The year 2020 has been a tough one for energy infrastructure companies. Weak demand and uncertain outlook have taken a toll on oil prices, in turn, the shares of the energy infrastructure companies listed on the TSX.

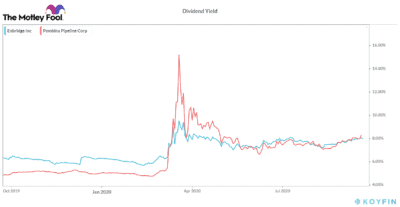

How long the prices will stay down is hard to gauge, but their eye-popping dividend yields (due to the plunge in their stock prices) must have caught your attention. For instance, shares of Pembina Pipeline (TSX:PPL)(NYSE:PBA) and Enbridge (TSX:ENB)(NYSE:ENB) are down 38.6% and 22.6% year to date, respectively. The massive decline in stock prices of these companies has driven their yields over 8%.

Pembina Pipeline

With a monthly dividend of $0.21, Pembina Pipeline currently offers a high-yield of 8.5%. Investors should note that its highly contracted business remains resilient to the volatility in commodity prices and generates strong fee-based cash flows.

Pembina pays its dividends through the fee-based distributable cash flows that come from the business not having direct commodity exposure. Moreover, its long-term contracts have take-or-pay or cost-of-service arrangements that lower volume and price risk. In 2019, the company paid its common share dividends from about 73% of its fee-based distributable cash flows, implying that its dividends are well covered.

Further, its strong balance sheet, high liquidity, and credit-worthy counterparties are reassuring. While Pembina’s low-risk and contracted assets should continue to support its payouts, its stock could remain volatile in 2020.

Enbridge

While a decline in throughput volumes and lower oil prices are taking a toll on Enbridge’s revenues and earnings, its diverse revenue sources are comforting. Its other businesses continue to generate steady revenues. Meanwhile, its adjusted EBITDA is supported through long-term agreements with the take or pay contracts and cost-of-service arrangements.

Investors should note that reservation-based revenue contracts support Enbridge’s gas transmission business. Meanwhile, its gas business has an incentive framework with long-term contracts. Also, Enbridge’s renewable power business benefits from long-term power-purchase agreements.

Amid the challenges, the company is focusing on cutting costs that could cushion its margins and bottom line. Enbridge’s expects to lower costs by $300 million in 2020. Enbridge’s resilient adjusted EBITDA and focus on cost savings could continue to support its distributable cash flows (DCF).

Despite the challenges, Enbridge reaffirmed its DCF outlook and expects to generate DCF per share of $4.50 to $4.80 in 2020, which implies its payouts are safe. Moreover, its Enbridge’s secured growth program is likely to deliver 5-7% growth in annual DCF per share through 2022, which is encouraging.

Enbridge has paid dividends since 1953. Meanwhile, it paid $6 billion in dividends in 2019. Currently, Enbridge offers a high forward yield of 8.1%.

Now what?

Should you buy the shares of these beaten-down energy infrastructure companies for their higher yields? The answer lies in your ability to take the risk. For risk-taking investors, Pembina Pipeline and Enbridge can be a bet worth taking.

Not only investors can benefit from their attractive yields, but a recovery in demand could also result in solid capital gains. However, risk-averse investors can avoid both these stocks as prolonged weakness in oil prices could pose a threat.