Income investors had the rug pulled from underneath them when Enbridge (TSX:ENB)(NYSE:ENB) stock plunged in 2015. Shortly afterward, shares rallied only to surrender all of those gains as regulatory hurdles and other setbacks caused shares to pull back to new multi-year lows.

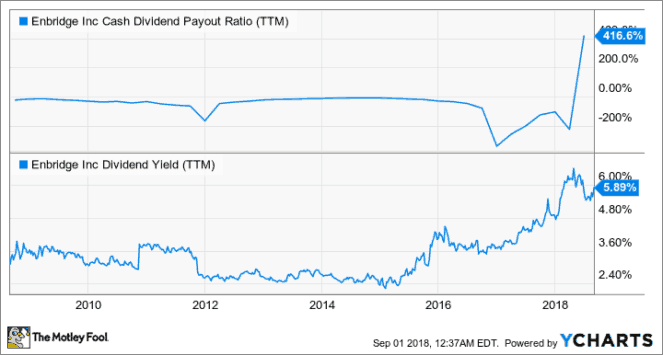

At the time of writing, Enbridge has a fat 6% dividend yield, which is substantially higher than the company’s historical average dividend yield, and while it may seem like the company is no longer a cash cow that can be relied upon given its rather uncertain future. I’d argue that most of the fears are already baked in here and that most conservative income investors have already had ample opportunity to throw in the towel, leaving better prices for contrarian investors who have the patience and the time horizon to ride out the harsh waters as the company returns to glory.

The highly regulated nature of the business of pipelines is actually a double-edged sword. Excessive hurdles placed before proposed pipeline projects are enough to make any manager pull their hair out. While it’s a pain in the side of Enbridge, the highly regulated nature serves as a moat if Enbridge can make it through the hurdles to complete its project in a somewhat timely manner.

Moreover, given the huge demand for energy liquids transportation, Enbridge and other pipeline firms are well-positioned to become rock-solid, stable cash cows. The way I see it, after the hard times are over will come a brighter, more optimistic road. Sure, Enbridge isn’t in excellent financial health today with the exorbitant amount of debt on its balance sheet, but given the promising growth path ahead and the stable nature of potential cash flow streams, I’d argue that the worst times for Enbridge are already in the rear-view mirror.

Now, Enbridge’s dividend commitment through difficult times was a questionable move according to some analysts. But given the potential cash flows, I think the dividend is safe and will continue to grow for many decades despite dividend payments exceeding the amount of free cash flow in recent years.

Foolish takeaway

If you’re an income investor, you can rely on the dividend payment that’s going to be hiked by 10% annually over the next three years. Once we hit 2021, I’m willing to bet that Enbridge will be in much better shape than it is today, and if that’s the case, expect another dividend promise to be put in writing.

Buy the stock here, collect the dividend payments, and don’t even look at the stock. Three years out, you’ll be glad you did.

Stay hungry. Stay Foolish.