Air Canada (TSX:AC) stock might be one of the most popular tickers on the TSX Index this year. Contrarian investors have good reason to be interested given the past performance of the stock after previous crashes.

Air Canada stock outlook

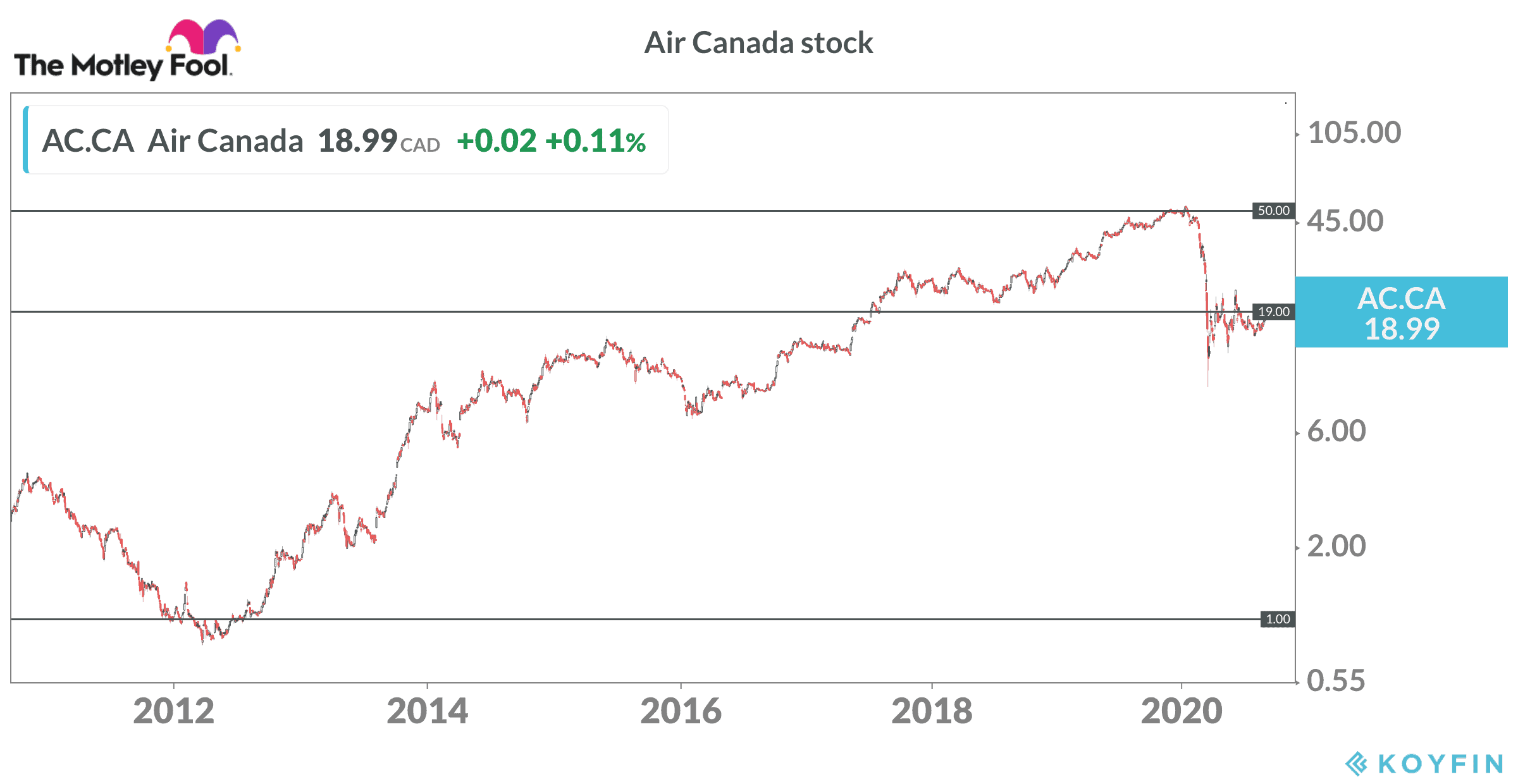

Air Canada stock soared from below $1 per share in 2012 to above $50 earlier this year. This made Air Canada one of the best-performing stocks on the Canadian market over the past decade.

The pandemic, however, sent the share price into a tailspin. Global travel restrictions effectively wiped out Air Canada’s revenue stream in recent months. The company reported revenue of just $527 million in the second quarter vs. $4.74 billion in Q2 2019. That’s a drop of 89%!

Expenses didn’t fall as quickly. Air Canada burned through more than $20 million in cash per day in the quarter, and the company booked a loss of $$1.7 billion for the three months ending June 30. Passenger numbers crashed 96% compared to Q2 last year.

Now what?

Investors are trying to decide where the bottom lies and how high Air Canada stock might go on a recovery.

Air Canada saw its stock price drop to $12 as a closing low in March. The action since then has been turbulent, with surges driven by positive COVID-19 vaccine news and pullbacks triggered by waves of rising cases.

At the time of writing, Air Canada stock trades near $19 per share. It briefly topped $23 in June and slipped back to $15 by early August. Since then, the stock has trended higher, although with some turbulence along the way.

Is this stock a deal at $19 per share or way too high?

Air Canada went bankrupt in the wake of the SARS outbreak in 2003. The stock then tanked from $20 per share in 2007 to below $1 in 2009 and 2012 after the financial crisis.

An argument can be made that Air Canada has a stronger liquidity position this time, thanks to timely moves by management to raise cash this spring. In the event a COVID-19 vaccine becomes widely available in the first half of 2021, the stock might take off and finish next year or 2022 much higher than where it sits today.

However, dark skies appear to be on the horizon, at least for the next six to nine months.

Canada remains closed to international visitors. This includes Americans. In addition, the pandemic continues to hit key destinations for Canadian travelers. The United States, Latin America, and even Europe are struggling with rising coronavirus cases.

Within Canada, rising case numbers in the larger provinces and ongoing interprovincial quarantine rules might keep more travelers at home.

Airlines in the United States are begging the government for more aid to help them navigate the storm. Some pundits predict at least one major U.S. carrier won’t survive.

Air Canada already cut more than half of its staff and scrapped more than 30% of its fleet. The company doesn’t expect capacity to return to 2019 levels for at least three years. The longer the Canadian government keeps the border closed, the more likely it is that Air Canada could quickly burn through the roughly $9 billion it had access to as of the end of the second quarter.

Should you buy Air Canada stock today?

Air Canada isn’t going to disappear. That said, I would be careful taking a large position in the stock at this level. The world has changed, and the company is going to be much smaller in a very uncertain market for the next few years.

Travel demand rebounded after SARS and the Great Recession, so there is a positive benchmark of the industry. Nonetheless, things might be different this time. We just don’t know if vacationers and business people are going to return to previous habits.

Investors who bought near $15 might want to trim the position. For those looking to add Air Canada stock to their portfolios, I would wait for the next pullback.