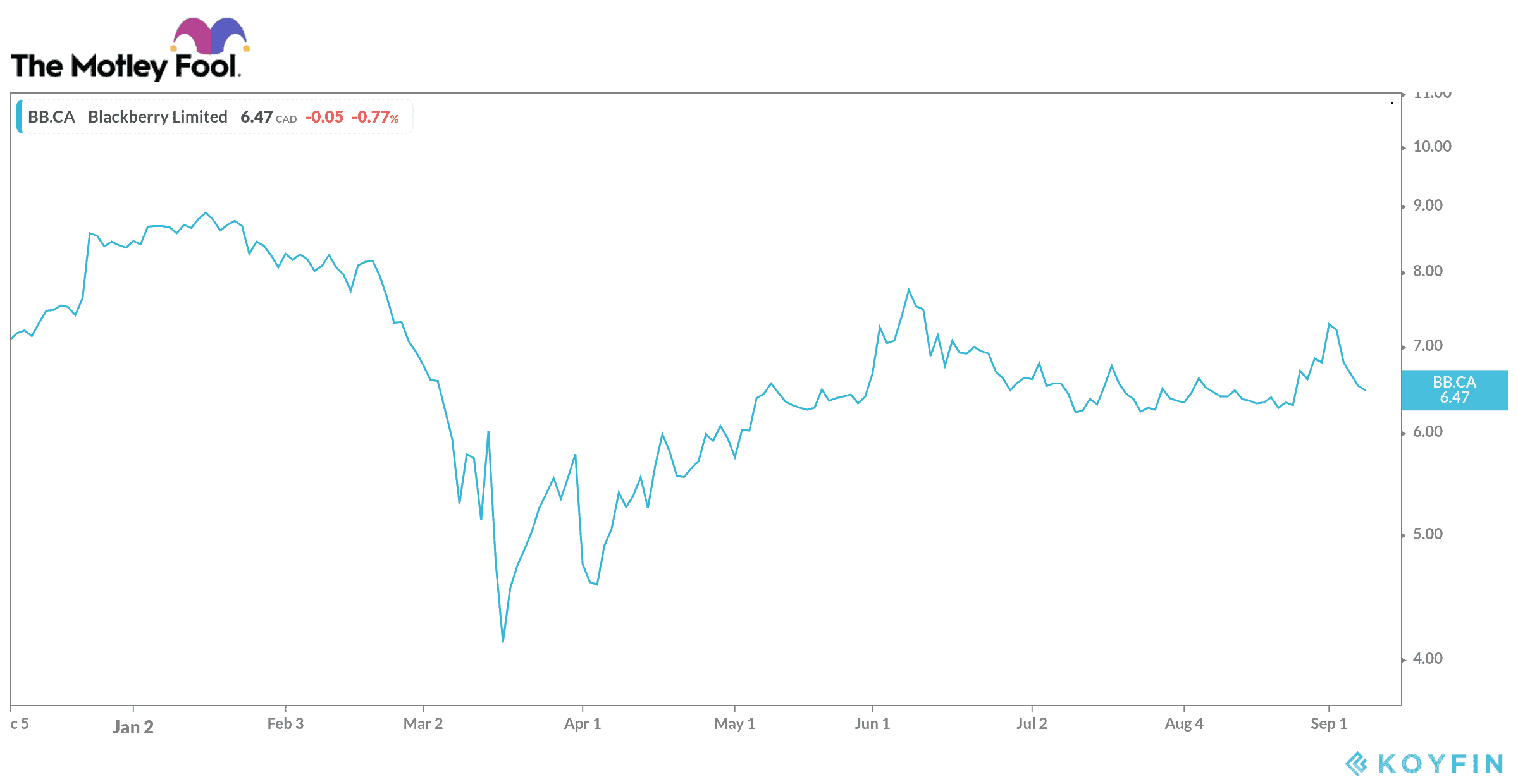

BlackBerry (TSX:BB)(NYSE:BB) stock peaked at $18.00 in early 2018, but has seen a notable decline since then and is now between $6.00 and$ 7.00. The stock is down by 20% since the start of the year. Should you buy BlackBerry stock now?

BlackBerry will enter the 5G smartphone market

BlackBerry lost its coveted stage of being one of the world’s top smartphone makers over a decade ago.

The company officially left the smartphone manufacturing industry four years ago when it licensed out its name to partners, including the Chinese communications company TCL, to make smartphones. TCL’s devices included the Key2 and KeyOne, which included BlackBerry’s physical keyboards, and the all-touchscreen BlackBerry Motion.

After losing out to Samsung and Apple’s slick devices, it turned to expand on the feature its handsets were recommended for – software security.

The cybersecurity giant recently announced the completion of its debt financing, with the redemption of its 3.75% unsecured convertible debentures.

Meanwhile, as BlackBerry stock continued to take a hit amid the COVID-19 pandemic, its phone business ended its partnership with Chinese company TLC. BlackBerry phones seemed destined to disappear again, but the company has found another partner in OnwardMobility. The Texas-based startup is now set to launch a new range of 5G phones in collaboration with Blackberry and Foxconn subsidiary FIH Mobile. These 5G phones under BlackBerry’s brand will be released in the market in the first half of 2021.

BlackBerry’s planned entry into the 5G smartphone market is generating some media buzz, but OnwardMobility and FIH Mobile are unlikely to fare any better than TCL. The iconic phone with a keyboard might not be enough to boost BlackBerry’s share price.

Many smartphone makers have already released 5G devices. Apple will likely launch its new 5G iPhones later this year. Investors hoping for the BlackBerry phone to return to something like a competitive position in the smartphone market will likely be disappointed.

By the time OnwardMobility launches its first 5G BlackBerry phones in the first half of 2021, the market will be saturated with more streamlined 5G phones. There will probably be not that many people interested in a phone with a handset.

In short, investors shouldn’t be paying much attention to this headline-grabbing deal. BlackBerry’s new partnership with OnwardMobility will likely fail before generating much license revenue, and BlackBerry will be forced to find another production partner for its dying brand.

BlackBerry stock will have trouble going higher

BlackBerry’s reemergence as a software and security company has seemingly stalled, with the company seeing revenue hampered by COVID-19 in recent quarters, where its connected technology for the automotive industry has taken a hit. For its latest quarter, delivered in June, BlackBerry revenue fell 17% year-over-year and 27% sequentially, while the company suffered a net loss of US$636 million, or US$1.14 per share, which included an impairment charge of US$594 million related to its Spark endpoint security and management business.

The tech company expects its license revenue to decline by around 28% this year due to disruptions from COVID-19 and delayed licensing agreements.

BlackBerry’s software and services business is also struggling, as disruption to the automotive market by COVID-19 slashed QNX’s revenue, which was about one-fifth of its revenue last year. All of these headwinds – which ended its streak of five quarters of revenue growth last quarter – indicate that BlackBerry needs all the extra revenue it can get.

Earnings are expected to decline at an average annual rate of 16.3% over the next five years. BlackBerry stock is expensive with a P/E ratio of 266.7 versus a five-year average P/E of 88.7. You’re paying a high price for a company that is making losses. It looks more prudent to wait for BlackBerry to return to the growth path before loading up on shares. There are better picks in the tech sector.