their growth estimates on Constellation, and with management not even holding a conference call, Mr. Market seems to be erring on the cautious side.

But here’s why there’s good reason to remain bullish: despite disappointing earnings, Q2 revenue soared 25% to $752 million. Furthermore, operating cash flow continues to be healthy, with $53 million coming in during the quarter.

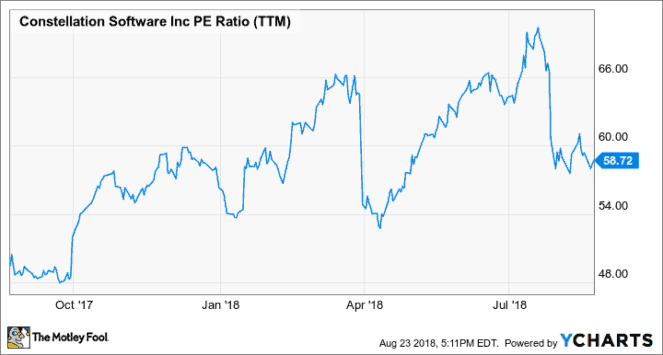

And this is my favorite bullish point, particularly for the value-conscious: Constellation’s P/E ratio has dipped significantly.

To be sure, a P/E in the high 50s is still no bargain. But in my experience, high-quality growth stocks will always look expensive. The key is to be reasonable — don’t chase them at ridiculous nose-bleed valuations, but don’t expect them to ever trade at bargain-basement prices either.

A company like Constellation is worth paying up for. And now seems like an opportune time to do it.

Fool on.