The best Canadian dividend stocks for Tax-Free Savings Account (TFSA) income investors tend to be companies with long track records of distribution growth supported by rising revenue and earnings.

Why use a TFSA to hold income stocks?

The TFSA is a popular vehicle for retirees who want to generate investment income to complement CPP and OAS pensions without being hit with higher taxes or the OAS clawback. All earnings from TFSA investments remain beyond the reach of the CRA.

That isn’t the case on investments held in taxable accounts where the dividend gross-up rule on distributions hits seniors particularly hard. Dividend gross-ups increase the total of your net world income, potentially triggering the CRA’s pension recovery tax on OAS payments.

Holding investments inside the TFSA avoids the problem. The TFSA also gives retirees a tax-free place to invest RRIF payments that might not be needed to cover living expenses.

Best Canadian dividend stocks for seniors

Retirees have to balance the need for yield with the protection of capital. The 2020 market crash reminded investors that stocks can be volatile. It has also provided income investors with an opportunity to buy some of Canada’s best dividend stocks at attractive prices.

In the current environment, it makes sense to seek out stocks that plan to raise dividends through the recession. Companies that provide essential products and services should be near the top of the buy list.

Fortis

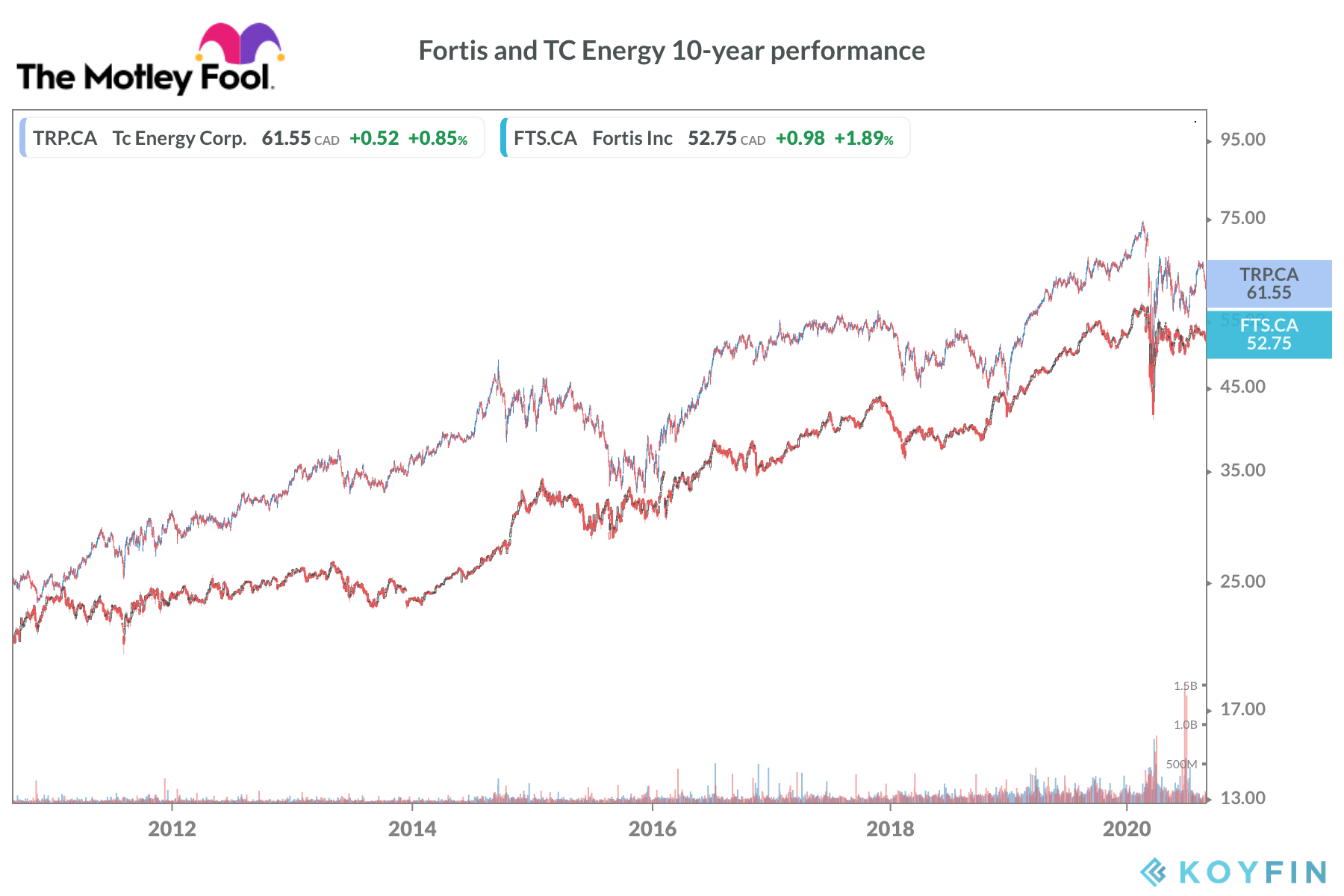

Fortis (TSX:FTS)(NYSE:FTS) raised its dividend in each of the past 46 years, making the company one of the best dividend stocks in the TSX Index over the past half century. The board plans to maintain the trend through at least 2024 with anticipated dividend hikes of 6% per year over that time frame.

The solid guidance comes on the back of expected revenue and cash flow growth. Fortis continues to work through nearly $19 billion in capital projects that will significantly boost the rate base. The company has utility operations across Canada, the United States and the Caribbean.

Assets include power generation facilities, electricity transmission networks, and natural gas distribution systems. These tend to be recession-resistant and operate in regulated sectors.

Fortis trades near $53 per share at writing. The 12-month high is near $59, so there is decent upside opportunity. The stock currently provides a 3.6% dividend yield.

TC Energy

TC Energy (TSX:TRP)(NYSE:TRP) is the new name for TransCanada. The board made the change to better reflect the overall operations. TC Energy is best known for its natural gas distribution networks across Canada and the United States. The company also has vast gas storage capacity and power generation facilities.

Growth stems from a combination of acquisitions and organic projects. The existing secured development portfolio includes roughly $30 billion in capital investments. As the new assets go into service, TC Energy expects revenue and cash flow to expand enough to maintain steady dividend growth.

In fact, investors should see a dividend increase of 8-10% in 2021 and 5-7% per year afterwars over the medium term.

The stock trades near $61.50 per share compared to $76 in February. Given the steady revenue outlook TC Energy appears oversold at this level, investors who buy now can get 5.25% yield.

Warren Buffett’s Berkshire Hathaway made a US$10 billion investment in the natural gas infrastructure sector earlier this year. That could lead to further consolidation and higher stock prices for TC Energy and its peers.

The bottom line

Fortis and TC Energy are two of the best dividend stocks in the Canadian market today. Retirees and other investors seeking reliable income stocks should consider these names for their TFSA portfolios.