Shares of Air Canada (TSX:AC) tanked more than 13% in recent trading. The drop takes Air Canada stock back to its lowest point in the past month and has contrarian investors wondering if the shares are a good buy now.

Air Canada stock plunge

The steep drop in Air Canada’s share price in recent days is a reminder that ongoing volatility should be expected for the sector.

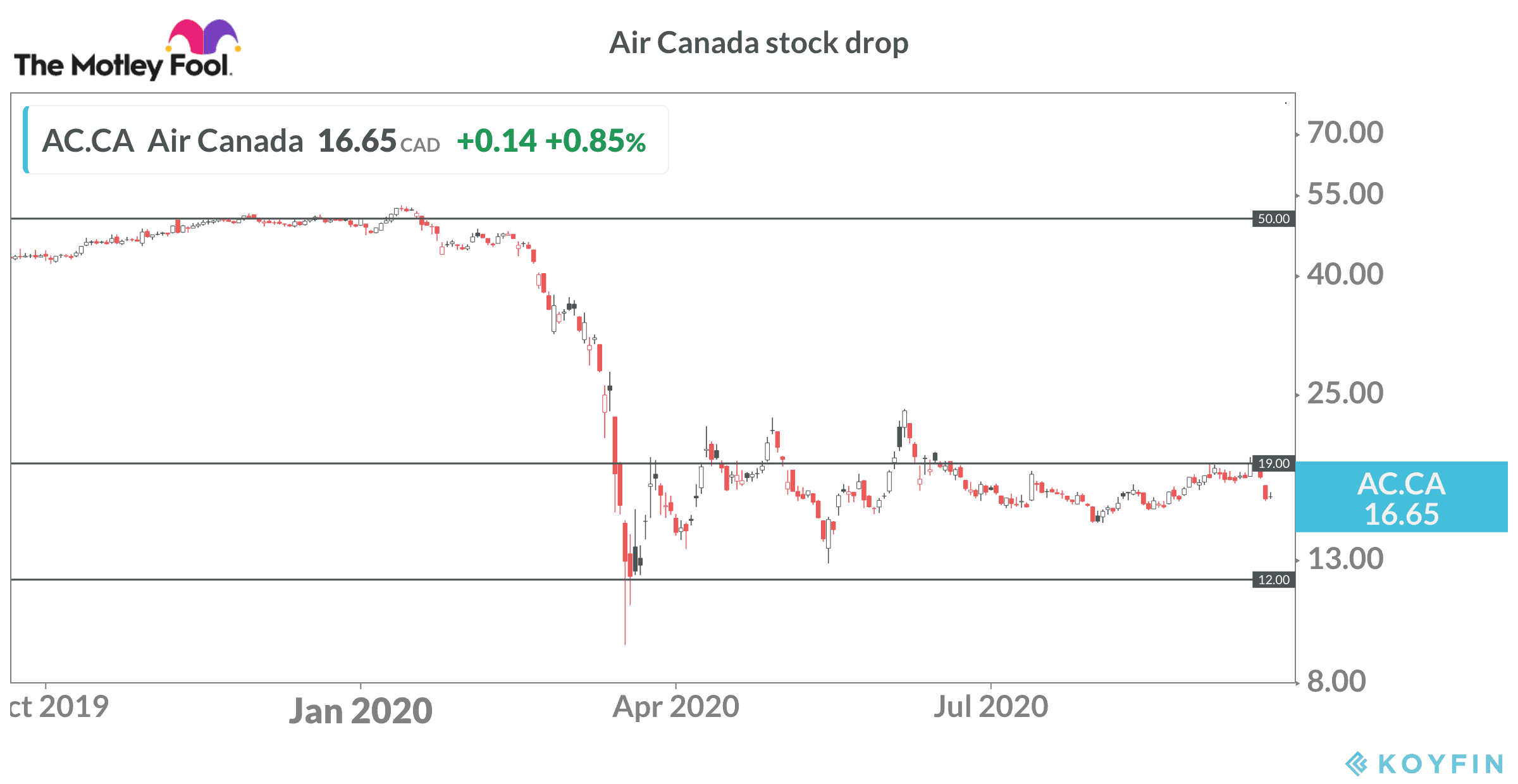

Air Canada stock might appear cheap given the massive declines. The shares traded for more than $50 before the arrival of the pandemic and hit a closing low near $12.

Since then, investors have been on a wild ride. Optimism for a quick end to the pandemic travel restrictions saw Air Canada stock rally as high as $23 in early June. Seasoned investors suggest the big spring move in the stock price might have occurred due to demand by new investors in the market who showed enthusiasm for airline stocks.

A renewed surge of COVID-19 cases in the United States through the summer put a lid on the rally in Air Canada and other airlines. The pullback in the share price in recent days is partly connected to fears that many developed countries are now entering a second wave of the pandemic and could be forced to extend, or tighten, travel restrictions.

Uncertain outlook for Air Canada stock

Airlines in the United States face a daunting situation and are pleading to the government to provide more financial aid. In May, the CEO of Boeing said he thought one major U.S. airline would ‘likely’ go out of business.

Airbus, another plane manufacturer, just warned it might cut more jobs than anticipated. The CEO said the airline industry is in worse shape than expected after the key summer travel season.

Canada remains closed to international visitors. This includes travellers from the United States. Key destinations for Canadian vacationers face rising COVID-19 case numbers. U.K. Prime Minister Boris Johnson told everyone the country is at a “perilous turning point” and asked people to start working from home again to fight the emergence of a second wave. France, Spain, and other European countries saw coronavirus cases spike to their highest levels in months in recent days.

In Canada, Quebec just declared it is in a second pandemic wave. Several other provinces are seeing cases rise.

Overall, the near-term outlook for Air Canada stock isn’t great.

Positive news for Air Canada stock?

Air Canada took advantage of strong demand for airline stocks and corporate debt this spring to raise capital. As a result, the company finished Q2 2020 with roughly $9 billion in liquidity.

The elimination of about 20,000 jobs and the retirement of 79 planes will help reduce expenses, but the firm still anticipates net daily cash burn of $15-17 million for Q3, based on the outlook provided in the Q2 report. That’s $1.35-1.6 billion for the quarter.

As a result, Air Canada has sufficient access to liquidity to get it through the coming months.

Should you buy Air Canada stock now?

Investors could see the cash burn number come in higher than anticipated for Q3. Government restrictions didn’t ease as anticipated and indications suggest travel demand remained very weak in July and August. In addition, a recent report indicated Air Canada and WestJet have cancelled hundreds of flights so far in September due to weak seat sales.

Nimble traders might be able to make some money on the short-term moves in the share price. Investors with a buy-and-hold strategy, however, should probably stay on the sidelines today.

It wouldn’t be a surprise to see Air Canada stock take another run at the March low in the coming months, especially if the broader stock market extends the recent correction. I would at least wait until the Q3 numbers come out before buying the stock.