Recently listed cannabis stock MediPharm Labs Corp (TSXV:LABS) is trending for all the right reasons in May after the company has achieved in two consecutive quarters what its big brothers in the industry could only dream of since inception.

The company reported its second adjusted operating earnings quarter on May 10 covering the three months ended March 31, 2019.

MediPharm received its initial sales license in November last year and went on to report a positive adjusted EBITDA from $10 million in revenues in two months. It has done so again for the second time on $22 million sales in its first full quarter of sales, beating several well-known industry giants like Canopy Growth (TSX:WEED) to operating profitability.

Who is MediPharm Labs?

Listed on October 4, the young firm was the first marijuana player to be licensed by Health Canada without a production facility as its business strategy is reliant on value addition, and not primary agricultural production.

The company specialises in producing and selling cannabis extracts on a wholesale basis from dried marijuana procured from various licensed producers (about 15 of them so far) and management has introduced tolling services to Canadian licensed producers (LPs) for oils, formulations and derivatives production.

The company has also entered into supply agreements for oils and capsules with four Canadian provincial authorities as it prepares to make direct sales into national distribution channels.

Record earnings performance

The company’s top line increased by a massive 115% sequentially as it reported its first full quarter of sales, and there wasn’t a single acquisition made to bolster sales growth.

Even more impressive is the fact that both quarters were actually profitable on a normalised Adjusted EBITDA basis, one of the most reliable cash based operating profitability measures that removes the impact of share based compensation and somewhat arbitrary amortisation charges to reflect the earning power in a company’s business model.

Although the gross margin was lower at 31% as compared to 39% in a previous quarter due to lower average selling prices (the opportunistic price increase during industry product shortages last year were not repeatable) the company maintained a positive 20% Adjusted EBITDA margin and grew the adjusted operating earnings by 102% sequentially.

Most noteworthy, the company recorded positive operating cash flows for the quarter, something most industry peers can only dream of.

…and the stock is responding so well

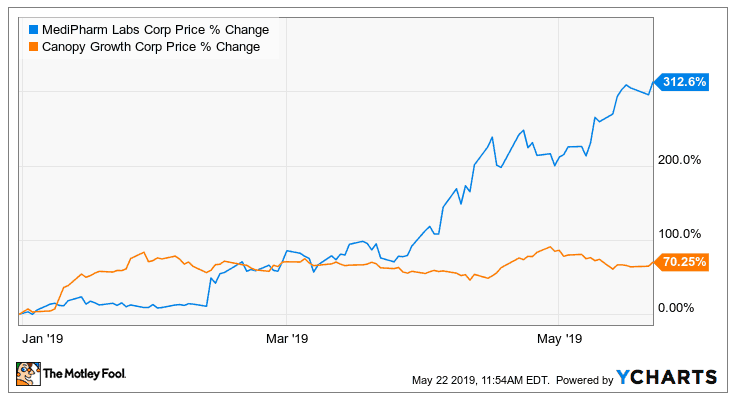

Marijuana investors love growth, but they reward profitability even more. MediPharm’s stock has grown by over 300% so far this year, trumping Canopy Growth by a very wide margin.

Will it conquer the world too?

It’s a new baby on the horizon, and the company has already made significant inroads into Australia while working on obtaining the all critical E.U. GMP certification that will allow it to export into the budding European market, but I wouldn’t model a massive market share gain globally as I would do for Canopy Growth and Aurora Cannabis this early.

That said, I like the company’s value-added business model that treats dried marijuana not as the product to be sold, but as an ingredient into its processes. The threat of commoditisation is therefore lower.

However, I see some emerging competition from other extraction innovators, the likes of Radient Technologies, to its business model. Even more concerning, Canadian LPs seem to be investing in extraction technologies too, and they won’t just give up the value added margins. Yet they control the production!

Foolish bottom line

In MediPharm Labs, we have a new marijuana player that deserves investor attention as it enters into new tolling and private label supply deals, just as management works on increasing annual throughput capacity from 150,000 kilograms to 250,000 kilograms during 2019 while targeting new geographical market.

The company’s growth plans will move the needle, while the business model has already displayed some good profitability traits.