The market continues its recent mini-slide. The S&P/TSX Composite Index fell on Friday, marking its fourth consecutive session. Overall, Canada’s main index fell 1% over the past Labour Day week.

So, what’s all the concern? Well, for starters, a trade deal between U.S. and Canada still isn’t done. Both parties remain at the table, but rumours are now swirling that NAFTA talks could continue until the end of September.

Adding to the worry, investors received some troubling economic news to end the week: the Canadian economy lost 51,600 net jobs in August.

That pushed unemployment rate to 6%, up from 5.8% in July, essentially wiping out the large gain in the month prior. The news came as somewhat of a shock to Bay Street, as economists were actually expecting an increase of 5,000 jobs in August.

Of course, not all stocks were negatively impacted. In fact, I’ll highlight a few of them that made particularly big jumps. It’s always good habit to take a look at stocks bucking the trend, as they could possibly serve as a hedge against a larger downturn.

Without further ado, here are three of last week’s biggest winners.

In addition to flying more than 10%, they all have market caps of roughly $1 billion and above. This helps us avoid speculative small-caps jumping on pure speculation.

| Company | 4-Day % Price Gain | Market Cap |

| Aphria (TSX:APH) | 20% | $4.7B |

| Hydropothecary (TSX:HEXO) | 27% | $1.4B |

| Savaria (TSX:SIS) | 11% | $920M |

As always, don’t view these stocks as formal recommendations. Instead, look at them as a starting point for further research.

With that said, Savaria makes a ton of sense to me.

Savory Savaria

Savaria isn’t a household name, but its business model is easy to understand: the company provides accessibility solutions — such as stair lifts, wheelchair lifts, and elevators — for the physically challenged.

While the accessibility industry probably isn’t the first place you think about when going for growth, Savaria’s recent results might have you thinking differently: in Q2, earnings spiked 131% to $6.4 million as revenue jumped 61% to $24.4 million.

“We have an impressive portfolio of new business in development that meets our strategic plan of adding sales territories, distribution channels and products,” said CEO Marcel Bourassa. “Both our ceiling lift product line and our new Vuelift glass elevator are building new sales opportunities, while our Greenville Span-America location provides us with an important U.S. manufacturing facility.”

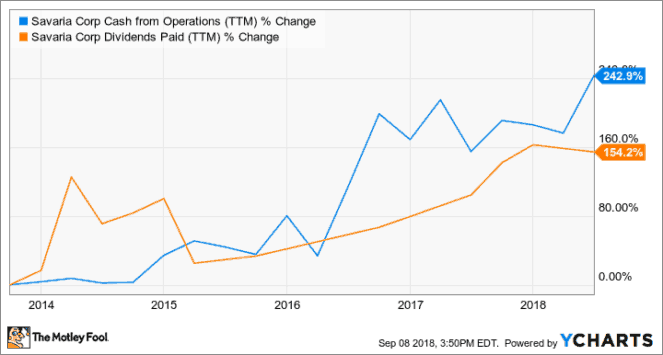

Of course, what we Fools really love is dividend-producing cash flow. Fortunately for investors, Savaria produces a very healthy amount of it. Over the past five years, in fact, the company has grown both its operating cash flow and dividend payout by 243% and 154%, respectively.

In terms of value, Savaria’s shares don’t look cheap. The stock is up more than 20% over the past month alone and sports a seemingly lofty trailing P/E of 38. So, it’s safe to say that Mr. Market is catching on.

But with a decent dividend yield of 1.8% and a forward P/E of less than 25, Savaria’s growth prospects might actually be very reasonably priced.

Fool on.