During the Financial Crisis of 2008, Canadian banks got caught in the massive tailspin even though the risky practice of sub-prime lending was generally used south of the border. For a brief period, however, bank stock prices were cut in half, which meant the dividend yields approached a lofty and incredible 10%. Imagine owning Royal Bank of Canada (TSX:RY)(NYSE:RY) and doubling your investment every ~seven years from the dividend income alone.

Against that backdrop is Laurentian Bank of Canada (TSX:LB) a golden opportunity? While the 6.3% dividend isn’t in the double digits, it is very high, seemingly sustainable and almost twice Royal Bank’s 3.8% yield.

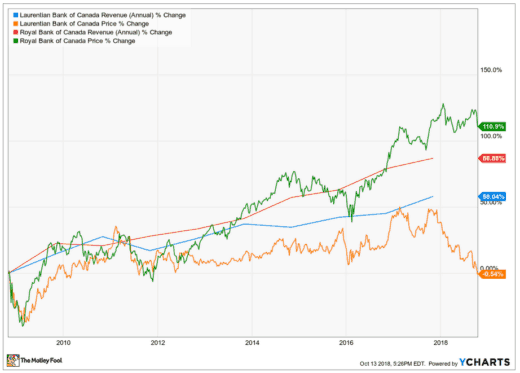

The rising interest rate environment could have been a tailwind for Laurentian, yet share price has dropped steadily. Shareholders are no doubt frustrated with a 32% decline in one year. Fears of a value trap are justified, but is it true? I think not, but only time will tell. In fact, value-oriented analysts are now beating the drum in support of Laurentian.

Revenue has climbed pretty consistently over many years. Earnings have not kept up, in part because restructuring is ongoing. In 2017, Laurentian merged 46 branches and converted 23 branches into advice-only service – yes, you read that right. I did a double take when I came across this term in the Q3 report. In my opinion this is a clear attempt to cut into the increasingly coveted wealth management business. Earning trust through sage advice is a way to gain access to eyes, ears, and pocket books from retail investors. This move also reflects the average customer experience clearly going in the direction of more online banking.

Presumably online services are less lucrative, and may be one reason why “Other Income” in the Q3 report states income from fees dropped by $11.8 million to $255 million over nine months. Meanwhile, a growing source of revenue is coming from business customers, something I think investors interested in Laurentian should watch closely.

Business-based customer revenue helped push total revenue up 8%, to $787 million over nine months compared to the equivalent nine months in 2017. Building more rapport with business clients provides diversification. Increased reliance on commercial banking could expose Laurentian to macroeconomic factors that influence small business success, such as employment rates, GDP growth and recessions.

Then there’s Royal Bank, a pension fund and retail portfolio favourite and the biggest Canadian bank by market cap. Although it is too big to outpace other stocks when it comes to growth, Royal Bank has pretty much crushed it since the Financial Crisis, with shares up 111% during that period, thus outperforming many U.S. banks and earning core holding status in many RRSP or TFSA accounts.

The takeaway

If you’re looking to buy your first really solid Canadian stock, now is a good time to buy Royal Bank. I’d invite pot investors — those who have been lucky enough to make a profit — to pull money off that commodity table and put it to work with an investment with longevity. Laurentian is certainly enticing right now, but patience is warranted.