The U.S. and Canadian markets are trading near their all-time highs. So, it has become more difficult to find bargain stocks. Yet, here we have an undervalued dividend stock that can double your money.

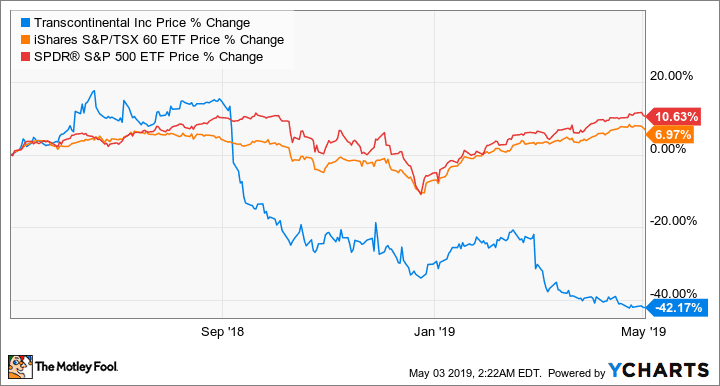

Transcontinental (TSX:TCL.A) stock looks super cheap compared to the market. While the North American markets have delivered roughly their long-term average returns over the last 12 months, the stock has fallen 42% and trades at a forward price-to-earnings ratio of about 6.4.

Transcontinental’s stock price action looks outright scary, but the company fundamentals are holding their own, even though admittedly, there are higher uncertainties and risks in the investment.

A Canadian Dividend Aristocrat

Transcontinental is actually a proud Canadian Dividend Aristocrat for having increased its dividend for at least five consecutive years. In fact, it passes the test with flying colours for having increased its dividend for 17 consecutive years!

The company just boosted the dividend by 4.8% in February, while its five-year dividend-growth rate is 7.4%. The payout ratio for this fiscal year is estimated to be about 35%. Although that’s the highest payout ratio in the company’s history, it leaves plenty margin of safety to keep the dividend safe.

What’s the risk

Transcontinental is a transforming business. It’s Canada’s largest printer, which has helped publishers and marketers deliver their content via integrated printing solutions for more than four decades.

Since 2014, it has begun transitioning the company into packaging, which is a higher-growth area. It did so by selling some of its printing assets and buying small packaging companies until the big acquisition in Coveris Americas in 2018.

In fact, in 2018, Transcontinental made three acquisitions in flexible packaging, including Coveris Americas. As a result, the company has become a North American leader in flexible packaging.

Making acquisitions and integrating businesses is a risky endeavour. A Harvard Business Review article dated 2011 stated that study after study showed that 70-90% M&A failed to deliver shareholder value. That’s a very high rate of failure! Making multiple acquisitions in a short time period only increases the risk.

Moreover, Coveris was worth about US$1.3 billion, whereas Transcontinental’s enterprise value is only about CAD$2.8 billion today. Investors need to trust that management learned from the previous acquisitions in packaging over the last few years and made the right decision in acquiring Coveris.

Coveris is a key acquisition. It increased Transcontinental’s international exposure and expanded its customer base. Management also estimates cost-saving synergies of about US$20 million per year within 24 months of closing the acquisition.

Another thing that’s weighing down the stock is that the company’s leverage ratio skyrocketed to 2.7 times after the 2018 acquisitions. Transcontinental expects to bring down the ratio to less than two times by the end of fiscal 2020. The good thing is, Transcontinental has maintained an investment-grade credit rating.

Foolish takeaway

Transcontinental is very different from a few years ago. In 2014, it was largely a printing business. Now, it’s largely a packaging business. Its revenue mix is about 52% in packaging and 45% in printing.

Currently, the company has a run-rate annual revenue of close to $3 billion. Since 2015, its adjusted EBITDA has increased every year for cumulative growth of 21% to $459 million, while its adjusted earnings per share have increased about 14%.

Management estimates that with synergies and organic revenue growth, the company can expand its EBITDA margin from 11.7% in fiscal Q1 2019 to 15% by 2021.

We’ll see if the Coveris acquisition is a fit for Transcontinental or not. If all goes well, an investment in undervalued Transcontinental stock today can double your money in a few years. Meanwhile, you can earn a high dividend yield of 5.5%, which looks safe.