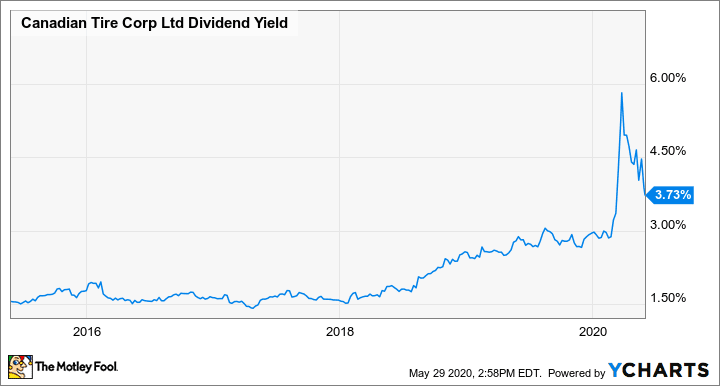

Canadian Tire Corporation Limited (TSX:CTC.A) has turned into an excellent dividend stock as a result of the COVID-19 pandemic. Entering June, the stock was down more than 15%, sending its dividend yield up to around 3.7%. That’s considerably higher than where the yield’s been in recent years:

CTC.A Dividend Yield data by YCharts

Unless you were able to buy the stock when the markets were crashing back in March, you’d be hard-pressed to lock-in a better yield than where the stock is right now. A big part of the reason Canadian Tire’s dividend is as attractive as it is today is that the company has been growing its payouts:

CTC.A Dividend data by YCharts

Its dividend payments have more than doubled during the last five years. However, with the world of retail even riskier than it’s been in the past — and COVID-19 likely throwing the economy into a recession, the dividend may not be as safe as it once was.

Canadian Tire’s coming off a tough quarter

Canadian Tire used to be a safe bet to post a profit every quarter. But that didn’t happen when the retail company released its first-quarter results on May 7. Not only were sales flat from the prior-year period, but the company also reported a net loss attributable to its shareholders of $13.3 million.

A year ago, it reported a profit of $69.7 million. Lower gross margins combined with higher selling, general and administration costs in Q1 drove Canadian Tire’s softer performance.

The quarter was also only up until March 28. The full effect of the pandemic has yet to be felt on Canadian Tire’s financials for a full three months. And when that happens, investors will get a better idea of how strong a position it’s in.

Could a dividend cut be around the corner?

Many companies have opted to cut or suspend their dividend payments due to COVID-19. It’s something Canadian Tire investors shouldn’t rule out happening to their stock, either.

It’s still too early to tell whether it’ll be a move that Canadian Tire needs to make or not. As of March 28, the company still had cash and cash equivalents on its books totaling $443.4 million. But Canadian Tire also burned through $147.1 million in Q1 and it spent $66.3 million on dividend payments.

A tougher second quarter could increase its rate of cash burn, putting pressure on the company to free up some cash. And stopping the dividend payments, at least temporarily, could be one option.

Bottom line

A dividend doesn’t have to be 10% or a ridiculous percentage to be cut. A company may not be able to afford even a more modest one. Given the uncertainty in the economy right now, it wouldn’t be all that surprising if Canadian Tire made a change to its dividend this year.

With retail already being full of risk, the one thing I wouldn’t have in my portfolio today is a dividend stock that’s dependent on that industry. Investors may be better off looking at other, safer dividend stocks to invest in rather than holding shares of Canadian Tire.

While the dividend’s safe right now, it may not stay that way in a quarter or two.