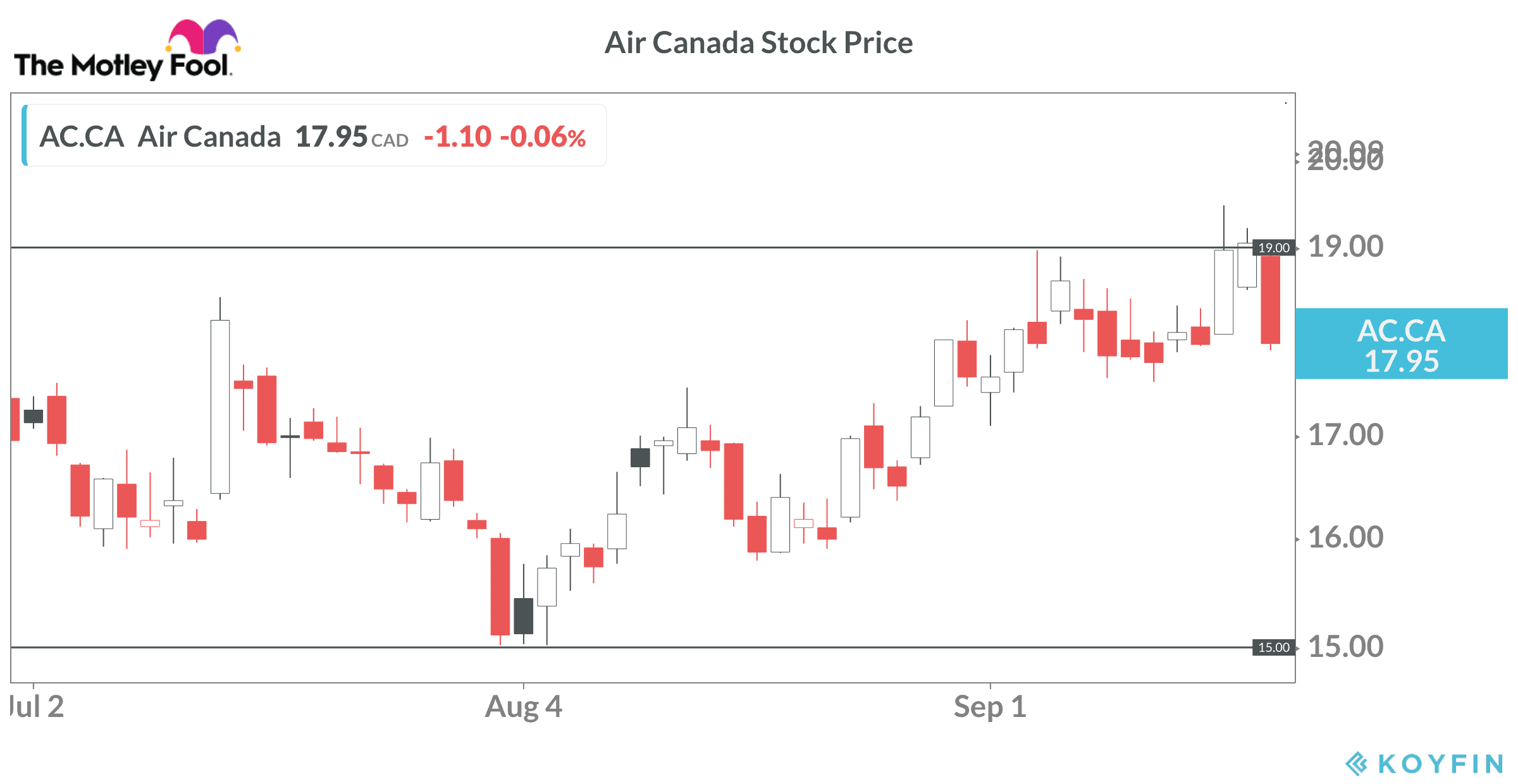

Air Canada (TSX:AC) saw its share price drop nearly 6% last Friday after a six-week run of gains that saw Air Canada stock run from $15 to $19 per share.

Investors who missed the late-summer surge want to know if the recent pullback is an opportunity to buy or a signal to stay on the sidelines until the correction runs its course.

What’s the scoop?

Air Canada stock headwinds

Air Canada faces a number of ongoing challenges. The drop in Air Canada’s stock price late last week might have been connected to a CBC report that indicated Air Canada and Westjet cancelled more than 400 flights so far in September.

The decisions to consolidate passengers from partly-booked flights come as the airlines struggle to cut costs amid ongoing weakness in travel demand.

Government restrictions remain in place and might not ease for some time. Canada still isn’t allowing foreign visitors. In addition, interprovincial travelers are required to quarantine in some cases.

The combination means high-margin business travelers remain absent and recreational trips are being postponed.

Rising COVID-19 caseloads across Canada and throughout the world don’t bode well for Air Canada’s prospects. A number of Canadian provinces hit their highest case numbers in months over the past few days. Ontario rolled back group gathering limits in some regions. British Columbia closed bars and banquet halls for a second time.

South of the border, several states continue to see cases rise.

On the international front, key destinations for Canadian vacationers — including Europe and Mexico — face ongoing challenges to get the coronavirus under control.

Business travel impact on Air Canada stock

At some point a vaccine will be widely available and people should feel comfortable traveling again by plane. Business trips will certainly make up part of that demand, but there is debate as to whether business travel will rebound to previous levels.

Why?

The pandemic lockdowns forced executives and salespeople to conduct long-distance meetings with clients and remote teams via video conferencing platforms. Technology advancements in recent years made a number of top platforms available to create high-quality interactive digital meetings with large numbers of people.

The success of online meetings surprised many people in the past six months. Companies negotiated deals worth millions, or even billions of dollars without in-person meetings, which could change the business-travel sector for years.

Business class seats are expensive. In addition, companies need to pay for hotels, local transportation, meals and the like when employees fly to conduct meetings. It therefore makes sense that travel budgets could get permanently trimmed.

This would be bad news for holders of Air Canada stock. All airlines make a good chunk of their profits from business travelers.

Should you buy Air Canada stock now?

Air Canada is a much smaller company than it was at the start of the year and it isn’t going to get that big again for a long time, if ever. As such, investors need to keep this in perspective when evaluating Air Canada stock for their portfolios.

Near-term risks shouldn’t be ignored. Extended travel restrictions and renewed lockdowns in combination with another correction in the broader stock market could see Air Canada stock retest the March 2020 lows.

Over the long term, the company should recover, but it is reasonable anticipate major turbulence along the way. I would wait to see how the next few months pan out before buying Air Canada stock.