The downtrend in gold continues. In August, the price of gold declined 2.2%, representing the fifth straight monthly decline — the longest streak in more than five years.

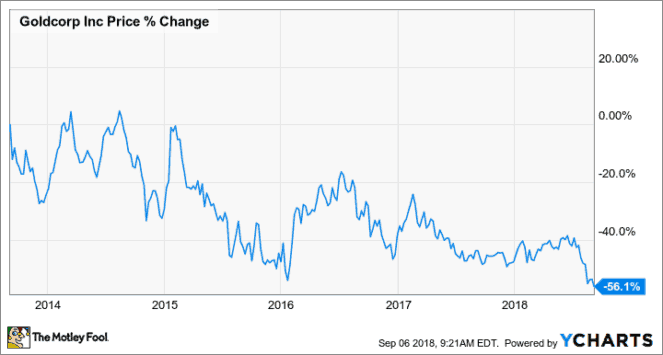

Of course, that weakness has also taken down large gold miners. Goldcorp (TSX:G)(NYSE:GG) in particular has been especially bruised, with its shares off more than 25% over just the past three months. Meanwhile, the S&P/TSX Composite Index has managed to eke out a slight gain over the same period.

But with that said, management issued a press release yesterday that should give investors some bullish vibes going forward.

Let’s check it out, shall we?

Golden strides

Here’s the latest news out of Goldcorp: management is reporting “significant progress” on key permitting and project milestones.

Among the highlights, Goldcorp says the bulk sample extraction at its key Borden Project is two months ahead of schedule. Additionally, its Pyrite Leach Project has completed construction with commissioning bumped up to Q3 of 2018 — two quarters ahead of schedule. First gold and commercial production at Pyrite Leach are expected in Q4.

Over its Coffee Project, the adequacy review phase has been completed, with production expected to commence in 2021.

So, what’s the big deal?

Well, all of these positive developments contribute to Goldcorp’s five-year 20/20/20 plan — a company objective to increase gold production by 20%, increase gold reserves by 20%, and decrease all-in sustaining costs per ounce by 20%.

Remember, the weakness in gold hasn’t been the only thing weighing on Goldcorp shares. Management has been trying to reverse a trend of lacklustre earnings, production, and increasing costs for a few years now.

So, this recent update from the company suggests that the turnaround is indeed gaining traction.

“We continue to be impressed with our team’s execution as we advance projects on time and on budget through the permitting and development process,” said CEO David Garofalo. “Goldcorp provides its shareholders with meaningful value growth opportunities over the next decade with reserve and production growth and declining costs from existing mines, and the strongest pipeline of potential large-scale new mines.”

Given Goldcorp’s clear operational improvements, its battered stock could very well represent exceptional value.

The bottom line

There you have it, Fools: Goldcorp’s recent update suggests that the company’s transition continues to go smoothly.

The shares remain pressured by the weakness in gold, and there’s no telling when that will subside. But it’s comforting to know that Goldcorp seems to be taking care of what it can control.

With the stock still off 30% from its 52-week highs, now might be a good time to play that fundamental improvement as well as a rebound in the price of gold. Moreover, with a beta of just one — the same volatility as the market — chances are investors won’t have to experience violent moves to do it.

Fool on.