One of the only things that most investors seem to remember about Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) is that it was the Canadian bank that got hit hardest by the 2008 financial crisis.

While there’s no question that management got caught with its pants down during the downturn, struggling to rebound as quickly as many of CIBC’s Canadian banking peers did, it’s worth noting that the bank has made major fundamental improvements to its underlying business such that it won’t be that “ticking time bomb” of a bank to blow up come the next economic downturn.

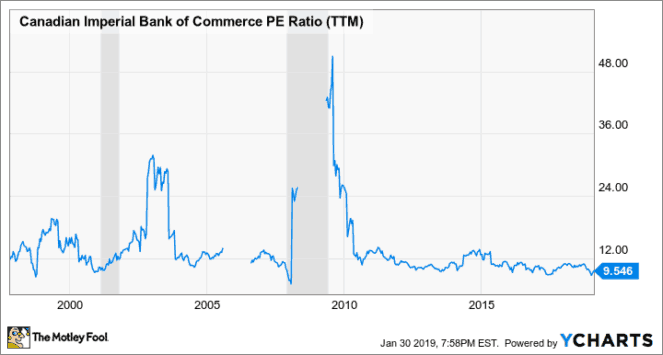

The most remarkable thing about CIBC is that the stock has never returned to its historical average valuation that was commanded prior to the 2007-08 crash, despite being a much better bank today compared to a decade ago. Have a look at the chart above and you’ll see that CIBC used to command a P/E that hovered around the 12 range. After the recession, a P/E of 10 turned into the new normal, with single-digit P/E multiples not being out of the ordinary on broader market pullbacks.

Indeed, the 65% plunge that took nearly a decade to fully recover from left a bad taste in the mouth of investors, especially when you consider how much better CIBC’s peers were at weathering the storm that crippled many U.S. banks that also exhibited sub-par risk-management policies.

CIBC isn’t today’s best-run Canadian bank by any means, but I think it’s the best bank for your buck given the perennial discount that’s been slapped on shares in spite of the efforts made by CEO Vic Dodig and his team. While still a bank that’s overexposed to the domestic market, CIBC is going all out with its new U.S. business PrivateBancorp (since renamed to CIBC Bank USA).

Moreover, CIBC has shuffled its corporate governance to adopt better internal processes so the bank won’t have a repeat of the disaster that was 2007-08. Operational efficiencies have been accomplished, but investors clearly remain skeptical because of the bank’s alarmingly high exposure to domestic mortgages, which have experienced more muted growth in recent quarters.

CIBC still has a heck of a lot of uninsured mortgages in its loan book, but this unattractive metric, when combined with the bank’s cringe-worthy history of dealing with crises, has produced massive value for investors who seek the greatest risk/reward trade-off.

Sure, you’re taking on a bit more risk with CIBC and its sub-optimal book of domestic retail loans, but when you consider the price you’re paying (8.8 times next year’s expected earnings), the probability of a Canadian housing downturn and its implications on CIBC are likely already factored into the stock. Perhaps the discount and worries over a possible housing flop are exaggerated in the case of CIBC.

From a longer-term perspective, CIBC is positioned to improve the quality of its earnings with its U.S. venture. And with more stringent Canadian mortgage regulations, CIBC’s mortgage growth has lagged all Big Six peers in recent quarters.

It appears that CIBC is putting a cap on its “single source of failure” with its less-aggressive mortgage growth numbers of late. Add CIBC’s operational improvements and enhanced customer perception into the equation, and I think CIBC is due for significant multiple compression over the next decade and beyond.

Foolish takeaway on CIBC

Sure, CIBC will still get smacked hard come the next recession, but don’t expect a repeat of 2007-08, because the bank is way more robust than it was back in the mid-2000s.

When you look at how banks have improved themselves over the last decade, I think CIBC ought to be at or near the top of the list. Moving forward, I expect Dodig and company to create substantial value for shareholders, and that’s with or without recessions thrown into the mix.

CIBC is the cheapest Canadian bank stock, and given the promising forward-looking growth runway in place, I think it’s ridiculous that the name is cheaper than the regional banks.

Stay hungry. Stay Foolish.