Retirees and other investors use top income stocks to boost earnings and supplement pensions.

The 2020 stock market crash hit some sectors hard, including real estate and energy. Many of the leading stocks in the TSX Index already recouped much of their earlier losses, but a few top income stocks still trade at discounted levels and appear attractive at current prices.

Is Enbridge a good income stock to buy today?

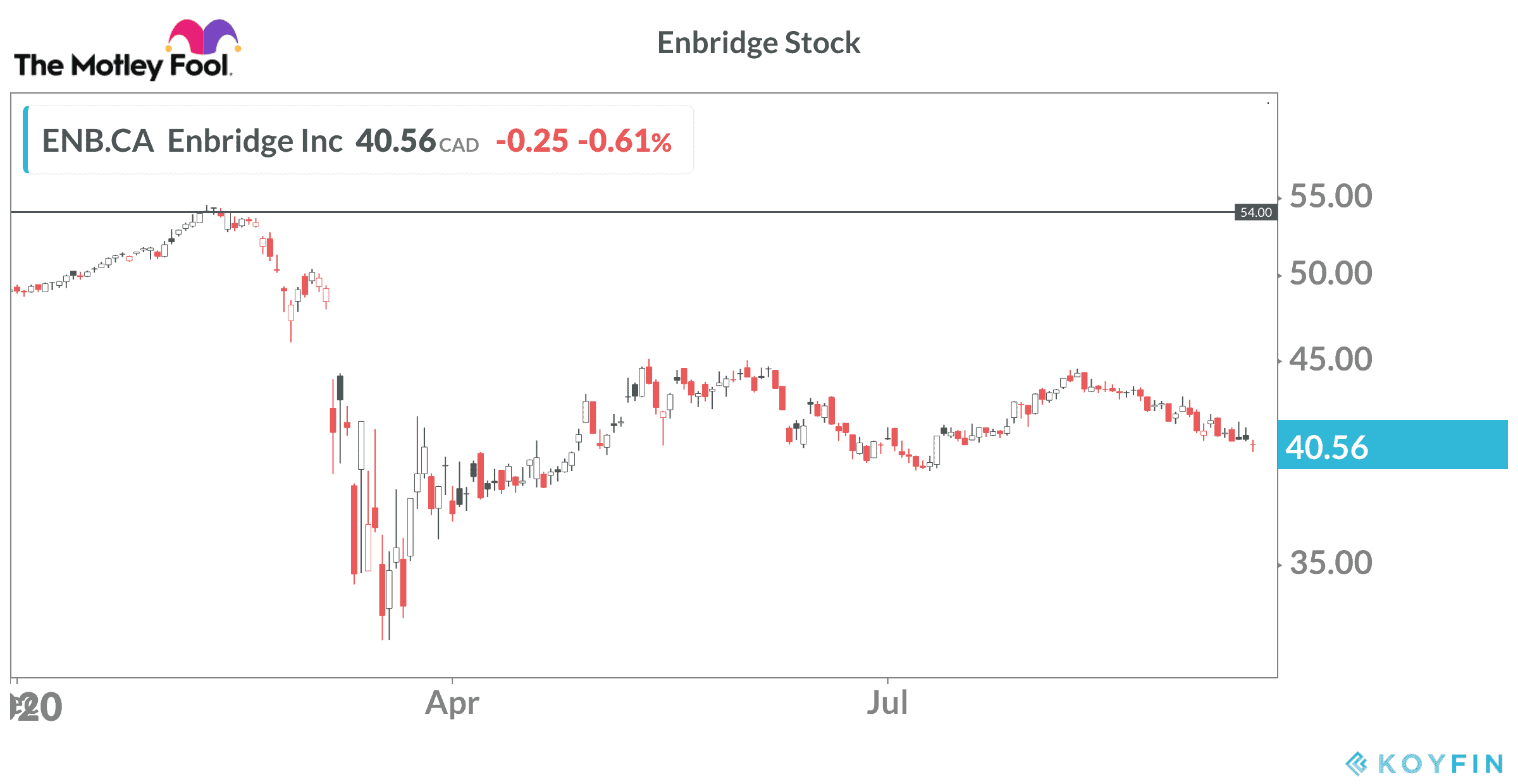

Enbridge trades near $40 per share at the time of writing and offers an 8% dividend yield. The stock is down from $54 earlier in the year, so there is a decent upside opportunity when the market recovers.

The sell-off appears overdone. Ongoing volatility is expected, but the downside risk should be limited.

Enbridge is a major player in the Canadian and U.S. energy infrastructure industry. The company transports roughly 25% of the oil produced in the two countries. Enbridge also owns natural gas distribution assets and renewable energy facilities.

The utilities provide a good hedge against the current weakness in the oil sector.

Throughput on the oil pipelines is down over the past six months due to the drop in demand for crude oil by refineries. As the economy recovers through 2021, the situation should improve, and Enbridge could be back to its normal volumes near capacity on the liquids pipelines network.

In the meantime, the dividend appears safe, and Enbridge remains one of the top income stocks for investors. In the Q2 2020 report, Enbridge confirmed guidance for distributable cash flow for the year. The company has more than $14 billion in available liquidity and continues to work on its $11 billion secured capital program.

This should drive higher cash flow when the assets are completed and provide additional support to the dividend.

Is RioCan a safe income pick?

RioCan Real Estate Investment Trust (TSX:REI.UN) has a long history of providing investors with reliable monthly distributions. The pandemic lockdowns that shut the doors on its shopping malls across the country have investors wondering if RioCan will be able to maintain its payouts.

According to the CEO, the distribution is safe.

RioCan has a strong balance sheet, and low interest rates mean it can access cash right now at very cheap rates. The company’s portfolio of assets in six major Canadian markets includes some of the most valuable retail real estate in the country.

RioCan’s mixed-use projects will diversify the revenue stream to include residential and retail.

On the mall side, RioCan gets no more than 5% of its revenue from any single tenant. A number of the anchor tenants have fared reasonably well due to their essential-service designations. This includes the grocery stores and pharmacies.

Government aid is helping others get through the worst of the downturn, and RioCan says it is collecting most of its rent. In fact, the CEO recently mentioned in an interview that the company received about 90% of the rent due for July and August.

The trust units trade around $15 at the time of writing. This puts the annualized distribution yield above 9.5%.

Risks remain as cases climb in major cities, and the potential for new lockdowns exists. However, COVID-19 vaccines should be widely available by the second half of 2021, and RioCan has the means to ride out the downturn.

This is arguably a riskier pick than Enbridge, but the worst is probably over, and the upside potential on a retail recovery is significant. RioCan traded around $26 at the beginning of the year.

The bottom line

Investors with some cash sitting on the sidelines should consider adding Enbridge and RioCan to their income portfolios. These top income stocks appear oversold right now and offer great yields.