Bundling is a powerful strategy to get consumers to open up their wallets even more. Apple (NASDAQ: AAPL) has been exploring the idea of bundling various services together for over a year. The Information had reported in the summer of 2018 that the Cupertino tech giant was interested in combining video, music, and news into a single subscription. Apple Music has been around for a while, but the company only launched Apple News+ in March, and Apple TV+ will debut next month.

Here’s why that bundle hasn’t been released yet.

Trying to get record labels on board

Financial Times reports that record labels are the primary hurdle to Apple releasing an all-in-one media bundle. Negotiations have started “recently,” and some labels are open to the idea, while others have reservations about dealing with Apple, according to the report. There could be various tiers of bundled services, as the tech titan has continued to introduce a growing array of first-party services.

Apple is widely credited with revolutionizing digital music distribution in the early 2000s with the iTunes Store, in part by convincing labels to unbundle albums and sell songs individually. That had cut into the industry’s profits, as many albums contained “filler” tracks in addition to top hits. Unbundling allowed consumers to just buy the most popular songs for much less.

Of all of Apple’s services, music streaming has the greatest variable costs because the company has to license the rights. Apple could bundle Apple Music and Apple TV+ for $13 per month without requiring lower licensing fees, according to FT. That suggests it may be willing to absorb the discount as opposed to trying to score lower fees from record labels. While Apple is investing billions in Apple TV+ content, those investments are largely fixed costs because the company owns the shows and films once they’re produced.

Licensing expenses are the biggest hurdle to scaling, a struggle that pure-play rival Spotify (NYSE: SPOT) is all too familiar with. The Swedish market leader’s pivot to podcasts is part of a multipronged effort to incrementally reduce its royalty burden, and gross margin ticked higher to 26% in the second quarter.

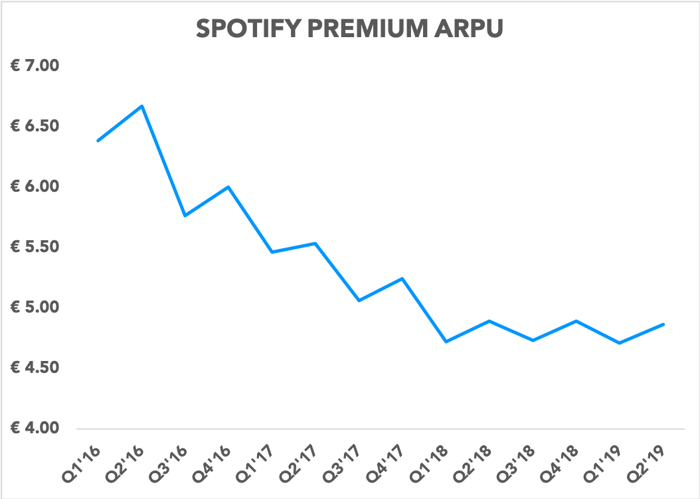

Record labels have been fretting about declining average revenue per user (ARPU) across the industry, a trend that has persisted for years as Spotify and Apple offer discounted plans for families and students. Bundling multiple services together could potentially add even more downward pressure. As a pure-play leader, Spotify’s operating metrics provide some valuable insight.

Data source: Spotify. Chart by author.

Apple’s growing portfolio of services offers numerous bundling opportunities. Allowing customers to mix and match, combined with a bundling discount, would dramatically strengthen the tech company’s services business and improve retention. Music streaming is a core service for many consumers, so getting the record labels to play ball will be an instrumental requirement for that effort.