Most investors know the feeling of regretting a seemingly logical decision. You buy shares of a company in the dip, sell it after doubling your original investment, and leave thinking there’s no logical explanation for the stock price doubling again. You lock your gain and wait for the stock price to follow your expectations and fall. But it doesn’t. You watch the stock price to continue its ascent, leaving your 100% gain in the dust.

One stock that followed such a storyline is Shopify (NYSE: SHOP). Some, rightfully so, call it the Amazon (NASDAQ: AMZN) of small businesses. Others, with some logical arguments, call it a scam.

Regardless of the appraisals and the name-callings, this Canadian e-commerce platform for small retailers has grown 144% year-to-date. If long-term investing is about picking the companies that are shaping the future, can Shopify keep defining the future of e-commerce for small retailers?

Source: YCHARTS

The world’s first retail operating system

Most investors know Shopify as a platform with easy-to-use website templates for online stores. While this description is accurate, it does not provide a complete explanation of how Shopify plans to evolve the future of commerce. Recently, Shopify COO Harley Finkelstein introduced the company as the world’s first retail operating system. Speaking at the Oppenheimer 22nd Annual Technology, Internet & Communications Conference, he explained a different vision for Shopify. Regardless of the online or offline nature of a retailer’s operations, and irrespective of the platform it uses to distribute its products, Shopify is the primary operating system that enables a retailer to run its business.

Shopify can support a retailer’s journey from day zero to becoming a large international brand. In the beginning, the company offers a simple online store. As the retailer grows, Shopify can support it with analytics, inventory management, discounted shipping rates, offline point of sales, and even a line of credit to support growth. At any point in this journey, retailers can connect with Facebook, Amazon, and eBay, to name a few of the existing channels to offload their inventory or find new sales channels. Looking at Shopify with such a widen lens drastically increases the company’s addressable market opportunity.

It’s not only the small retailers

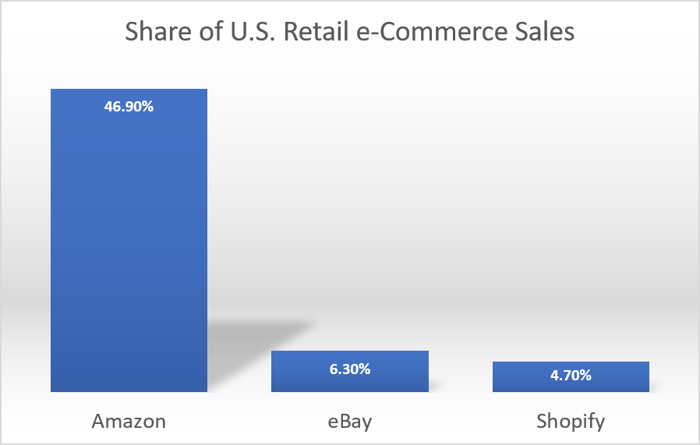

The company’s investor presentation suggests Shopify is not limited to small mom and pop online operations. Rather, the company has exposure across all segments of the market. While every 52 seconds a brand-new retailer makes its first online sales on Shopify’s platform, large brands such as Kylie Cosmetics, Allbirds, Heineken, Clarks Shoes, and Sony are among Shopify’s customers. The combined volume of merchandise going through Shopify’s platform positions Shopify as the 3rd largest online commerce platform in the U.S., behind Amazon and eBay.

Data source: Shopify. Chart by Hoda Mehr.

The Amazon alternative

It’s no surprise to anyone that Amazon has a myopic focus on customers. This means Amazon puts retailers that use its fulfillment platform second on the list. And, that’s an opportunity for Shopify. Recently, the company launched its fulfillment platform, which allows Shopify to work with independent fulfillment centers and manage its own shipping facilitation software. Shopify uses its software-native advantages to make shipping and fulfillment better. According to the company’s COO, by just digitalizing fulfillment for independent fulfillment centers and aggregating the gross merchandise volume of all Shopify retailers to get a better shipping rate, the company can make the free 2-day delivery a reality for millions of retailers who prefer not to go through Amazon Fulfillment.

Final takeaway

The 144% year-to-date growth rate of Shopify’s stock price may indicate irrational exuberance of investors. However, the company is truly shaping the future of commerce. With a vision to become the retail operating system, online or offline, and with its comprehensive offering for retailers of all shapes and sizes, Shopify can be the Amazon-alternative investors have been looking for all along. While the stock price may seem overvalued, investing is not about where the stock has been so far, instead, it is all about where the stock can go from here. And, Shopify is certainly going places.