Canadian light oil producer Bonterra Energy (TSX:BNE) cut its monthly dividend by a staggering 90% to a mere token $0.01 per share in December last year to preserve the balance sheet, as uneconomically wide oil price differentials threatened cash flow viability. The outlook has significantly changed after Alberta government intervention and a rebound in world oil prices.

With a current dividend yield of just 1.9%, the stock is nowhere near an income investor’s universe anymore, but the obtaining economic dynamics in the company’s operating environment could make it a worthy candidate for a dividend investor’s watch list, as management may “reintroduce” the juicy payout sooner than we may anticipate.

The company’s first-quarter results increased the hope for a return to strong dividend growth, as management funds its desired capital-spending budgets and repairs the balance sheet.

A return to strong cash flow generation

As price differentials on Canadian oil narrowed back to normal levels for most of the first quarter, coupled with a stronger rebound in world crude oil prices, the company recorded a 67% increase in realized average oil prices per barrel to $64.87 from a mere $38.96 per barrel in a previous quarter.

As a result, the company pulled off a 42% sequential quarter-over-quarter revenue growth to near $50 million and reported a strong 129% rebound in quarterly funds flow back within the historical range achieved during the same quarter last year.

Productivity was 8% weaker at 12,020 total barrels of oil equivalent (BOE) as compared to first-quarter 2018 volumes, as production teams battled delays caused by an extremely cold weather, coupled with a significant number of drilled wells coming into production after the quarter end. It’s natural to expect higher productivity this quarter.

Most noteworthy, cash operating netbacks recovered by 175% sequentially to $22.53 per BOE, well close to the $23.81 per BOE recorded for the same quarter in 2018, while all-in costs, including royalties, operating costs, and interest expenses were 5% lower as compared to the same period last year.

The return to significant operating netbacks, higher funds flow, and a lower-cost operating profile coupled with a very small cash dividend payout rate could see Bonterra paying down debt and repairing its balance sheet much faster, while investing significantly in its operations to increase daily productivity and sustain higher profitability.

Lower leverage loading…

A high debt level has been a strong issue against the stock’s valuation, as leverage ranks higher than most industry peers.

The company managed to slightly reduce its net debt to $326.7 million during the first quarter — an achievement management noted as very meaningful considering the historically high capital expenditures that are usually incurred during the first quarter.

Noting that the first-quarter dividend per share was just 4% of quarterly funds flow, and that management has maintained its capex budget for the year, there is more room to significantly pay down debt, as oil prices maintain the rebound so far achieved in 2019.

…and the dividend could grow soon

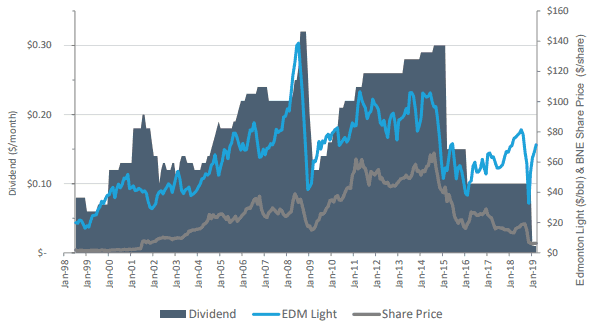

Bonterra’s dividend payout has been historically tied to oil price growth as shown below.

The monthly dividend has historically increased with higher Canadian crude prices and suffered massive cuts as prices plummeted. It can be safe to anticipate a strong return to higher dividends as oil prices remain strong into the next year.

Further, cash flow generation may remain strong as management forecast an exit 2019 production rate of between 13,000 and 14,000 BOE per day for a strong start in 2020, and the dividend could start growing modestly later this year, if oil doesn’t disappoint.

Foolish bottom line

Provided that oil prices maintain their 2019 levels achieved so far, Bonterra stock has strong recovery prospects in 2019 as management repairs the balance sheet, while a return to dividend growth could propel the valuation further.

If asked what a strong start to 2020 could mean for the company if oil prices hold strong over the coming year, my bold answer would be, a return to strong dividend growth!