BlackBerry (TSX:BB)(NYSE:BB) trades at a fraction of its previous highs. This has contrarian investors kicking the tires on one of Canada’s best-known companies.

Buying unloved stocks takes courage, especially when the outlook on their future remains uncertain. However, getting the timing right ahead of a rebound can result in huge gains.

Does BlackBerry stock deserve to be a top contrarian pick for your portfolio today?

BlackBerry’s stock price

BlackBerry’s fall from grace in the smartphone market is a great example of how difficult it is for tech innovators to remain leaders when new competition targets their customers.

The phones found great initial success with government and corporate clients due to the high level of security offered by BlackBerry’s system. BlackBerry then bet big on the consumer market, hoping to dominate the global smartphone industry. In the end, the company found out that it probably should have stayed focused on what it knew best.

BlackBerry went from being the global leader in the smartphone market to essentially non-existent today.

The stock, which topped out around $150 per share in 2008, currently trades near $7.

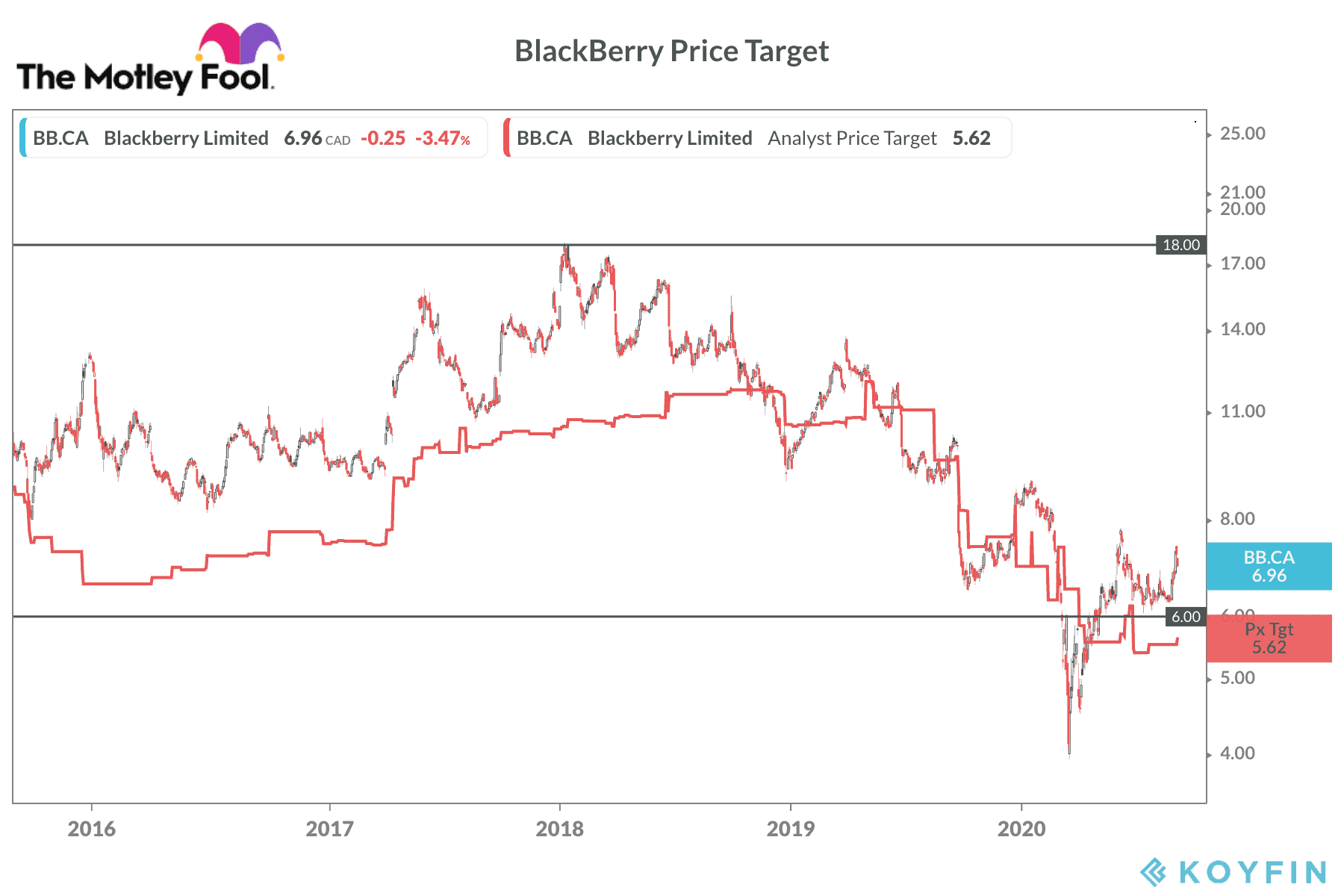

Analysts who cover the stock don’t expect much good news in the near term. In fact, the following chart shows that consensus estimates are down meaningfully over the past 18 months, and the average price expectation currently sits well below BlackBerry’s recent stock price.

IoT and security

BlackBerry reinvented itself as a software company providing AI and IoT security products and services to enterprise clients. Security has always been BlackBerry’s strong point, and the new world of ubiquitous internet connectivity offers a huge opportunity.

BlackBerry already leads IoT security in the automotive sector through its QNX group. It’s 2019 purchase of Cylance, now called BlackBerry Spark, initially fell short of expectations. However, demand should improve for its enterprise security offerings that help companies and government agencies ensure remote workers have secure connections and devices.

Why?

The pandemic has changed the way the world works, at least in the near term. Millions of corporate employees that used to fill massive office towers now operate from their kitchens or living rooms. This poses security challenges for their employers who used to control all internet access.

BlackBerry is one of the companies that helps ensure remote workers operate in a secure environment.

New BlackBerry phones

Nostalgic BlackBerry fans recently got some interesting news. A Texas-based startup secured a deal to licence the BlackBerry brand for a new 5G smartphone using Android and sporting a physical keyboard. The new phone is expected to hit the market in 2021.

This might be exciting for BlackBerry die-hards, but investors probably won’t see much of a revenue impact.

Financials

For the three months ended May 31, BlackBerry reported revenue of US$214 million compared to $267 million in the same period last year. Non-GAPP earnings came in at $0.02 per share.

The company took a US$594 million goodwill impairment charge in the quarter. The writedown relates to the Spark group and is likely connected to the US$1.4 billion Cylance acquisition BlackBerry completed last year.

Risks

BlackBerry only has a market capitalization of about $4 billion. This restricts its ability to raise capital or invest heavily in new acquisitions or new developments.

Big tech competitors in the United States are chasing the same opportunities, so BlackBerry’s size puts it at a disadvantage.

Is BlackBerry stock a buy or sell today?

BlackBerry’s turnaround has taken much longer to materialize than anticipated. Whether the company can capitalize on the remote-work security needs created by the pandemic is still unknown.

The consensus outlook from analysts suggests the stock could head back below $6 in the next year. However, that might be overly pessimistic.

Risks remain, but investors might want to take a small contrarian position on further weakness. Enterprise security revenue might bounce on remote-work demand in the next six months. If that happens, the stock could take a run at $10 per share by the end of next year.

A takeover offer wouldn’t be a surprise at some point, which could also push BlackBerry’s stock price higher.