Bombardier (TSX:BBD.B) stock jumped as much as 7% in morning trading. The move comes on the heels of a big announcement regarding the sale of its rail division.

Why did the share price of Bombardier stock rally?

Earlier this year, Bombardier announced an agreement with Alstom that would see the European rail giant buy Bombardier Transportation, Bombardier’s train division.

The arrival of the pandemic put the success of the deal under question. That is part of the reason the stock is near record lows.

In the September 16 press release, however, Bombardier just announced a definitive agreement to sell the rail operations to Alstom.

The sale gives Bombardier Transportation an enterprise value of US$8.4 billion. This is a US$350 million reduction from the original bid price from Alstom.

Once the deal closes, likely in Q1 2021, Bombardier should receive net proceeds of roughly US$4 billion. Quebec’s pension fund, the CDPQ, will take back its US$2.2 billion equity position in Bombardier Transportation. The net proceeds to Bombardier also include about US$585 million in Alstom shares that Bombardier intends to monetize after the three-month lock-up expires.

You might think the reduced price would put pressure on Bombardier’s stock price. It appears investors are just happy the deal appears to be going ahead.

Bombardier’s debt problem

Bombardier finished Q2 2020 with roughly US$9 billion in debt. That’s a lot for a company with a market capitalization of about $1 billion. The proceeds from the sale of Bombardier Transportation will help reduce the debt load coming due in the next three years.

In the Q2 2020 report, Bombardier indicated the company has US$1.485 billion in debt coming due in 2021. Another US$1.7 billion in due in 2022 and a further US$1.25 billion in 2023.

Bombardier burned through US$1 billion in cash in Q2 2020. It finished the quarter with cash and available credit facilities of US$2.46 billion, so it should have adequate liquidity to get it through the closing of the Bombardier Transportation sale.

Betting on business jets

Once the sale of the rail division closes, Bombardier will be a much smaller company than it was in recent years. The disposition of the rail unit wraps up a flurry of asset sales that saw Bombardier exit the commercial airline industry and now the rail sector.

The only remaining business is the private jet operations.

At the start of 2020, this group looked promising. The global economy was on a roll and executives frequently dashed around the world to conduct team meetings and visit key customers.

Wealthy individuals with strong performing stock portfolios likely felt comfortable treating themselves to a private jet.

Then COVID arrived, and the world changed.

Risks

The long-term outlook for private jets is probably attractive, but the near-term risks to the market have to be considered.

Travel restrictions remain in place around much of the world, so rich people might put off ordering expensive new jets for their personal use.

Companies in many industries face cash flow challenges right now. In addition, the success of virtual meetings in the past six months could put a permanent dent in executive travel.

Businesses might decide their corporate jets are no longer required.

Opportunity

The flip side of the argument could be a surge in demand for private jets.

COVID-19 isn’t going to disappear quickly and wealthy families or companies with ample cash might decide the safety provided by travelling in private jets justifies the expense. Flying on commercial airlines could be perceived as too risky.

Should you buy Bombardier stock today?

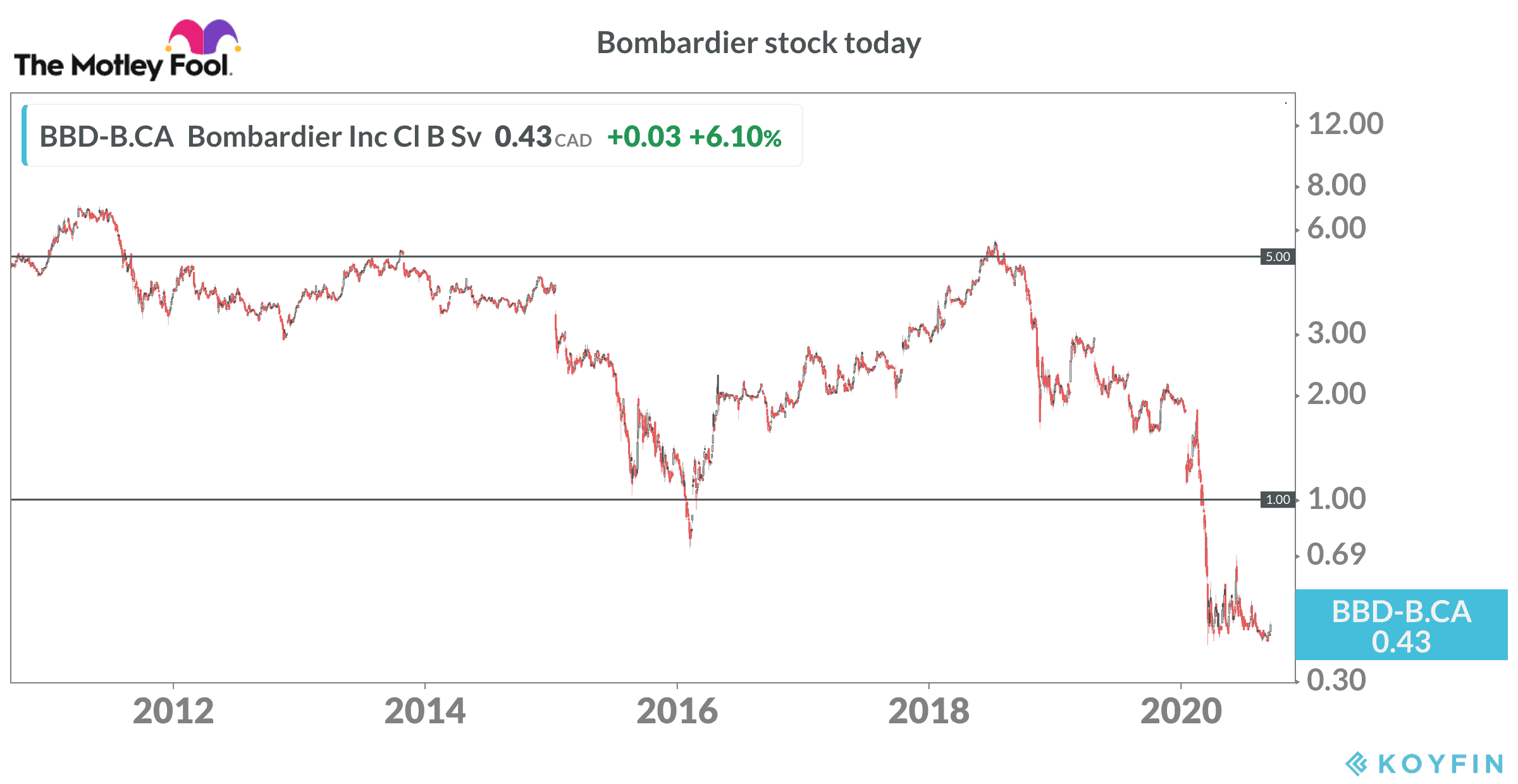

Bombardier trades near $0.43 per share at the time of writing, up a few pennies from the previous close.

The stock remains a risky contrarian bet given the ongoing debt load, even after the sale of the rail division. When we add in the uncertainty of the global business jet market in the next few years, investors have to think hard about whether they want to put money in Bombardier stock. The share price is down 90% in the past two years and a fraction of where it traded two decades ago.

I would search for other opportunities right now that appear oversold and pay well while they ride out the downturn.