Screening for stocks using the price-to-earnings ratio (P/E) is a strategy that may box a do-it-yourself investor into a corner of the market.

A P/E below 12 is a decent way to spot value. Sometimes, however, it may be wise to de-emphasize this valuation metric — or, dare I say, ignore it.

Tech stocks, REITs, pharmaceuticals, and nascent industries are examples where P/E is less relevant. Investors that love the P/E metric can ask these questions as a way of getting healthy investment context:

1. What is the five-year P/E range?

2. What are some of the reasons the P/E is really low?

Here’s the perfect odd-ball pairing with two companies with completely opposite forward earnings.

Cascades (TSX:CAS)

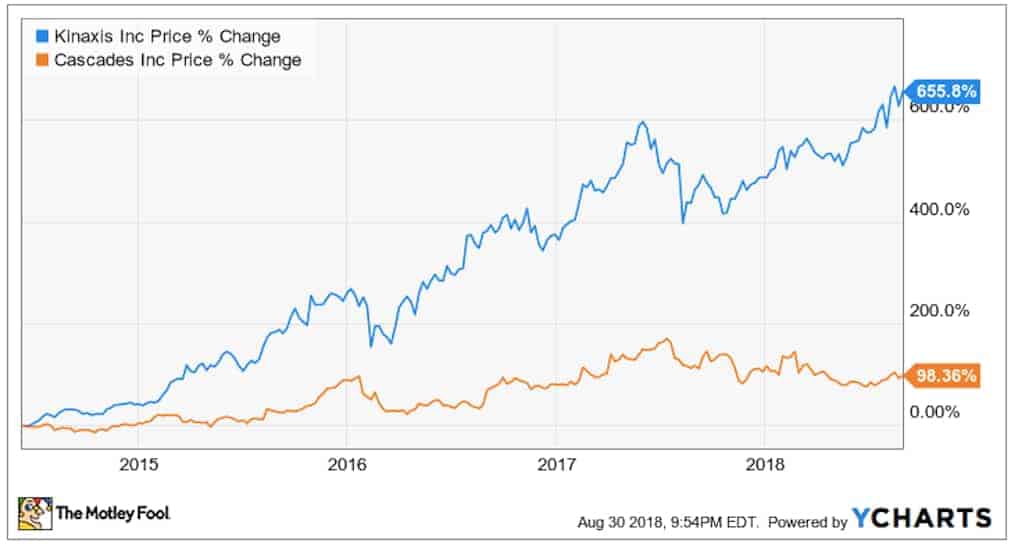

Fellow Fool contributor Andrew Button referred to Cascades as the “cheapest stock on the TSX.” Before value investors get too excited, let’s back up and look at a few details on this Québec-based, green recycling company with a market cap of $1.3 billion.

The forward P/E is the price of the stock divided by the expected annual earnings. Cascades has a forward P/E of 8.4, which is definitely on the low end but not far off from where the market prices this company over long stretches. The five-year average forward P/E is 9.9.

Six analysts give Cascades votes of confidence with unanimous “buy” recommendations, according to a August 30th Thomson Reuters report. Will these analysts retain their convictions if Cascades has another bad quarter?

I’m being a bit snarky, but Cascades seems to have missed quarterly earnings estimates 17 out of the last 23 quarters. As a baseball batting average, .260 is not bad, whereas a company that misses quarterly earnings that often is enough to drive down investor confidence — that is a low P/E!

Analysts might be optimistic that the stock has already put in a bottom. The forward P/E puts this stock at undervalued, so the price may have one way to move, which could be up.

Kinaxis (TSX:KXS)

Then there is Kinaxis, with a whopping forward P/E of 71. The Canadian-born, Ottawa-based tech company covets the high multiple because the supply chain management business is booming. Companies use Kinaxis’s solutions to identify business efficiencies. The list of Kinaxis’s awards suggests this company is a clear leader.

Up year to date by 28%, it looks to be another year where this stock will beat the market.

Has Kinaxis ever missed earnings estimates? Why, yes. Kinaxis whiffed on earnings estimates with almost equal proportion as Cascades. Let’s face it; the business of operating a public company is not easy.

Subscription services accounted for roughly 80% of revenue in the Q1 2018 report, covered in more detail by Brian Paradza. As long as Kinaxis can keep its clients happy, this consistent source of revenue is a cash cow.

Foolish take-home

Markets may be irrational at times, leading to “inaccurately” priced equities, a.k.a. low-P/E, cheap stocks. Generally, though, stocks covet the price multiple they deserve. So long as an investor goes in with eyes wide open, buying stocks at either ends of the valuation spectrum can make for a good investing ride. Will Cascades and Kinaxis both beat the overall TSX market performance this year? I’ve got my money on Kinaxis.

Stock Up Sale

Stock Up Sale