Top dividend stocks become more attractive when the broader stock market takes a dive.

Many people missed the rally after the market crash in March, but the the September correction provides an opportunity to add some of Canada’s best dividend stocks to your TFSA retirement income fund or RRSP portfolio.

Bank of Nova Scotia is one of Canada’s oldest top dividend stocks

Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) paid its first dividend in 1832. The bank survived every major economic and geopolitical crisis since then, including two world wars, the Great Depression, and the Great Recession.

COVID-19 poses challenges for Bank of Nova Scotia and its peers, but Canada’s third-largest bank will survive the pandemic. In addition, the dividend should be safe.

Bank of Nova Scotia remains very profitable, even with elevated provisions for credit losses (PCL) during these difficult times. The international group might take longer to recover due to the heavy focus on Latin America. However, Canada normally contributes roughly two-thirds of profits, and the Canadian economy is recovering at a steady pace.

Bank of Nova Scotia trades for less than $54 per share at the time of writing. This is the cheapest price for the stock since May. Investors who buy today can pick up a solid 6.7% dividend yield and simply ride out the pandemic. The stock traded above $74 earlier this year, so there is decent upside potential on a recovery.

Why Enbridge is one of Canada’s top dividend stocks

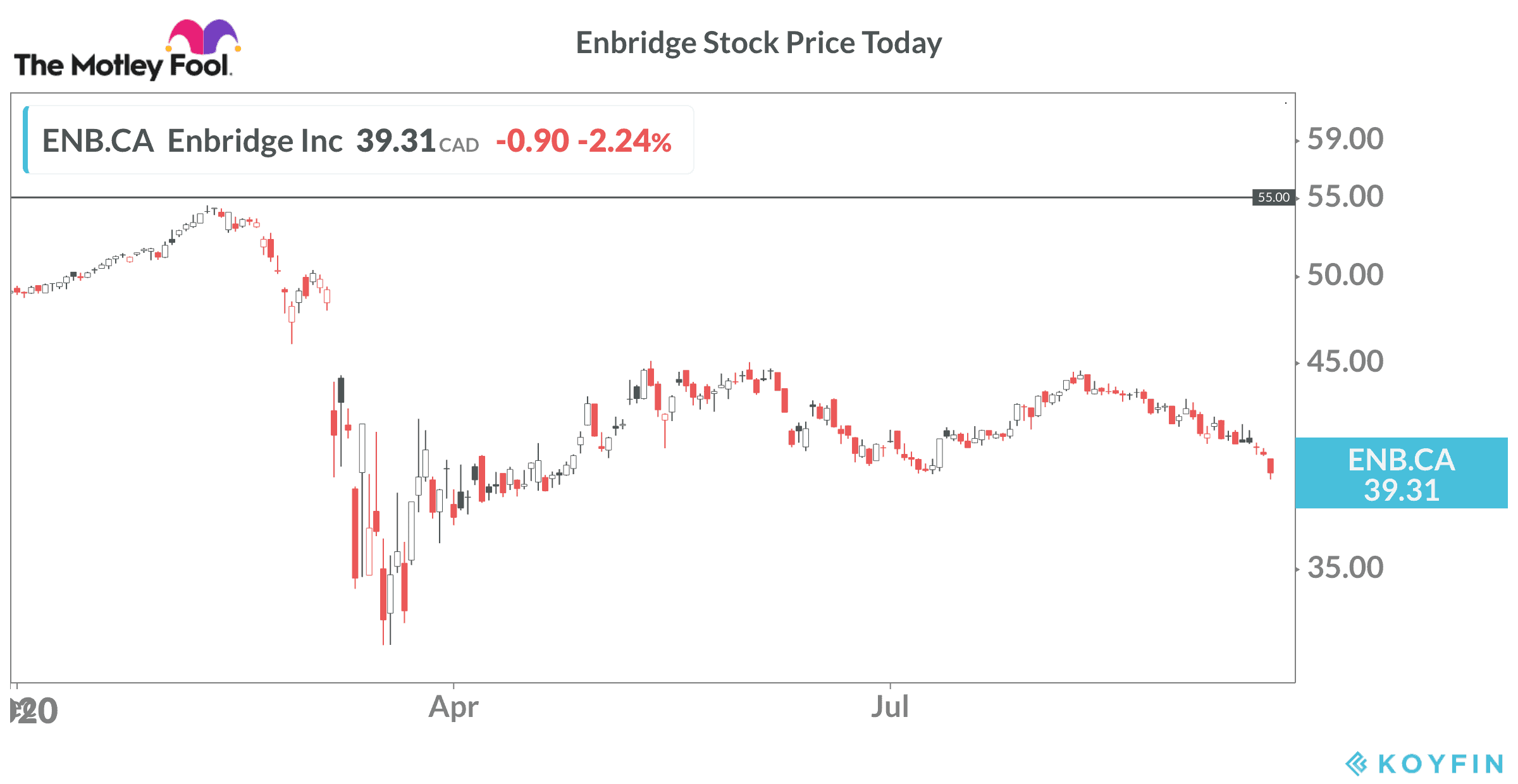

Enbridge (TSX:ENB)(NYSE:ENB) stock is heavily out of favour, yet the company continues to be one of the top dividend stocks in the TSX Index.

The energy infrastructure giant certainly faces some growth challenges on major pipelines developments. In addition, the pandemic lockdowns hammered demand for fuel in recent months. Enbridge isn’t an oil producer or a refiner, but it moves crude oil between the two groups.

Jet fuel, gasoline, and diesel fuel usage dropped significantly in recent months. Airlines continue to face difficult times, but people are driving again, and commercial trucks are back on the roads. Once COVID-19 vaccines become widely available, demand for flights should improve, and many commuters will head back to offices.

Enbridge has utility and renewable energy assets that provide steady revenue and cash flow. The company also has more than $10 billion in secured capital projects underway to support revenue growth. Enbridge stock appears oversold today at $39 per share and provides a juicy 8.25% yield.

Enbridge completed a restructuring process before the pandemic arrived. The company sold roughly $8 billion in non-core assets and streamlined the business. This means it entered 2020 with a solid balance sheet and an asset base that primarily generates revenue from regulated businesses.

Management confirmed the 2020 guidance for distributable cash flow when Enbridge reported Q2 2020 earnings results. As such, the dividend payout should be safe.

Enbridge’s stock topped $55 per share at one point in February, so there is an opportunity to book some significant gains when the market stabilizes.

The bottom line

Investors should anticipate ongoing volatility in the coming months. However, Bank of Nova Scotia and Enbridge now trade at stock prices that appear oversold. The two remain top dividend stocks for income and RRSP investors. Distributions might not increase in the next year, but they appear stable and offer attractive yields.

The shares should trade meaningfully higher five years from now and investors can collect decent income while they wait for the rebound.