Warren Buffett is a legend in the investing world. As such, the purchases made by his firm Berkshire Hathaway attract a lot of attention.

Announcements of new investments often drive up the share prices of the stocks the company buys.

Takeover deals create interest in other stocks in the same sector, as investors seek out potentially undervalued companies. Additional consolidation might also occur if interest heats up in the industry.

Warren Buffett bets big on natural gas transmission

Berkshire announced a US$10 billion deal in July to buy the natural gas transmission and storage assets of Dominion Energy. The deal includes the assumption of US$6 billion in debt and is the first large acquisition made by the company during the pandemic.

In the spring note to shareholders, Warren Buffett said Berkshire had US$137 billion to spend and was searching for attractive targets.

The big purchase in the energy sector might come as a surprise to the market. Oil and gas producers continue to struggle with weak prices. Energy infrastructure companies that move the hydrocarbons face serious challenges to get major new pipelines built.

Obviously, Warren Buffett sees a strong long-term opportunity for the natural gas transmission sector.

Could TC Energy be a Warren Buffett investment target?

TC Energy (TSX:TRP) (NYSE:TRP) would be the top Canadian company with similar assets. The firm is primarily a natural gas transmission and storage business. It also has oil pipelines and power-generation facilities.

TC Energy’s natural gas transmission network includes 93,300 km of pipelines that cross Canada and run right down through the United States to the Gulf Coast. TC Energy also has a large presence in Mexico.

When you add it all up, TC Energy transports more than a quarter of the natural gas used in North America to heat buildings and generate power. The unique portfolio of assets also positions the company to play a key role in the long-term expansion of the global LNG market.

On the storage side, TC Energy has more than 650 billion cubic feet of natural gas storage capacity.

Despite challenges to get new pipeline approved and completed, TC Energy still has a robust development portfolio. In fact, the secured capital program through the end of 2023 stands at $37 billion.

As the new assets are completed and go into service, TC Energy should see revenue and cash flow grow enough to support a dividend increase of 8-10% in 2021. Dividend hikes of 5-7% per year are expected afterwards.

That’s great guidance in the current economic environment.

TC Energy gets about 95% of its comparable EBITDA from regulated assets or long-term contracts. This means cash flow should be predictable and reliable.

No wonder Warren Buffett likes the gas transmission sector.

TC Energy has a market capitalization of $56 billion, so it would be a big purchase, but it certainly isn’t beyond the reach of Berkshire. A large investment in the company might also be a possibility.

Should you buy TC Energy stock?

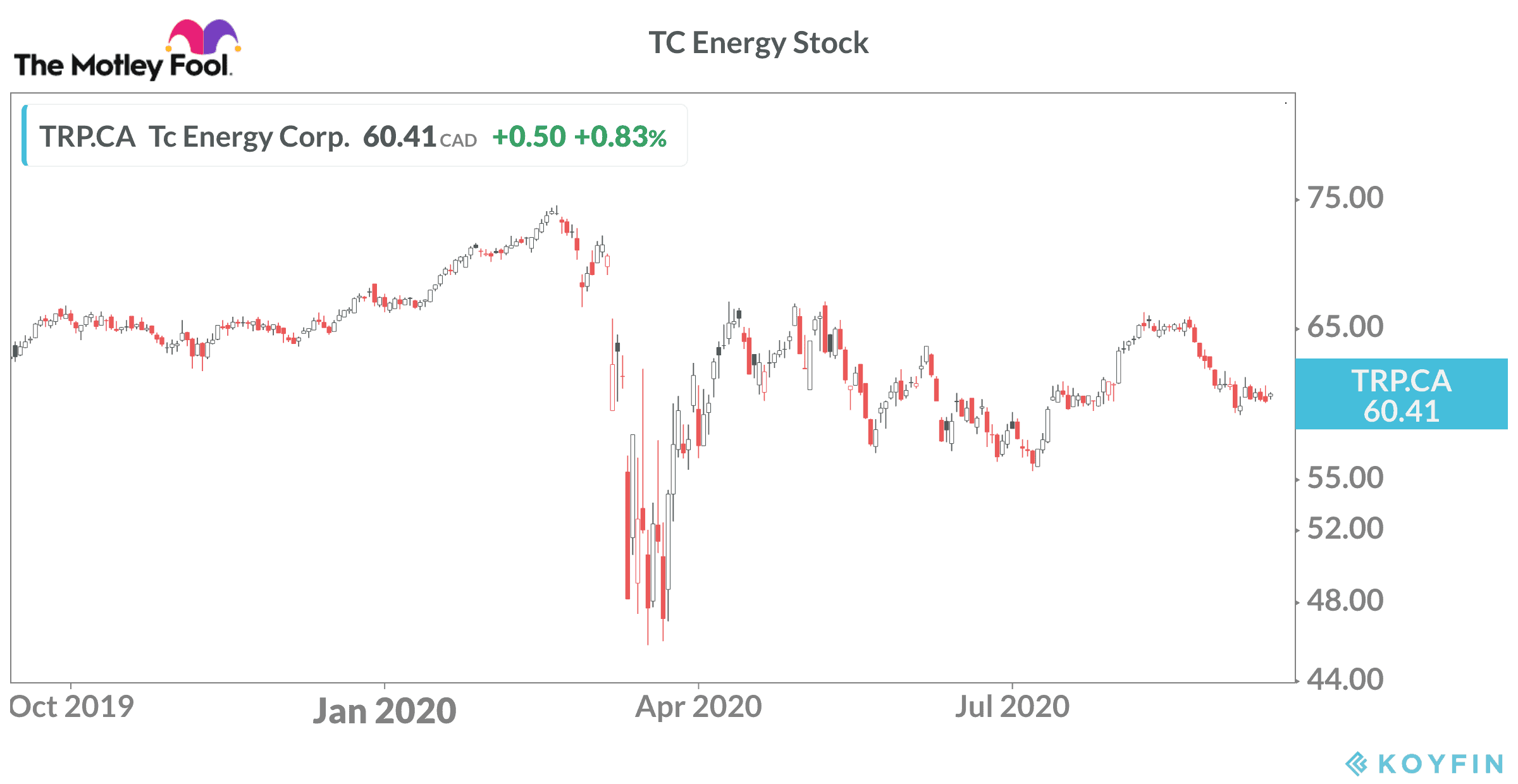

TC Energy trades near $60 per share and offers a 5.3% dividend yield. The stock traded above $76 per share earlier this year, so there is decent upside potential.

At this point, TC energy appears oversold. I expect volatility to continue in the near term, but the downside risk should be limited, and you get paid well to wait for the recovery.

If you have some cash available for a top dividend stock, I would consider adding TC Energy to the portfolio today.