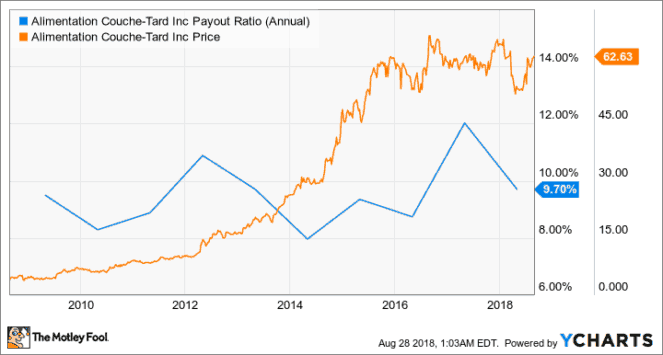

Alimentation Couche-Tard (TSX:ATD.B) could very well be Canada’s most misunderstood stock. Just have a look at the long-term chart. It’s indicative of a business whose stock is transitioning from growth to value mode. While it may seem that Couche-Tard is destined to suffer from lower top-line growth numbers and fewer M&A opportunities moving forward, nothing could be further from the truth.

Make no mistake. Couche-Tard is still the growth stock we’ve grown to love; it’s just taking a lengthy breather. The convenience store industry remains incredibly fragmented, so there are no shortage of potential M&A (and synergy) opportunities out there.

Moreover, investors need to remember that Couche-Tard is a global player, not just a North American one. And given founder Alain Bouchard’s commentary over the possibility of an Asian expansion, I suspect another market-crushing leg-up may be possible for Couche-Tard stock after its multi-year hibernation.

Why the slowdown?

Couche-Tard isn’t the talk of town like used to be when a new deal was announced on a somewhat regular basis. The higher frequency of its acquisitions in the past (before its massive $3.67 billion CST Brands acquisition in 2016) kept investors excited because an announced deal pretty much meant that a considerable amount of value was to be realized in the form of synergies.

Since the massive CST Brands (and Holiday) acquisition though, the pace of Couche-Tard’s wheeling and dealing has slowed considerably.

The CST Brands acquisition is taking a lot longer to digest than the smaller-scale deals it has made in the past. There are still ample synergies that are to be realized over a year after the massive deal was closed and as it stands, there’s a considerable amount of debt on the balance sheet compared to prior years (over $8.84 billion in long-term debt).

This elevated amount of debt may prevent fast-and-furious small-scale acquisitions in the meantime, but given the ample amounts of free cash flow that Couche-Tard is generating, it’s only a matter of time before there’s enough cash to put to work, likely in the red-hot Asian market where high double-digit ROEs can be expected.

In the meantime, Couche-Tard’s going to be busy squeezing the remaining synergies from its CST Brands and Holiday acquisitions, while continuing to rake in wads of cash from its network of c-stores that are well positioned to bounce back from a tough start to the year.

There’s no incentive for long-term thinkers to stick around

Couche-Tard, while incredibly busy behind the scenes, appears to be dormant through the eyes of investors, which has many throwing in the towel.

The stock hasn’t appreciated in years, and the 0.65% dividend is meagre, so there’s really no incentive for an investor to stick around until the stock can garner momentum to break through its high-$60 long-term level of resistance.

While a couple more solid quarters could bring the stock out of its funk, given the change in the company’s M&A approach (larger takeover targets and lengthier integration cycles), I think it would be a wise idea for management to “bribe” shareholders with a fatter dividend in much in the same way that Restaurant Brands International did when it more than doubled its dividend.

Today, Couche-Tard has a mere 9.7% payout ratio, so there’s a ton of room to double or even triple its dividend such that it’d yield around 2%, giving investors more of a reason to hold their shares through difficult times like the “perfect storm” of one-time issues it faced several months ago.

Foolish takeaway

The growth is still there, and in time, Couche-Tard will be making deals again, but in the meantime, shareholders don’t have much to get excited about.

While I do think shares are severely undervalued at just 15.4 times forward earnings, I also believe that management should be doing a better job of rewarding its long-term shareholders in the form of a more significant dividend increase to keep them happy over the medium-term.

Couche-Tard has grown its dividend by a generous double-digit percentage amounts in the past, but the fact remains that a yield south of 1% isn’t going to do much, if anything, to keep investors sticking around.

Stay hungry. Stay Foolish.