Long-term Bombardier (TSX:BBD.B) investors have watched the stock plunge over the past 20 years. The board is now betting on business jets to save the stock, but COVID-19 makes that increasingly uncertain.

Why is Bombardier’s stock price so low?

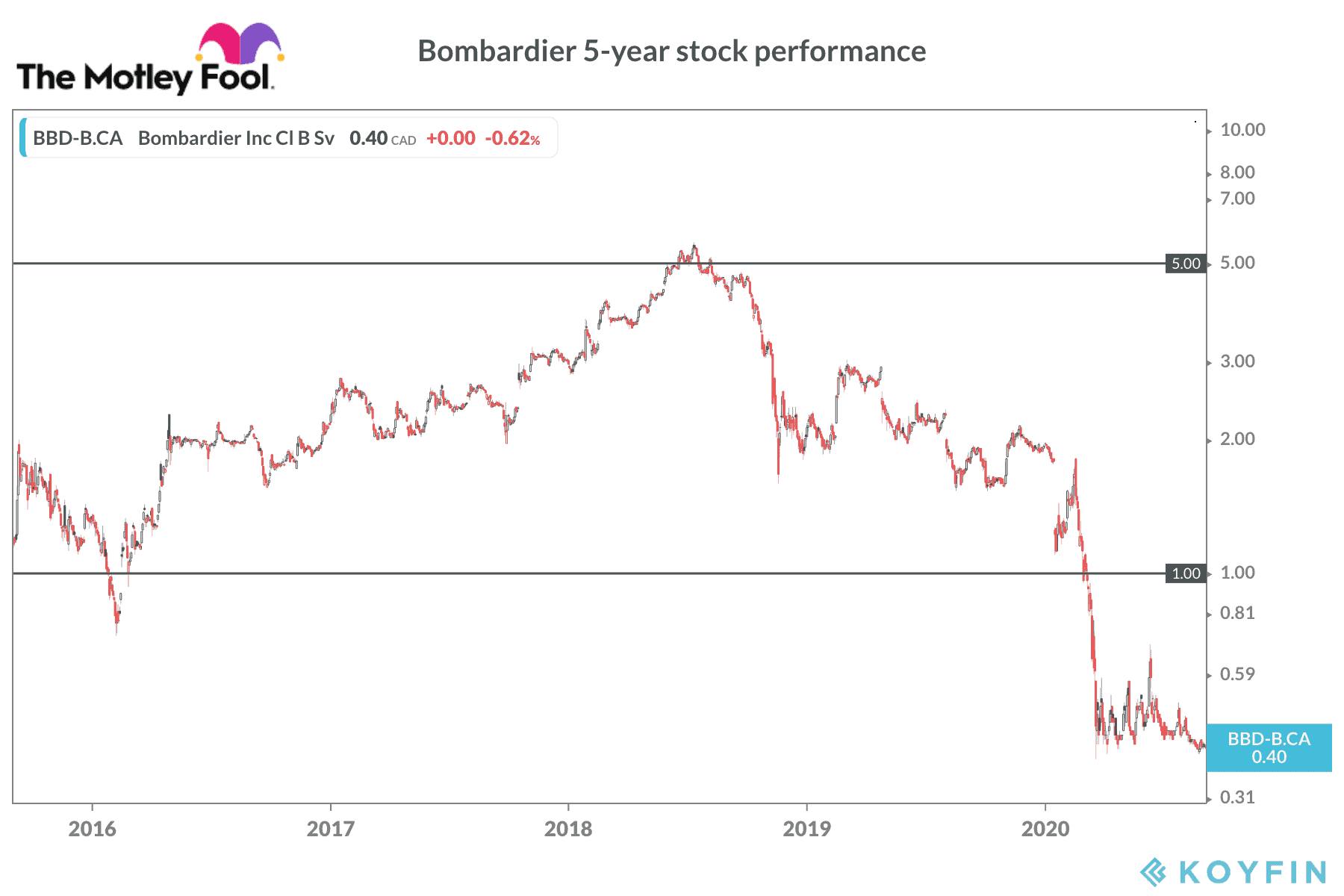

Bombardier trades near $0.40 per share at the time of writing. The stock is down more than 90% since the summer of 2018, after a strong rally from the 2016 lows.

Much of the pain is attributed to the former CSeries jet program. Bombardier developed the fuel-efficient planes with a goal of carving out a leadership position in the mid-size commercial jet market. Initial sales indicated strong interest from global airlines. However, Bombardier ran into development and production troubles.

Delivery of the first batch of planes occurred more than two years later than expected. The program ran billions of dollars over budget and forced Bombardier to pile on debt and seek emergency investments from Quebec and the provincial pension fund.

As orders dried up and cash burn accelerated, Bombardier’s share price slipped below $1 in early 2016. The board brought in a new CEO, shelved the dividend and focused on getting a couple of deals done to protect jobs while the company sorted out its issues.

Air Canada came to the rescue with a large CSeries order, followed by Delta Air Lines. Bombardier had to sell the planes at heavy discounts to secure the business. This caused trouble for the company with the U.S. government after Boeing filed a dumping complaint.

The U.S. placed a 300% tariff on CSeries planes sold to U.S. customers. This threatened to derail the Delta deal. In the end, Bombardier sold a majority interest in the CSeries to Airbus, which is building the planes for Delta and other U.S. airlines at its American facilities.

Bombardier shares hit $5.40 in the summer of 2018, just after Airbus took control of the CSeries program. Unfortunately, the wave of new orders anticipated once the planes moved under the wing of the European giant didn’t materialize.

Rail troubles

Bombardier’s train division experienced its own challenges in recent years. Delays on a large streetcar order for the Toronto Transit Commission (TTC) led to very a very public dispute. Bombardier subsequently lost bids for a series of high-profile projects, including light-rail deals in Boston, Chicago, and even Montreal. In addition, Via Rail decided to give a $1 billion contract to a European competitor.

Asset sales

With debt above US$9 billion weighing heavily on the balance sheet and a stalled recovery plan launched by the new management team, Bombardier started selling off various businesses. The Dash-8 turbo prop business and the CRJ regional jet business went on the block, effectively ending the company’s presence in the commercial jet sector.

The remaining stake in the CSeries, now named A220, went to Airbus.

Now, the rail division is being sold to Alstom. Assuming the deal closes as expected in 2021, Bombardier will be left with its business jet division.

COVID-19

Business jets are a profitable business for Bombardier when the economy is strong and companies are comfortable splurging on perks for their executives. The arrival of the pandemic in 2020 puts the future of the business in question.

On the risk side, companies will cut budgets to save money in lean times. Also, the success of video meetings over the past six months might permanently alter the way people do business in the future. In-person meetings might not be deemed as necessary to get big deals done. As a result, the demand for expensive business travel might disappear.

The bull side of the story points to a possible surge in demand for private jets by corporations and wealthy families that don’t want to take the new health risk associated with flying on commercial carriers. Time will tell if that scenario materializes.

Business jet deliveries are expected to decline by 30% across the industry this year, according to Bombardier’s Q2 2020 report, so the near-term outlook remains bleak.

Debt woes

Bombardier finished Q2 2020 with nearly US$9 billion in debt, much of which comes due in the next five years. The business should have enough liquidity to cover cash needs through the next 12 months, but the situation beyond next year is hazy.

Should you buy Bombardier stock?

I wouldn’t bet on another surge from below $1 to $5 per share. Buy-and-hold contrarian investors should probably seek out other opportunities in the market today.