At least one Wall Street pro thinks that the recent sell-off for Roku (NASDAQ: ROKU) has run its course. Macquarie analyst Tim Nollen is upgrading shares of the streaming video pioneer on Wednesday, bumping his rating from neutral to outperform.

A cascading stock often finds firms boosting their ratings while sticking to or even lowering earlier price targets, but that’s not the case here. Roku shares have fallen a steep 39% since peaking last month, but Nollen’s still boosting his price goal on the stock from $110 — where it’s roughly at right now — to $130.

Nollen believes that Roku’s market leadership in the U.S. will translate well internationally, where the migration to connected TV is still early in the process. He sees Roku reaching more than 70 million active accounts by 2022, more than double the 30.5 million folks on its platform at the moment. With consumption and average revenue per user scaling higher, he sees platform revenue more than tripling to $2.3 billion come 2022, with overall revenue at $2.7 billion.

Starting lines matter

Arguing that Roku stock bottomed out when it briefly dipped into the double digits a few days ago is relative. The shares have corrected sharply since peaking at $176.55 exactly one month ago, but we’re comfortably ahead of where Roku was just before it posted blowout second-quarter results two months ago. The one-month chart is brutal, but Roku is still one of this year’s hottest stocks — up 252% so far in 2019.

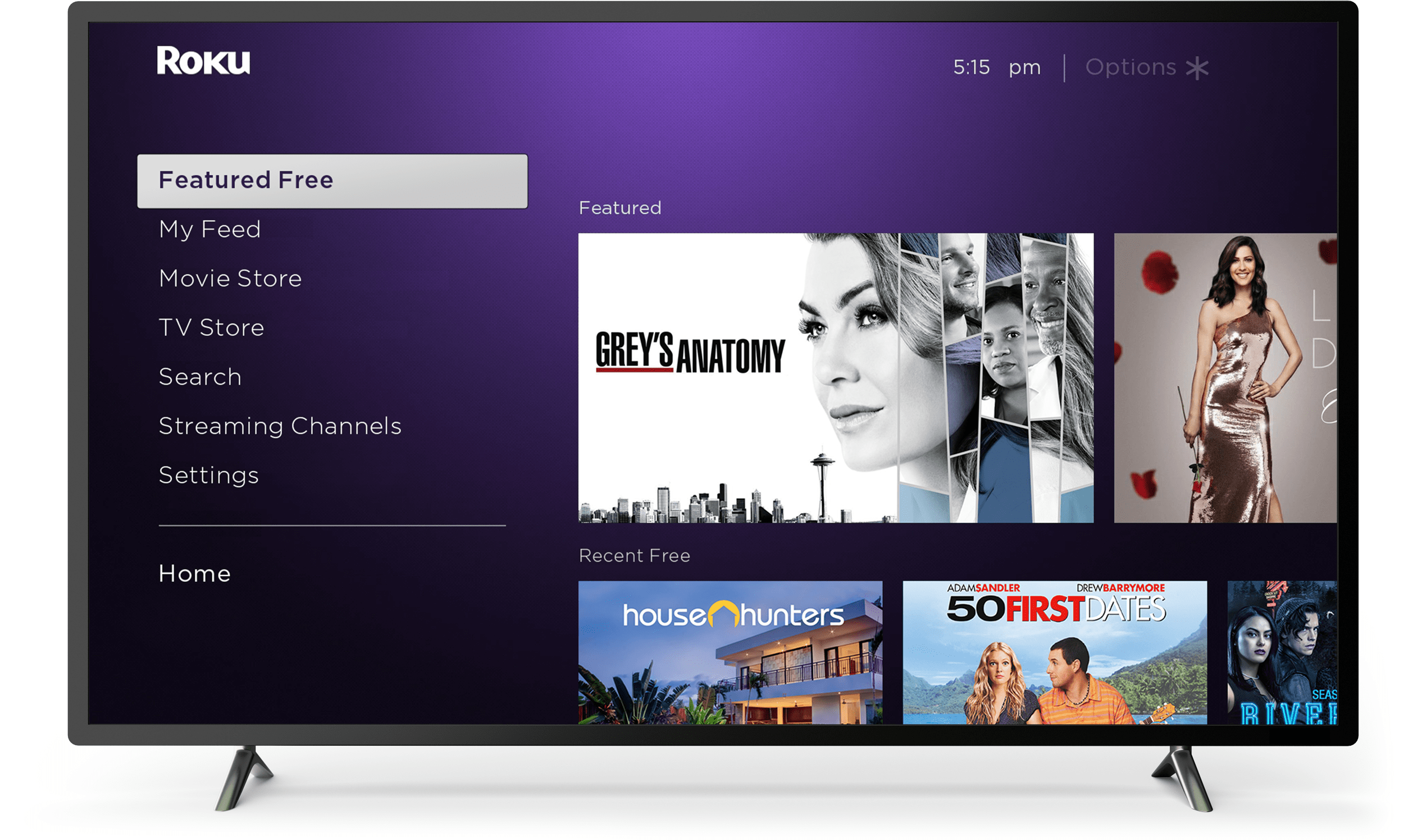

It has been sneaking its way into a lot of growth-stock portfolios, once they overcome their initial instincts about the company’s business. Yes, Roku is the patent-rich company that hit the market first with the once-clunky boxes that would plug into your TV to provide access to what was originally a limited number of streaming offerings. It wasn’t until video game consoles with video-streaming access that the niche went mainstream. And these days, most people think of video game systems and the tech giants with subsidized hardware as the key players here. Reality is different than that perception, especially with Roku now inside TVs as the operating system of choice for television manufacturers.

Roku has evolved into a high-margin platform company, with its operating system delivering an average of more than three hours a day of streaming services to its 30.5 million active users. It still makes the hardware, but that’s not the growth driver here. Platform revenue has gone from 44% of total revenue in 2017 to 56% of the mix last year. Nollen’s 2022 projections translate into platform revenue commanding an 85% slice of Roku’s total revenue in three years.

The platform’s popularity is booming because Roku is agnostic. It doesn’t play the games that the tech giants are engaging in — i.e., steering consumers to their homegrown services at the expense of rival offerings that sometimes aren’t even available if the two parties are bickering. Roku offers thousands of services, and with some pretty hyped-up offerings hitting the market next month, it is again sitting pretty ahead of the holiday shopping season.

The stock will be volatile, and we may very well fall back into the double digits, where the shares were exclusively until this summer. But with momentum reaching a tipping point, one can make the odd-sounding remark that a stock that has already more than tripled in 2019 is bottoming out here.