At first, you might ask yourself why would there be interest in stocks trading at all-time highs? After all, there are so many stocks out there providing a steal of a deal. But why can’t it be both? There are some TSX stocks that, even though the stock is trading at all-time highs, still provide an opportunity for investors.

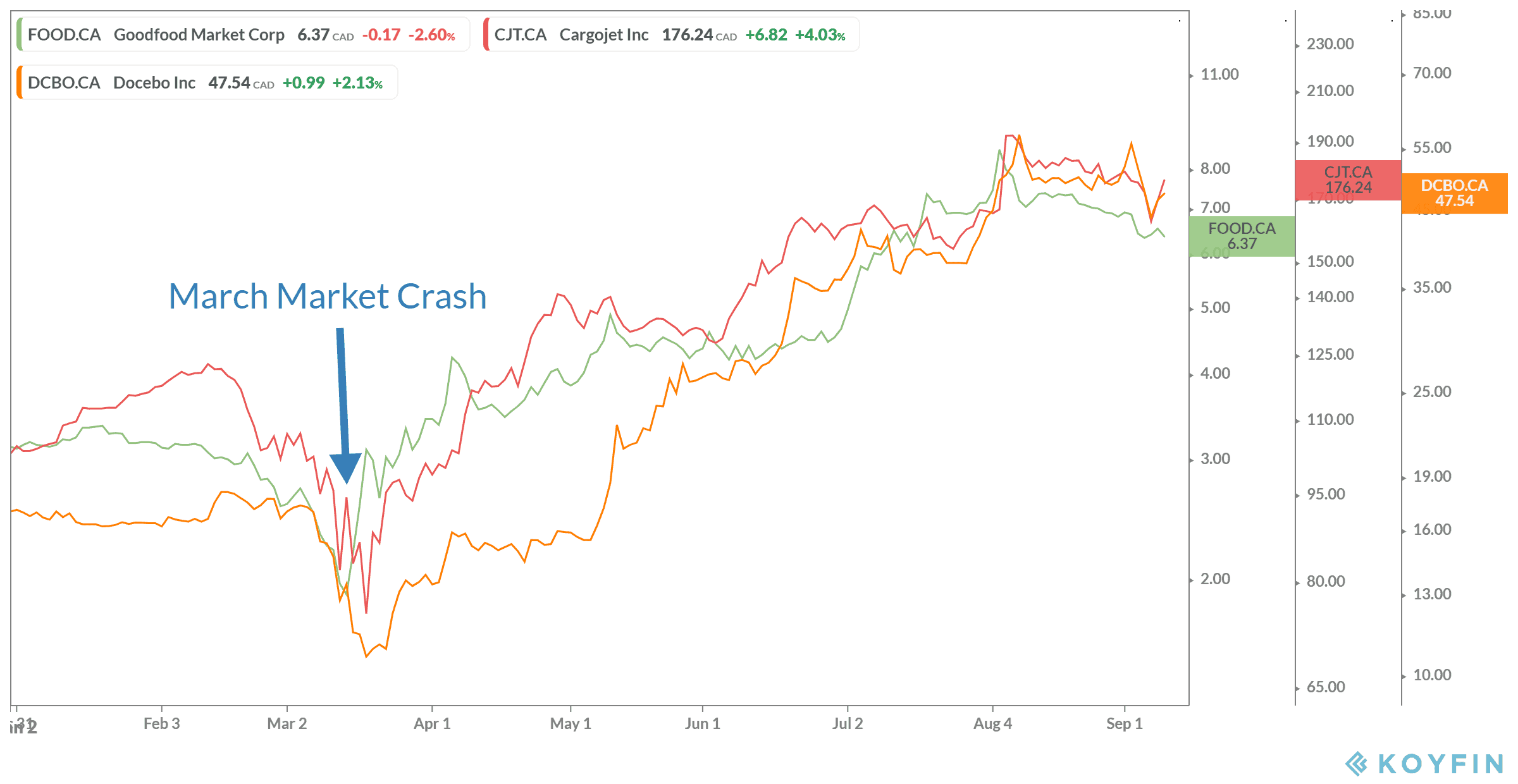

Right now, the world is changing more than ever before. The pandemic has created a time to sink or swim, and there are some companies out there actually able to use the pandemic to an advantage. Three of those TSX stocks I’d like to focus on to today are Goodfood Market (TSX:FOOD), Cargojet (TSX:CJT) and Docebo (TSX:DCBO). As you can see below, each stock has not only reached pre-crash levels but soared past them.

Goodfood

The meal kit industry was booming even before the pandemic. But once the virus hit Canada, new customers flocked to Canada’s most popular meal kit service, Goodfood. After some growing pains, the company hired 450 new employees and opened another distribution centre in Toronto after just opening up one in Vancouver.

The result is huge growth for the company, with record net income and profit for the first time in company history. Sales increased 74% year over year so far in 2020, with the company’s returns up 120% in the last year alone. But this stock could double yet again, as this billion-dollar industry has a lot to offer Goodfood, which is only in its infancy comparatively. The company merely has to look to its global peers for ideas on expansion. So, investors have a long road ahead for even more growth.

Cargojet

Another company soaring to new heights is Cargojet. The company already saw tremendous growth last year after partnering with Amazon. The e-commerce giant, which recently added 2,500 new distribution jobs in Canada, now owns a 9.9% stake in Cargojet. That stake is set to rise to 14.9% if Amazon provides $400 million in business in the next few years.

Then the pandemic hit, and the need for shipping products (personal, professional, and medical) across the country became a necessity. Cargojet became one of the few airlines to actually stay in the air. With the rise in e-commerce, Amazon took a bet that’s already paying off in spades.

The last quarterly report was strong for Cargojet and should continue to be strong for decades to come. As e-commerce continues to grow, so too will Cargojet. Investors have already seen a 73% return in investment this year and a 790% rise in the last five years! Economists predict a 100% increase in earnings per share through to at least 2022.

Docebo

Finally, Docebo is one thing: the future. Just as there has been a rise in e-commerce, there has also been a huge rise in the work-from-home industry. These stocks that have been able to take advantage of this growth have seen huge returns already. That includes Docebo, which offers a learning-management system powered by artificial intelligence. Now, employees can be anywhere and receive training at any time. This now includes Amazon’s Web Service, to name drop just one company.

Share prices for the company have spiked since the market crash, with a return of 444% from peak to trough for investors who managed to time it right. There has been a dip in the share price, as another market crash looms on us, but investors should buy this stock and plan to hold it. As the world continues to change in the coming months and years, Docebo should see massive growth.