Each stock has its investor market segment that it attracts, but resilient and defensive all- weather giants like Fortis (TSX:FTS)(NYSE:FTS) are core portfolio candidates for most long-term retirement-focused portfolios.

A leader in the North American regulated gas and electric utility industry, Fortis enjoys the safety of highly regulated and near certain cash flows, with over 94% of its earnings coming from regulated geographically diversified utilities.

The stock has proven to be one of the most cherished highly defensive proven low beta, low risk investment offering that’s a great candidate for a core retirement portfolio.

One could reasonably expect to realise some capital gains on the ticker given the recently upsized $18.3 billion five-year capital investment program that’s expected to power a 6.5% compounded annual growth in the rate base to 2024.

Management had previously announced a 16% increase to this year’s capital expenditure budget in August before passing a $1 billion increase to the 2020 to 2024 investment budget the following month.

It’s even possible that this capital program could be increased mid-way through the next five years.

A sustained increase in the rate base and cash flows could not only drive earnings growth, but also power an already lively dividend growth policy that’s seen the company deliver 46 years of consecutive annual dividend increases.

The market is evidently willing to pay a high price for this ever-increasing dividend payout as the annualized yield remains very low at 3.5% today given the strong capital gains that have followed the company’s growing utilities business.

Millennials may easily want to ignore this boring and not so trendy stock, but I foresee this business being very much relevant even in the long term.

Management is making a serious effort to become a green energy firm that could power a greener future.

Further, the company has recently entered into LNG supply deals with China, an encouraging development for Canada’s budding LNG export industry.

The new market could develop into a new growth segment and drive further earnings expansions.

How long has it taken others to double their returns?

Unlike Enbridge, which has seen its share price trade in an agonizing range over the past three years, Fortis stock price has continued on a steady growth path for almost a decade now.

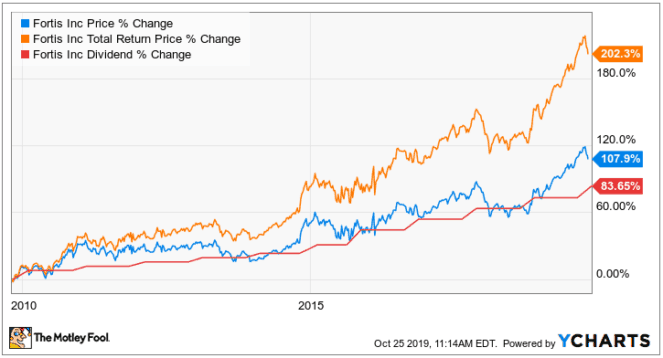

A 202% position gain has been realized over the past decade, double the 100% growth target that readers may have expected while reading my headline.

As we can see, dividend growth has played a pivotal role in magnifying the gains. The good news is that this total returns compounding power is still present on the ticker, as management has promised an average dividend growth rate of 6% per year to 2024.

Rather than reinvesting the dividends individually, one may benefit from the company’s lucrative Dividend Reinvestment Plan (DRIP), which not only eliminates transaction costs, but may also top the paycheck with an incentive that could significantly boost the compounding power over a long term horizon.

Foolish bottom line

Doubling one’s investment with this utilities giant could become a matter of one’s time in the market, and a buy-and-hold strategy could yield sizeable returns.

That said, stocks do have higher investment risks than bonds, and climate change could continue to impact the business through increasingly unpredictable weather patterns.