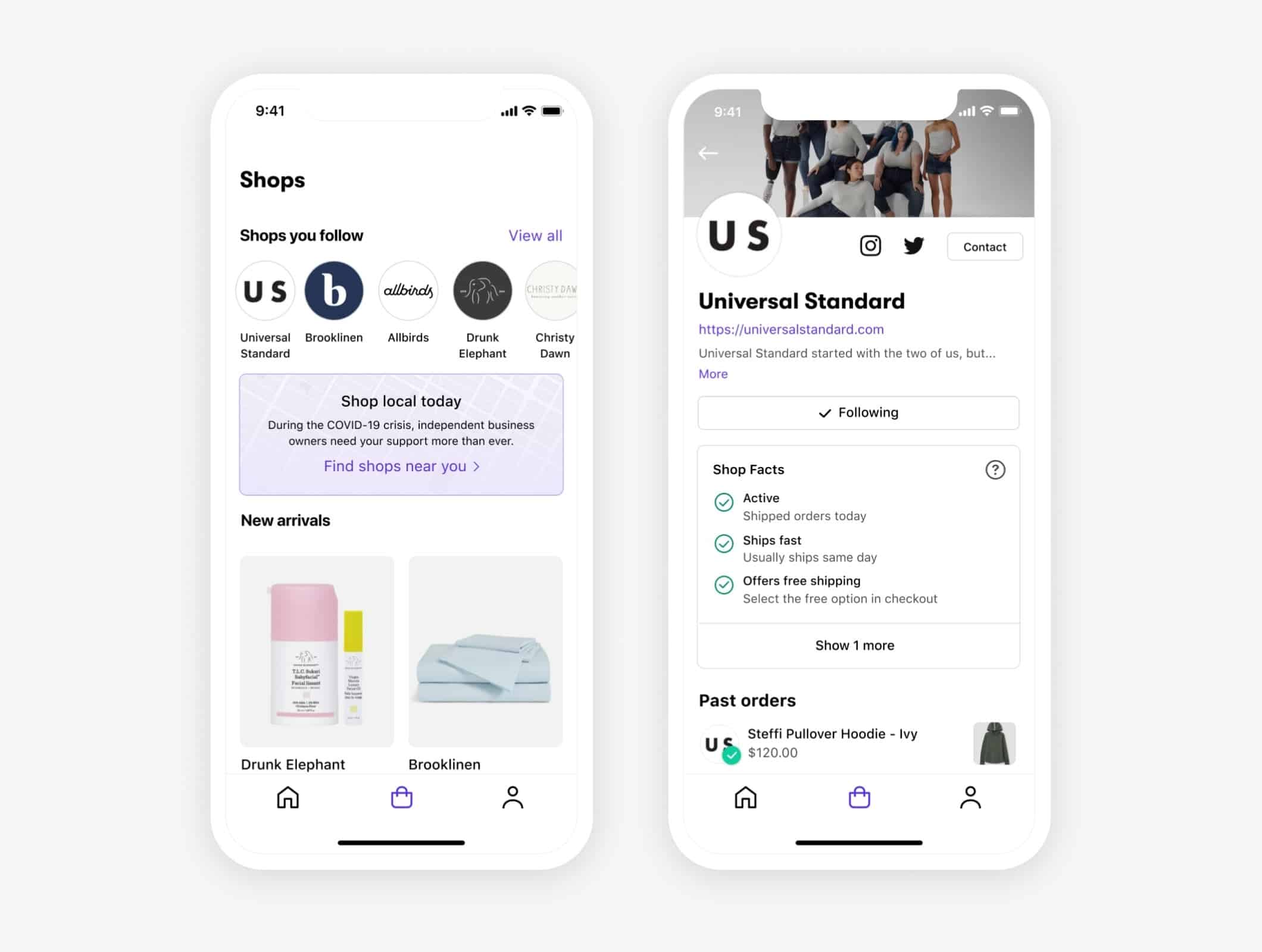

Shopify (TSX:SHOP)(NYSE:SHOP) announced on Tuesday the release of Shop, a mobile shopping app designed to help consumers find products and connect with local businesses. The app encourages shoppers to review a feed of recommended products and learn about local brands. The company was quick to point out that the app contains no advertising and focuses on brands customers have already shown an interest in.

The company cited social distancing, stay-at-home measures, and the reliance on e-commerce as the reason it chose to develop the app, which contains a number of features designed to help businesses better connect with customers in a world that is increasingly separated. This includes filters that help users find local merchants, while also providing information about shopping, pick-up and delivery options, and return policies.

Shop provides customized recommendations including newly released products, as well as specialized deals based on a user’s shopping history. Once connected, the app ushers customers through the shopping process by providing fast and easy checkout with Shop Pay. It also delivers real-time order and tracking information via Arrive, which provides the status of each package, all in one place on the app.

“Shopify has focused the last decade on solving complex problems for entrepreneurs by making commerce seamless and accessible,” said Carl Rivera, General manager of Shop. “Now, we want to do the same for customers. We set out to solve the common pain points in the customer’s shopping journey today, while developing specific features, like local business discovery, that will be relevant today and in the future.”

This is an expansion of Shopify’s existing Arrive app, which was originally designed to help customers track packages, which the company said has already been used by more than 16 million shoppers.