Two stocks operating in the visual computing space, one American and one Canadian, look to be almost direct opposites: one of them is involved in commercial and government Earth-imaging, while the other is a key player in the gaming industry. Together they make the perfect odd-couple, although only one of them wins on value. Let’s see which of these two very similar — yet very different — stocks is worth your investment.

Money makes the world go round … but this company maps it

Probably the best undervalued tech stock on the TSX index, Maxar Technologies (TSX:MAXR)(NYSE:MAXR) had a bad end to 2018, to put it mildly, with a pretty precipitous nosedive. An aerospace and geospatial intelligence player, Maxar operates in the imaging and data business, earning its bread and butter with planetary imaging and the kind of cutting-edge Earth imagery you’ve seen more basic versions of whenever you use your GPS or online maps.

Selling at a discount of more than 50% of its future cash flow value, Maxar is still in undersold territory today, with a negative one-year past earnings growth that failed to match the 16.9% aerospace and defence industry average for the same 12 months, while its own five-year average is also in the red.

Never mind the bad news though, or the fact that Maxar’s debt level is way up at 187.8% of net worth, because it gets better: inside buying has been high over the last six months, with the last three months in particular seeing significant volumes of shares changing hands.

Meanwhile, deep undervaluation is indicated by a very low P/B ratio of 0.2 times, and a cheap share price is pushing up the dividend yield to impressive double digits. Thinking of buying at that deep discount? If you do, you should hold on for the rewards, because a 69.6% expected annual growth in earnings is on the way over the next one to three years.

Time to get your investing game on!

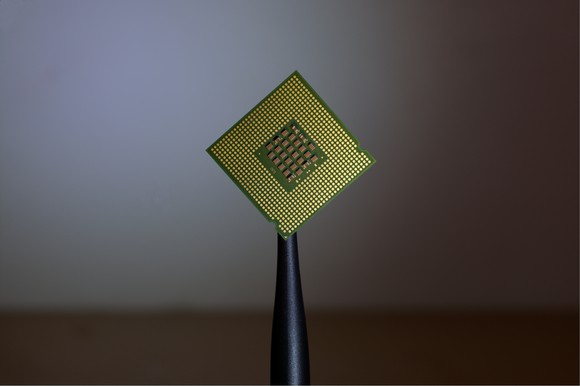

Overvalued by almost a quarter of the future cash flow value, Nvidia (NASDAQ:NVDA) stock is one expensive puppy. A P/E of 19.5 times isn’t too bad at all, but a P/B ratio of 9.7 times means that anyone buying today will be paying close to 10 times what this stock is worth in terms of real-world assets. Still, if you’re into gaming, artificial intelligence, or self-driving cars, then this is the stock for you.

If you want to see a good track record in your stocks, a one-year past earnings growth of 82% beats the semiconductor industry average of 7.1% for that same year, as well as its own (already impressive) 50.4% five-year average past earnings growth. Meanwhile, a debt level of 21% of net worth is below the danger threshold, meaning that this stock is relatively safe to hold long term, and a 50% ROE for the past year is exceptionally high — even if a dividend yield of 0.43% is not.

The bottom line

E-sports are set to be a huge growth industry — a trend which will only continue exponentially if a global economic downturn forces people to cut back on spending money — and if industries decide to cut back on people to save money. That’s right — the robot revolution is coming, and companies like Nvidia will be front and centre when it happens. Maxar is much better value, though, so if you want affordable visual computing shares, you may want to buy Canadian.