Canadian marijuana firm Aurora Cannabis (TSX:ACB)(NYSE:ACB) will release its earnings results for fiscal fourth quarter and year ended June 30, 2020, after market close on Tuesday, September 22. Management has already issued detailed guidance for the quarter, but Aurora Cannabis’s stock price could pop on Wednesday if there’s bullish information in the upcoming financial results.

What to expect in ACB’s fourth-quarter earnings

Management at Aurora expects fourth-quarter net revenue to sequentially decline from $75.5 million during a previous quarter to $70-$72 million. Analysts expect the reading to come at the upper end of the guidance.

Gross margins are expected to hold in the respectable 46-50% range, excluding fair-value adjustments. However, the company will make another inventory write-down of up to $140 million. This is a big number for a company stuck in the $70 million quarterly revenue run rate. The number could be equivalent to nearly two quarters of sales.

Further, the company could recognize a $90 million impairment charge on its fixed asset capital. Management is concluding a very painful production capacity rationalization program.

Most noteworthy, as previously feared, investors should expect goodwill and intangible asset charges of up to $1.8 billion during the quarter. During the first nine months of the fiscal year, the company took $1,07 billion in impairment charges. Therefore, if the expected write-offs come to pass, the $995 million company will have taken nearly $3 billion in charges in 12 months. That’s a significant loss in book value.

Adjusted EBITDA and operating earnings will be in the red. However, we should witness a significant reduction in operating costs’ run rate. The company is working towards a targeted $40-45 million per quarter of selling, general, and administration (SG&A) expenses by December this year. This would mean a 60% reduction in quarterly recurring operating expenses during the year, as the company strives to become earnings and cash flow positive.

Here’s what could move Aurora Cannabis stock

I do not expect any surprises in the company’s upcoming earnings. Bad news is already priced into shares after a thorough guidance release on September 8. I look forward to management’s updated comments on future financial outlook going forward. That is where the good news could lie.

Shares could surge on Wednesday if management’s outlook assures the market that bankruptcy can be avoided without too much dilution and if the company meets its recently renegotiated debt covenants through successful cost management and revenue growth.

Time to buy?

Given a forward price-to-sales multiple of just 3.1 and an enterprise value-to-sales multiple of 4.1, the pot producer’s shares are trading in value territory. ACB stock is too cheap to ignore after falling far from their fair value. A new CEO, reduced costs, lower cash burn, and potentially positive operating earnings next year support a recovery narrative for the company.

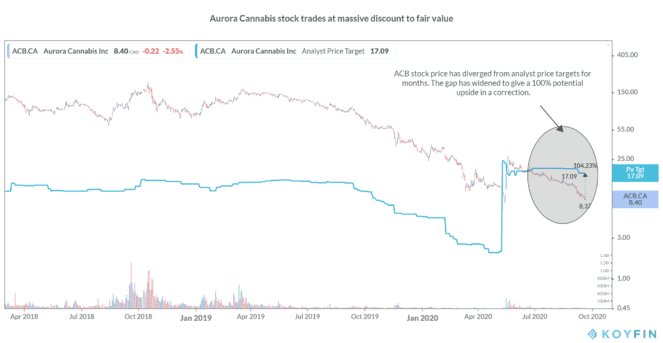

For the first time ever, shares in Aurora Cannabis traded below average analyst price target mid-year this year. The valuation gap widened after management’s dull September 8th market update.

Market prices don’t necessarily follow or reflect analyst estimates. However, analyst estimates reflect professionally computed valuation opinions on a stock, given all known information and expectations of the future. According to analysts covering the company, Aurora Cannabis stock is underpriced right now.

Any subsequent dips in the share price are thus potential buys for long-term profit when Mr. Market finally corrects its over-reaction to the sad news that has come out of the firm ever since it started restructuring its operations.

As outlined in June, significant business risks remain. However, a correction to fair value could mean a 104% potential upside in the share price from current lows. That’s a nice and juicy double!