Editor’s Note: A previous version of this article stated that you could earn $500 in dividend income per month with a $10,000 investment in Pembina Pipeline. This has been corrected to say “per year.”

It’s wonderful to generate passive income to complement your active income. It’s like hiring someone to work for you, except you only pay him once.

Simply buy quality dividend stocks when they’re priced at good valuations and then hold them forever. So, you only have to pay that commission fee once and earn passive income for life.

Right now, Pembina Pipeline (TSX:PPL)(NYSE:PBA) is getting attractive on the recent dip. Conveniently, the energy infrastructure stock offers a monthly dividend that’s currently good for an annual 4.85% yield. This is very compelling — a boost of more than 70% in income — compared to the Canadian stock market’s yield of about 2.8%.

Why Pembina is quality

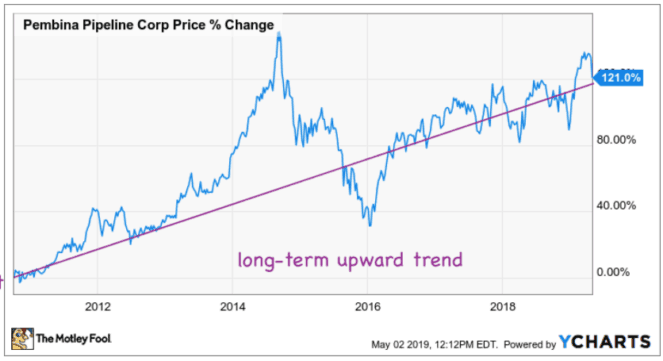

One easy way to identify that Pembina is a quality stock is that its long-term stock price chart has been in an upward trend with returns that outperforms the markets’. This indicates that the market recognizes that Pembina has been consistently generating shareholder value.

In fact, since 2007, Pembina stock has delivered annual total returns of more than 12%, which beat the North American stock market returns of less than 8% in the period. This was supported by operating cash flow per share growth of about 12.8% per year in the period.

Why Pembina’s dividend is safe

You want to get passive income from safe dividends, so you don’t get those nasty dividend cuts that are way too common in the stock markets.

Here’s why Pembina’s dividend is safe. Its business consists of diverse and integrated assets, including pipelines, midstream, and gas processing plant assets.

Together, they generate about 87% of cash flows that are supported by long-term contracts, which reduce the impact of swings in commodity prices or volumes. This coupled with an adjusted funds-from-operations payout ratio of about 60% makes Pembina’s juicy monthly dividend secure.

How to make $500 of passive income a year

To get $500 per year from Pembina, invest about $10,340 at the stock price of $47 per share as of writing. However, if that’s all you’re investing in your portfolio, that’s too much concentration in one stock.

You don’t want all your eggs in one basket. You shouldn’t just stop at having one dividend stock to generate your passive income. Instead, you can divide that +$10,000 to up to five quality dividend stocks.

That way, you wouldn’t be paying too much in commission fees, but you’ll have your hard-earned capital well invested. Make sure your chosen stocks are diversified across different sectors. Utilities, banks, REITs, and telecoms are common places to invest for secure passive income.

Stock Up Sale

Stock Up Sale